Last updated on Feb 17, 2026

Get the free Recreational Land Tax Lien template

Show details

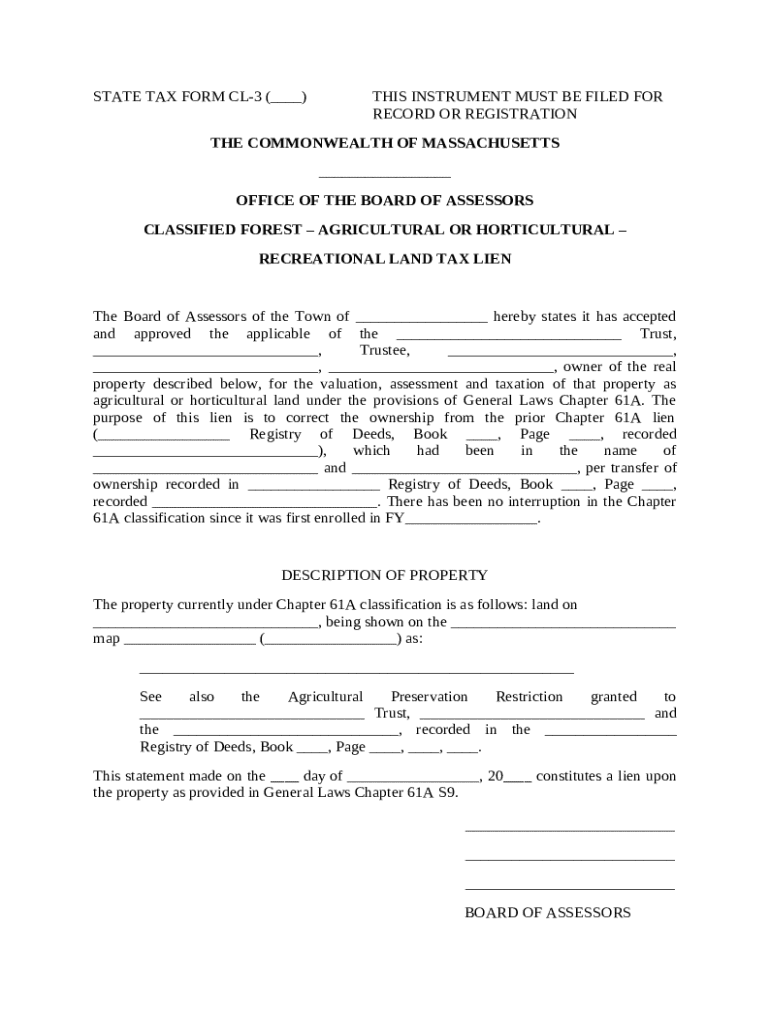

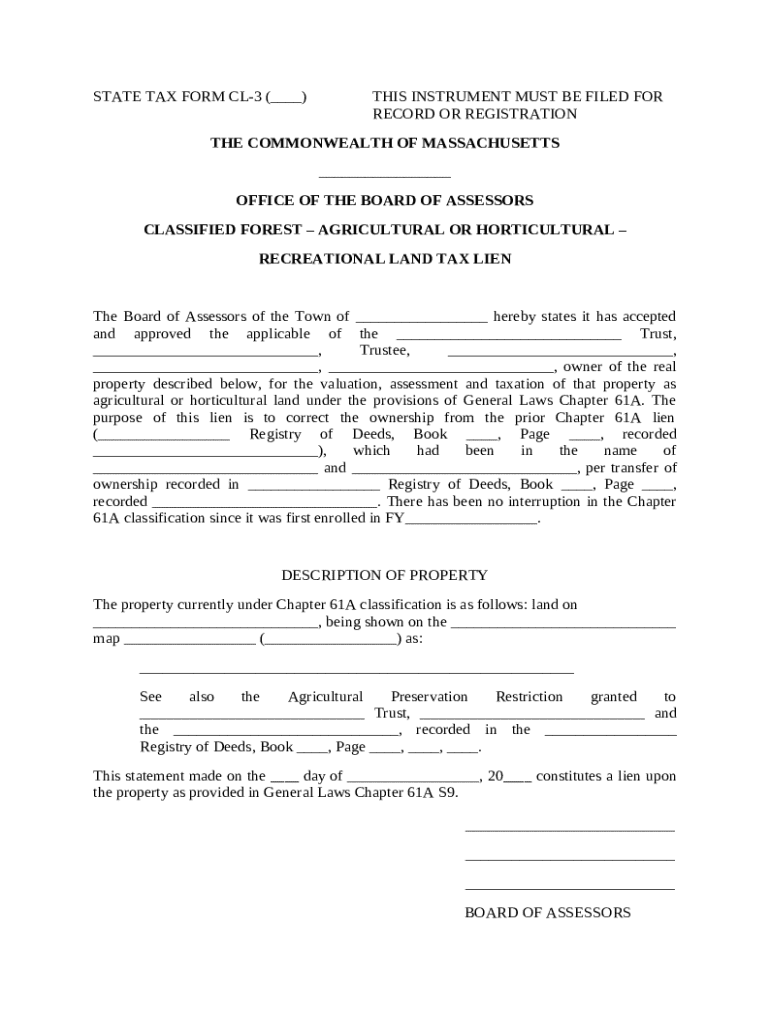

This form is an agreement where the Board of Assessors of a Town accepts and approves the Owner's valuation, assessment and taxation of the property as agricultural or horticultural land. The purpose

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is recreational land tax lien

A recreational land tax lien is a legal claim against a property for unpaid taxes that pertain specifically to land used for recreational purposes.

pdfFiller scores top ratings on review platforms

Thus far, has worked seamlessly whenever I've approached program.

EASY TO USE

satisfied but not able edit all pdf

fanático

Signing documents electronically was made easy

I love it

Who needs recreational land tax lien?

Explore how professionals across industries use pdfFiller.

Your guide to completing the recreational land tax lien form

What is a recreational land tax lien?

A recreational land tax lien refers to a claim placed against a property due to unpaid property taxes related to recreational or agricultural use. This mechanism ensures that property owners fulfill their tax obligations, promoting accountability in property management and compliance with taxation laws. Under General Laws Chapter 61A, these provisions are particularly relevant in Massachusetts, where landowners may qualify for reduced tax rates based on land stewardship.

Why complete the recreational land tax lien form?

Completing the recreational land tax lien form serves several essential purposes for property owners. First, it allows for correcting ownership details on existing Chapter 61A liens, which is critical to maintaining accurate public records. Additionally, it outlines the property assessments tied to recreational land usage and ensures compliance with tax obligations.

How do you fill out the recreational land tax lien form?

Filling out the recreational land tax lien form involves several steps to ensure accurate and timely processing. First, you will need to gather required information such as property identification details and ownership status.

-

Provide exact details about the property, including its location and size.

-

Ensure that the name and contact details of the property owner are accurate.

-

Fill in the relevant tax identification numbers and any previous lien details.

It's also vital to review each section thoroughly for accuracy and completeness to prevent delays in processing. Any inaccuracies can lead to legal complications.

What tools can help with the form?

Using pdfFiller provides an easy and efficient way to fill out the recreational land tax lien form. The platform offers various functionalities such as editing and eSigning, which streamline the completion process and help simplify collaboration among teams managing document workflows.

What are compliance and legal considerations?

When filing the recreational land tax lien form, it is crucial to adhere to state-specific requirements and regulations, particularly in Massachusetts. Improper filing can lead to significant consequences, including penalties and the potential loss of land use benefits.

-

The form may need to be notarized to ensure authenticity.

-

Certain submissions might also require a witness, depending on local regulations.

Understanding these legal details is essential for ensuring compliance and protecting your property rights.

Who are the key legal entities involved?

The Board of Assessors plays a vital role in the recreational land tax lien process by overseeing assessments and adjustments to tax statuses. Connecting with local attorneys who specialize in property law can also be beneficial for staying informed of your rights and any changes to property legislation.

What additional resources are available?

Property owners can access various government and legal resources related to property management. Additionally, pdfFiller offers numerous forms that assist in different aspects of property management and tax filings.

How do you track your form submission?

After submitting the recreational land tax lien form, it's important to confirm its receipt and processing. Typically, response timelines from the Board of Assessors can vary, but using pdfFiller helps you retain proof of submission, ensuring your application is processed efficiently.

How to fill out the recreational land tax lien

-

1.Obtain the recreational land tax lien form from the relevant tax authority or pdfFiller.

-

2.Open the form in pdfFiller and review the required fields.

-

3.Fill in the property owner's name accurately in the designated section.

-

4.Enter the property address where the recreational land is located.

-

5.Include the tax year for which the lien is being filed.

-

6.List the amount of unpaid taxes owed along with any applicable penalties.

-

7.Provide your name, contact information, and role (e.g., tax collector or representative).

-

8.Sign the form electronically using pdfFiller's signature feature.

-

9.Review all entered information for accuracy and completeness before submitting.

-

10.Submit the completed form electronically through pdfFiller or print and mail it to the appropriate tax office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.