Get the free Promissory Note - Horse Equine s template

Show details

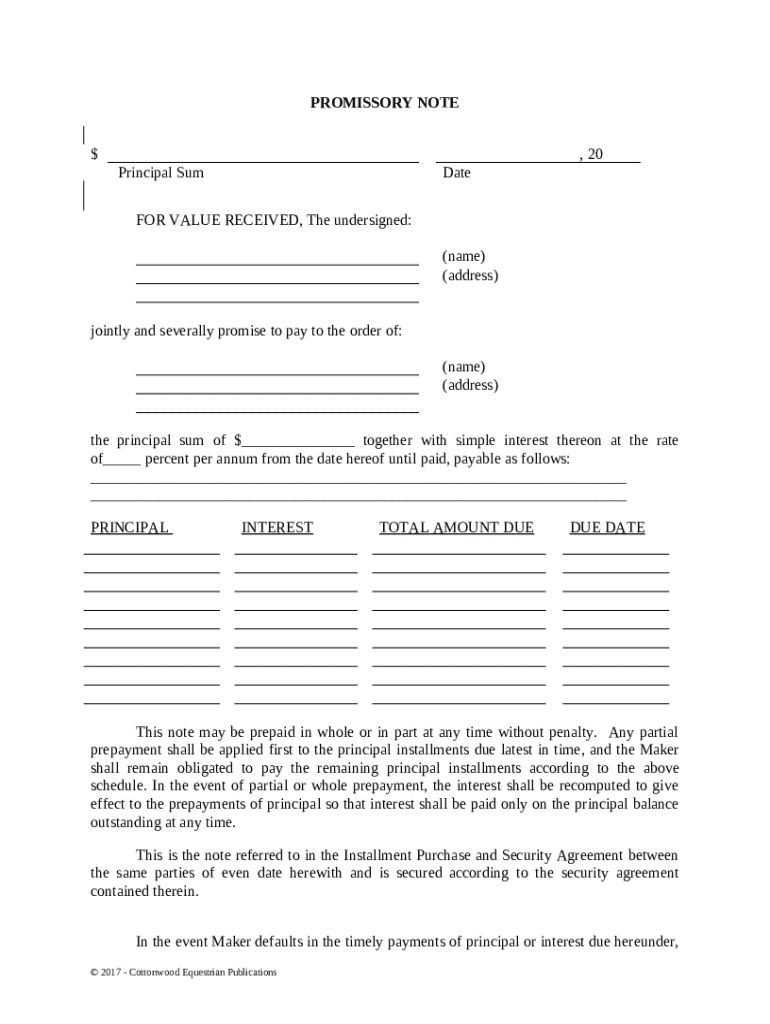

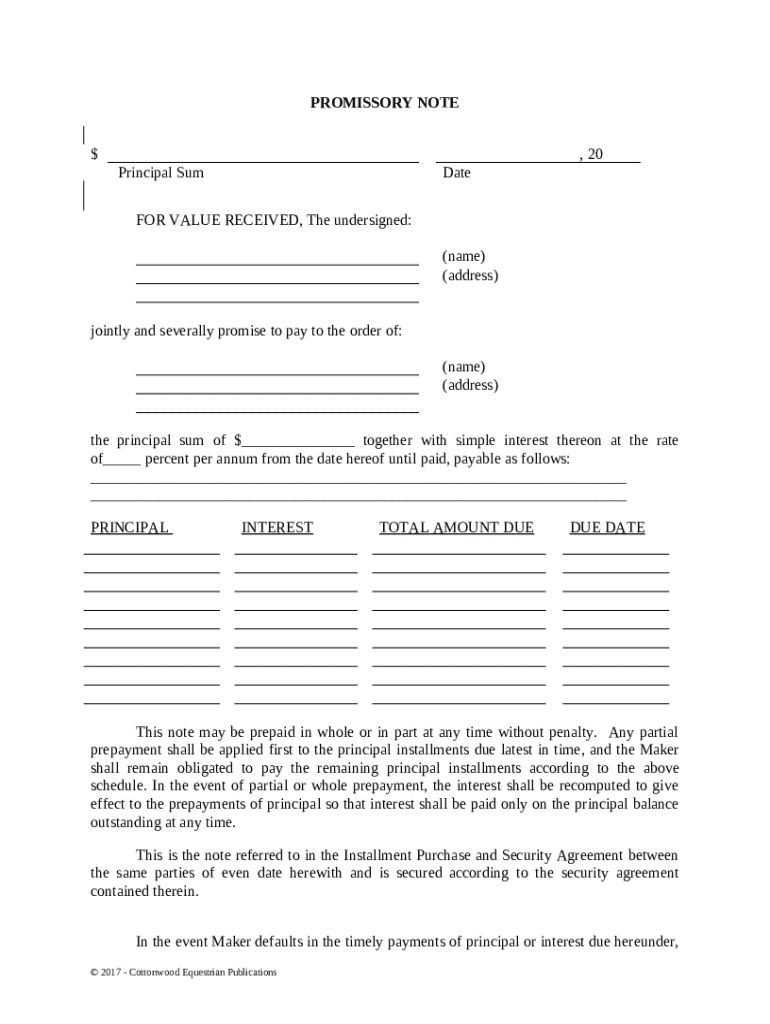

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note for a horse is a legal document in which one party promises to pay another a specified sum of money for the purchase of a horse.

pdfFiller scores top ratings on review platforms

Fast and easy to use and I will continue using

This was very helpful in completing my assigned task

it's great - all the old forms that I needed I found - easy to use

A little combersome navigating but pretty good overall

Makes everything look professional that I send out.

I did not know about PDFfiller.com but once I found it and realized what great features were offered and how easy it was to navigate and use, I was definitely impressed. I love the features since I work a lot with PDF documents and now I can make corrections or additions without recreating the entire document.

PDFfiller makes my job much easier.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Promissory Note - Horse Form Form

Understanding the promissory note

A promissory note is a written, unconditional promise to pay a specified amount of money to a designated person or entity at a specified future date. It serves as a fundamental document in loan agreements, establishing the borrower's obligation to repay the lender. Understanding the legal significance of promissory notes is crucial for both parties involved in the financial transaction.

-

A promissory note details the borrower's commitment, outline, and repayment structure, which is vital for transparent financial engagement.

-

These notes are enforceable in court, meaning if a borrower defaults, the lender has legal recourse to recover funds.

-

Various elements such as amount, interest rates, and terms must be clearly outlined for enforceability.

What are the key components of a promissory note?

Each promissory note includes several important components, which ensure clarity for both the borrower and the lender. Knowing these elements can help you draft a more effective document.

-

The total amount of money borrowed, which must be calculated accurately and detailed in the note.

-

Defines how much the borrower will pay back over time, influencing the total repayment cost.

-

Indicates when the borrower must repay the loan, helping both parties manage their expectations.

-

Defines the repercussions if the borrower fails to make the scheduled payments.

How do you fill out your promissory note?

Filling out a promissory note requires careful attention to detail. Each section must be completed accurately to avoid disputes later. Below is a structured guide on how to effectively fill in the form.

-

Provide the legal name and address of the borrower to ensure proper identification.

-

Detail the lender's name and contact information to establish who is providing the loan.

-

Clearly state the principal amount and the applicable interest rate to avoid confusion.

-

Outline when and how often payments are to be made, including any grace periods.

-

Incorporate any additional clauses or provisions pertinent to special conditions of the loan.

How to edit and manage your promissory note?

Editing an existing promissory note is straightforward with tools like pdfFiller, which allows for easy modifications to PDF forms. Ensuring that your document remains legally binding requires some steps.

-

Use user-friendly interfaces to make changes without needing extensive technical skills.

-

Use tools within pdfFiller to eSign forms, ensuring that the document is legally enforceable.

-

Invite team members to review or edit documents, facilitating better communication and accuracy.

What are the common mistakes to avoid when creating a promissory note?

Creating a promissory note can be tricky, and small errors can lead to significant complications. Understanding these common pitfalls can help ensure your document stands up in legal scrutiny.

-

Make sure to verify that the interest calculations are correct to prevent disputes over payments.

-

Always include vital information such as date, amounts, and identification to ensure enforceability.

-

Be aware of and comply with laws that may affect the terms of promissory notes in your region.

What additional considerations should be made regarding legal issues?

In addition to the document itself, borrowers and lenders must consider various legal aspects that apply to promissory notes. This awareness can significantly impact the effectiveness of the agreement.

-

Different states have unique laws regarding promissory notes; be sure to familiarize yourself with these.

-

Certain agreements may necessitate notarization, adding a layer of formality to the agreement.

-

Establish clear pathways for dispute resolution and protocols for managing payment defaults.

How can pdfFiller help you create and manage your promissory note?

Using pdfFiller offers numerous benefits in creating and managing your promissory note. It streamlines the entire process from drafting to execution, making it ideal for both individuals and businesses.

-

Access your documents anytime and anywhere, ensuring flexibility and efficiency in modifications.

-

Easily share your finalized form with stakeholders in a secure environment, maintaining confidentiality.

-

Utilize numerous available templates for various types of promissory notes to save time and effort.

How do promissory notes facilitate financial transactions?

Promissory notes play a significant role in financial transactions, serving as a tool for both individuals and organizations. They ensure that lending and investment processes are documented and secure.

-

Using promissory notes simplifies the processes of lending and investment by providing clear legal documentation.

-

They are commonly used in situations ranging from personal loans to business financing.

-

Promissory notes can be contrasted with bills of exchange and loans, highlighting distinct purposes and functionalities.

How to fill out the promissory note - horse

-

1.Open the promissory note template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Provide the full name and address of the borrower (the buyer) in the designated fields.

-

4.Enter the full name and address of the lender (the seller) as required.

-

5.Specify the amount of money being borrowed for the horse purchase in the principal amount section.

-

6.Indicate the interest rate, if applicable, next to the principal amount.

-

7.Detail the repayment terms, including how often payments will be made and the final due date.

-

8.Include a description of the horse being purchased, noting breed, age, color, and any identifying information.

-

9.Sign the document where indicated, ensuring both parties also do so, to make it legally binding.

-

10.Save the completed document and ensure both parties retain a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.