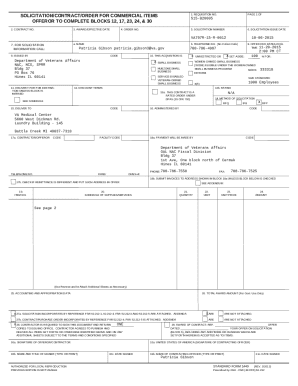

Get the free Recreational Land Tax Lien template

Show details

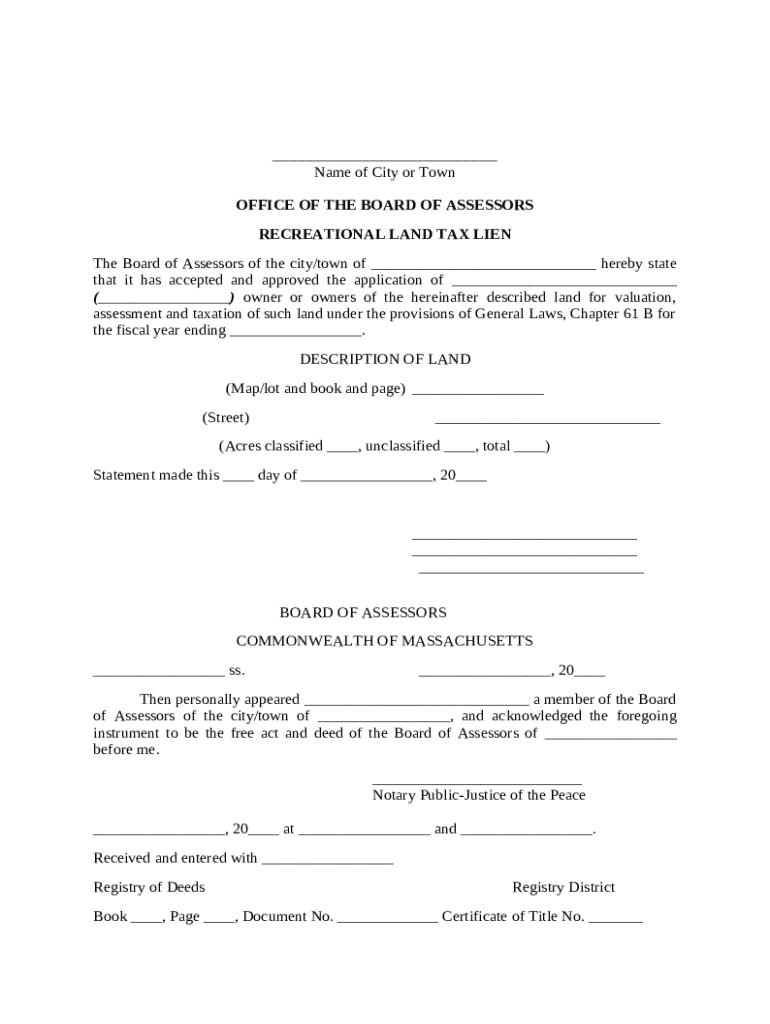

This form is a statement where the Board of Assessors of a Town accepts and approves the application of the Owner's valuation, assessment and taxation of the land.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is recreational land tax lien

A recreational land tax lien is a legal claim against a property for unpaid taxes related to recreational land.

pdfFiller scores top ratings on review platforms

Customer service 5 star! Program 4.9 Star - would like touchpad scroll feature.

This is my first experience with PDFfiller, I am not sure how to save the signatures.

great experience thus far. Would like to learn more about the features. I'd attend a webinar if I'm available.

So far so good. Appears to be as useful as Acrobat without the hassle of a stand alone program on your PC.

Excelente editor, fácil y sencillo de usa

I have no experience with PDF Filler, Just PDF filler Expert

Who needs recreational land tax lien?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the recreational land tax lien form on pdfFiller

What is a recreational land tax lien?

A recreational land tax lien is a legal claim against property due to unpaid taxes, specifically related to land designated for recreational use. This ensure local governments recover tax revenue while providing oversight on land uses under specific regulations, such as Chapter 61 B.

-

The form serves as a legal document to claim taxes owed on recreational land, protecting municipal revenue.

-

This chapter outlines guidelines for recreational land use, ensuring that properties remain protected under certain conditions.

-

Understanding this lien can help landowners avoid financial penalties and maintain compliance with state laws.

How to navigate the tax lien form?

Navigating the recreational land tax lien form requires a clear understanding of its structure and essential components. This ensures that you provide all necessary information in the correct format.

-

Familiarize yourself with the sections of the form, enabling easier navigation while filling it out.

-

Begin by entering the local government authority that oversees property taxes.

-

Include the official statement from the assessors' office as part of the required documentation.

-

Provide detailed information such as map/lot number and street address to identify the property.

-

Specify whether your land is classified as recreational or unclassified for tax purposes.

-

Don't forget to date the document correctly, as this could influence its processing.

-

All necessary signatures must be obtained to validate the form before submission.

How do fill out the recreational land tax lien form?

Filling out the recreational land tax lien form accurately is crucial for a successful submission. Following a set of guidelines can help minimize errors that could delay processing.

-

Follow the instructions precisely to ensure all necessary fields are filled with accurate information.

-

Watch for misplaced signatures or errors in property description, which can lead to rejection.

-

Leverage pdfFiller’s editing and eSigning functionalities to streamline the completion process.

What collaboration is needed with local authorities?

Collaboration with local authorities is essential in ensuring compliance with the recreational land tax lien requirements and smooth processing of your forms.

-

Establish clear communication regarding any queries or requirements, preventing delays.

-

Certain documents may require notarization to validate their authenticity.

-

Understand the method of submission and follow through by confirming that the document is correctly entered into the Registry of Deeds.

What happens after submission?

After submitting the recreational land tax lien form, landowners can expect a processing timeline based on local jurisdictions and procedures.

-

Processing can take several weeks depending on the local authority’s workload.

-

Landowners may need to follow up to ensure that their submissions are processed and to receive confirmation.

-

Continuously check the status of the lien to manage any changes or updates effectively.

What are the advantages of using pdfFiller for document management?

Utilizing pdfFiller represents a strategic advantage in managing tax documents through advanced features that simplify the process.

-

Easily edit and sign documents without needing to print and scan.

-

Access your documents from anywhere at any time, enhancing convenience for users.

-

Invite additional signers or collaborators to assist in filling out or reviewing the document.

What are best practices for managing recreational land tax documents?

Managing recreational land tax documents can become seamless when following a well-structured plan that promotes organization and compliance.

-

Establish a filing system to keep all tax-related documents in one central location.

-

Stay updated with state tax regulations to avoid any lapses in compliance.

-

Employ pdfFiller for ongoing management, making it simple to revise documents as necessary.

How to fill out the recreational land tax lien

-

1.Open pdfFiller and upload the recreational land tax lien form.

-

2.Enter the property owner's full name and contact information in the designated fields.

-

3.Provide the legal description of the property, including its address and identification number.

-

4.Calculate the total amount of unpaid taxes, including any penalties or interest, and input this amount in the appropriate section.

-

5.Review the jurisdiction's requirements for signing the document, and ensure any required approvals or signatures are obtained.

-

6.Attach supporting documentation as required, such as previous tax statements or notices.

-

7.Double-check all entered information for accuracy and completeness before submitting the form.

-

8.Submit the completed form electronically through pdfFiller or print it for physical submission to the relevant tax authority.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.