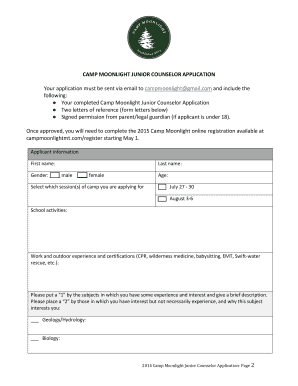

Get the free Notice of State Tax Lien template

Show details

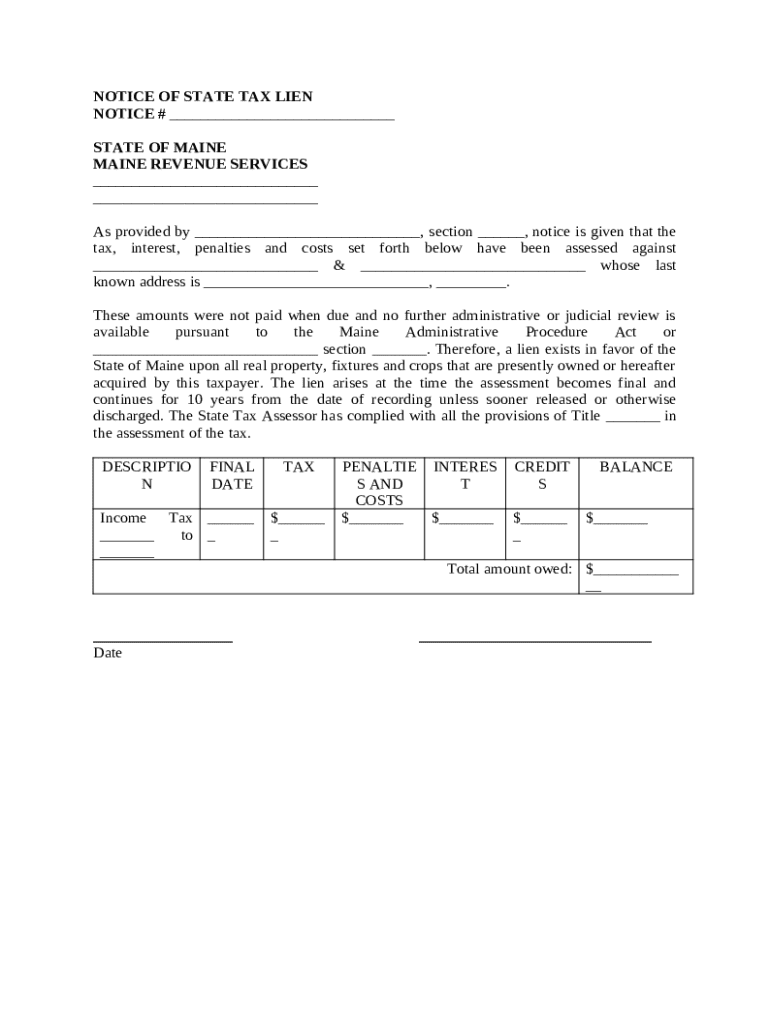

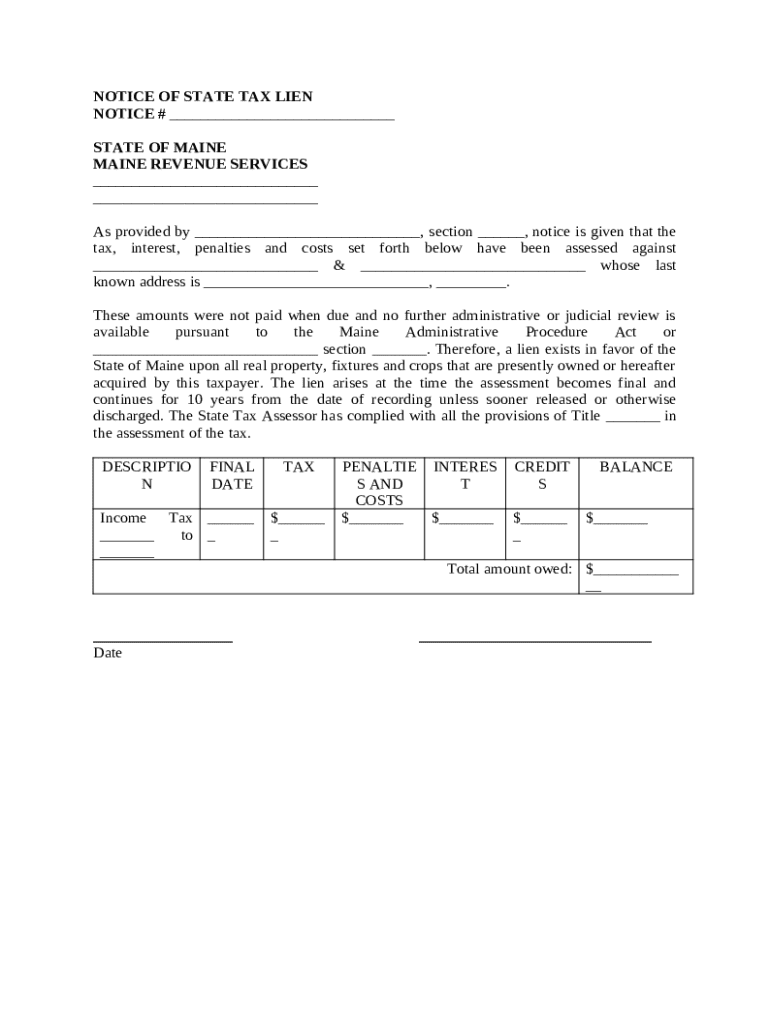

A lien exists in favor of the State of Maine for nonpayment of tax, interest, penalties and costs as assessed.

We are not affiliated with any brand or entity on this form

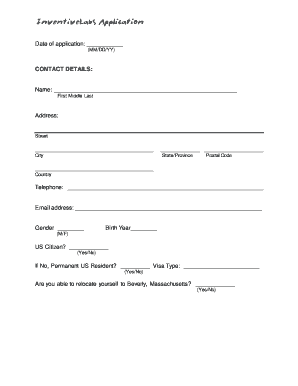

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of state tax

A notice of state tax is an official document issued by the state tax authority informing individuals or entities of their tax obligations or assessments.

pdfFiller scores top ratings on review platforms

user friendly but would like to learn more about features

Simple, easy and convenient

I dont have the money for the software.

HANDY AND HELPFUL TOOL

Good to use its honestly very straight forward

I found it very good and easy to use

Who needs notice of state tax?

Explore how professionals across industries use pdfFiller.

Understanding the Notice of State Tax Form

How to fill out a notice of state tax form?

Filling out a notice of state tax form requires careful attention to detail. Start by obtaining the form from your state’s tax agency website, ensuring you use the latest version. Complete each relevant field accurately to avoid delays or penalties.

What is a notice of state tax form?

A notice of state tax form is an official document issued by state tax authorities detailing the taxpayer's obligations. This form is critical because it ensures that taxpayers are aware of their tax liabilities, which may include assessments, penalties, and interest on unpaid taxes.

-

The state tax form indicates specific amounts owed and the deadlines for payments.

-

Understanding this document is vital for realizing tax implications and avoiding liens.

What are the components of the notice?

The notice consists of several components, each providing crucial information about your tax liability. Important sections include your taxpayer identification number and the notice number, which distinguishes each form.

-

This unique number identifies your specific notice for tracking purposes.

-

This indicates the jurisdiction under which the tax is being assessed.

-

This is the body responsible for administering tax collections in the state.

-

Includes details of taxes due, penalties, accrued interest, and remaining balance.

How do you fill out the notice of state tax form?

Completing the notice may seem daunting, but with clear instructions, it can be manageable. Each field should be filled out beginning with personal identification and moving through income details and tax calculations.

-

Follow precise instructions provided with the form, ensuring accuracy and completeness.

-

Pay special attention to numbers and alphabet entries to prevent mistakes.

-

Avoid miscalculating totals or failing to sign the form, as these can lead to penalties.

How can you manage your state tax document?

Using tools like pdfFiller allows you to edit, sign, and manage your state tax forms conveniently. These features enhance collaboration for individuals and teams working on tax documents.

-

Easily make corrections and updates to your tax documents without the hassle of reprinting.

-

Teams can work together in real-time, ensuring synchronized input on vital tax documents.

-

Remote access allows you to sign documents anywhere, streamlining the file submission process.

What are the legal implications of a state tax lien?

Unpaid tax liabilities can lead to the establishment of a tax lien, which is a legal claim against your property. This can significantly affect your credit rating and future financial dealings.

-

Failure to pay can result in seizure of property and claims on income.

-

This statute governs the taxation processes and your rights as a taxpayer in Maine.

-

Promptly address any notice of tax lien to avoid escalation.

What should you know about compliance and important dates?

Compliance with tax requirements is crucial to avoid penalties. There are specific deadlines for responding to notices of tax liens to ensure you remain in good standing with tax authorities.

-

Mark your calendar with all vital dates related to tax submissions and appeals.

-

Adhering to state guidelines mitigates legal repercussions.

-

Establish a routine to regularly review your tax obligations each year.

How can you stay updated on tax regulations?

Staying informed about changes in tax laws can significantly impact compliance. Utilize pdfFiller’s resources to access updates that affect your tax obligations.

-

New tax laws can alter your filing requirements and potential liabilities.

-

Regularly reviewing legislation helps prevent errors in tax submissions.

-

Access guides and updates provided by pdfFiller for comprehensive compliance.

How to fill out the notice of state tax

-

1.Download the ‘notice of state tax’ form from the official state tax authority website or access it through pdfFiller.

-

2.Open the downloaded PDF file in pdfFiller.

-

3.Read the instructions carefully at the beginning of the document to understand the requirements.

-

4.Fill in your personal information including name, address, and Social Security number in the designated fields.

-

5.Provide details about the tax year for which you are filing, ensuring it matches the notice period.

-

6.Enter the specific tax amounts due as outlined in the notice you received, including any penalties or interest.

-

7.If applicable, include information regarding tax credits or deductions that you are claiming.

-

8.Review your entries for accuracy and completeness before proceeding.

-

9.Sign the document electronically using pdfFiller’s signature feature.

-

10.Save your completed form and either print it to mail to the tax authority or submit it electronically if that option is available.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.