Get the free Promissory Note - Horse Equine s template

Show details

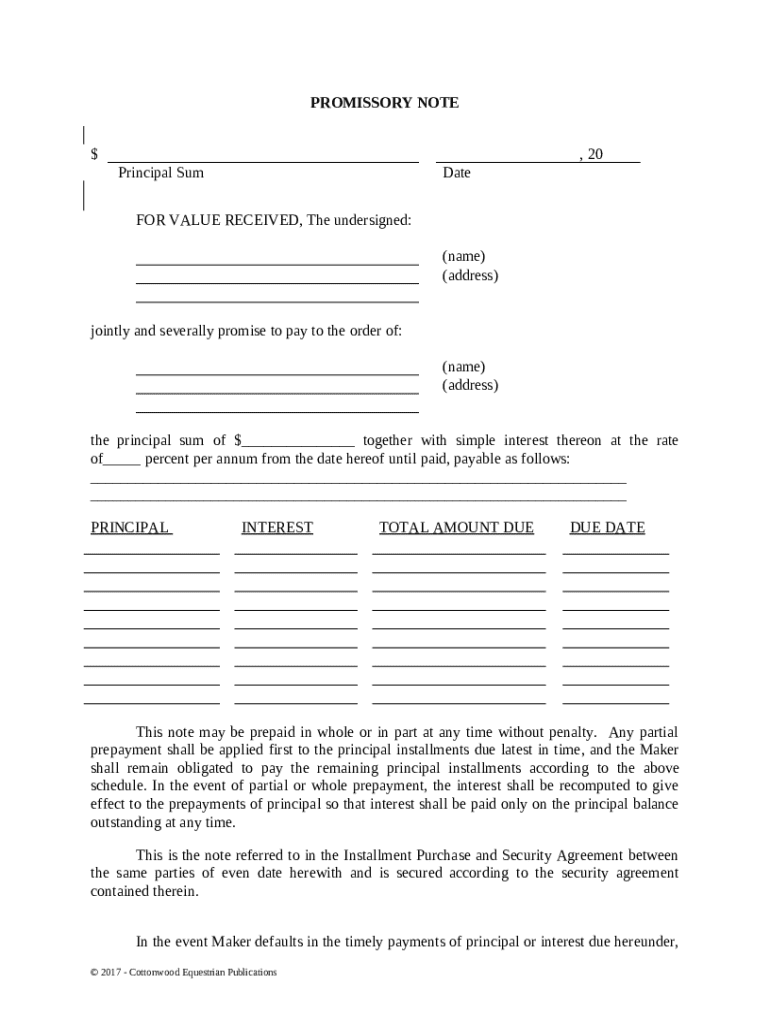

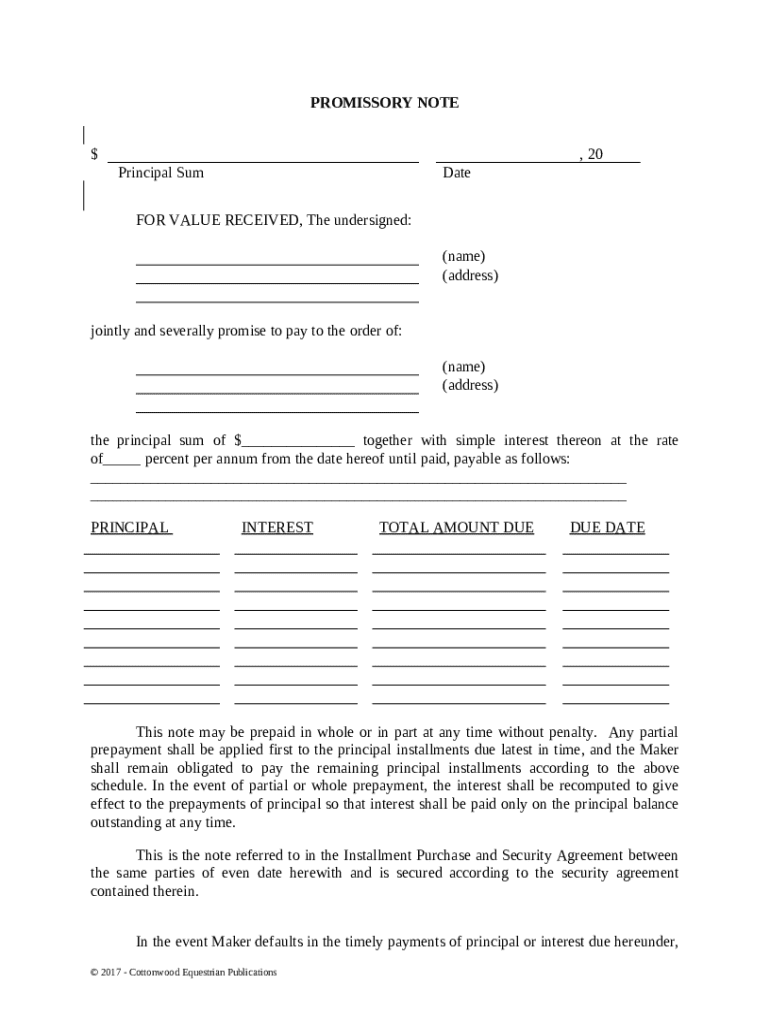

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a written promise to pay a specified amount of money for the purchase or loan of a horse.

pdfFiller scores top ratings on review platforms

I cant live without PDFfiller :)

A little confusing

I DON'T KNOW ENOUGH TO OFFER A BETTER…

I DON'T KNOW ENOUGH TO OFFER A BETTER ASSESSMENT

Easy to use

Easy to use, Customer service is fast. Great buy for the money.

excellent

excellent excellent excellent

the best pdf filler ever.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Creating and Managing a Promissory Note

How to fill out a promissory note form?

Filling out a promissory note requires clear information about the agreement between the parties involved. You must specify amounts, repayment terms, and other legal stipulations to ensure enforceability in any jurisdiction. Follow this guide to navigate through the necessary steps seamlessly.

What is a promissory note?

A promissory note is a written promise to pay a specific amount of money to a designated party at a future date. This essential financial document serves an important purpose in both personal and business transactions, providing security and clarity.

-

A legal instrument in which one party promises to pay a sum to another party.

-

Includes the principal sum, interest rate, repayment schedule, and maturity date.

-

Establishes the terms of the loan and is enforceable by law.

How do you fill out a promissory note?

Filling out a promissory note involves detailing all necessary elements accurately. Start by identifying the parties involved, then specify the principal sum and interest rate, set the repayment schedule, and include relevant clauses.

-

Clearly state who is the Maker (borrower) and who is the Payee (lender).

-

Write the exact amount being borrowed.

-

Research current market conditions to establish a fair interest rate.

-

Define when and how the payments will be made, detailing due dates and amounts.

-

Incorporate terms for prepayment options and consequences for default.

How can pdfFiller help with your promissory note?

pdfFiller is an invaluable tool for editing and managing promissory notes. With its user-friendly interface, you can customize existing templates, incorporate digital signatures, and collaborate with others effectively.

-

Easily modify templates or existing documents to fit your needs.

-

Facilitate secure signing and ensure all parties can sign from anywhere.

-

Utilize built-in tools to verify formatting and compliance with legal standards.

What legal aspects should you consider for promissory notes?

Legal compliance is crucial when executing a promissory note. Make sure you understand state-specific regulations and the importance of consulting with legal experts to avoid pitfalls.

-

Each state may have its own rules about promissory notes that must be followed.

-

Engaging with a lawyer can ensure that all legal requirements are met.

-

Neglecting critical details like interest rates or repayment terms can render the note unenforceable.

How do you manage your promissory note after creation?

Managing a promissory note involves diligent tracking of payments and knowing your options in case of defaults. Effective systems can help you stay organized and ensure timely actions.

-

Use spreadsheets or financial software to monitor payment schedules.

-

Be prepared with a plan in case payments are missed, which could include legal action.

-

Keep your promissory note in a secure place, whether digitally or physically.

What should you do if a default occurs?

In case of a default, it's essential to know your rights and available actions. Enforcing the terms of the promissory note may require legal action or negotiation for a resolution.

-

Initiate a dialogue with the borrower or consider legal avenues.

-

Explore options like small claims court for payment recovery.

-

Consider restructuring the payment terms if possible to reach a compromise.

What resources can assist you in navigating promissory notes?

Numerous resources, including checklists and templates, can aid in creating and managing promissory notes. Seeking legal assistance is also invaluable for ensuring everything is correctly addressed.

-

Review comprehensive lists that cover all necessary steps in drafting and managing notes.

-

Access various templates available online tailored to different situations.

-

Contact professionals for expert advice if you encounter challenges.

How to fill out the promissory note - horse

-

1.Access the promissory note template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Enter the lender's name and address next, ensuring accuracy.

-

5.Specify the total amount of the loan or purchase price clearly in the appropriate section.

-

6.Detail the interest rate if applicable, stating it as an annual percentage.

-

7.Outline the repayment terms which may include payment schedule and due dates.

-

8.If collateral is involved, describe the horse being financed, including breed, age, and registration details.

-

9.Sign and date the document at the bottom; a witness signature may also be required.

-

10.Review the completed note for any errors before saving or printing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.