Get the free pdffiller

Show details

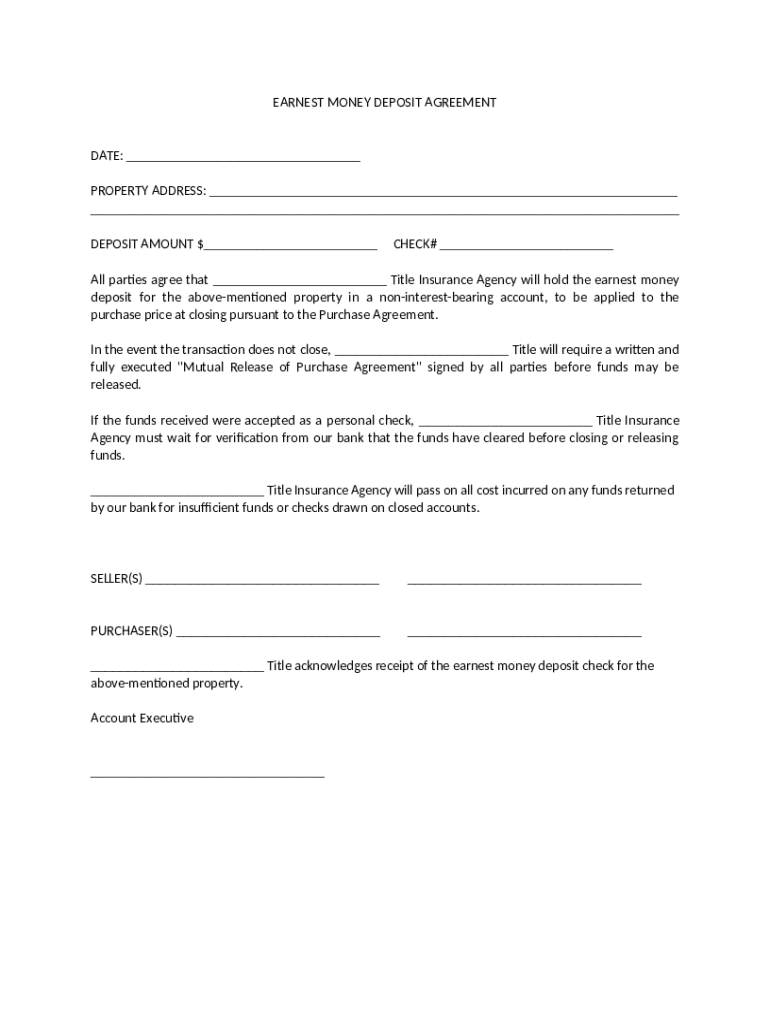

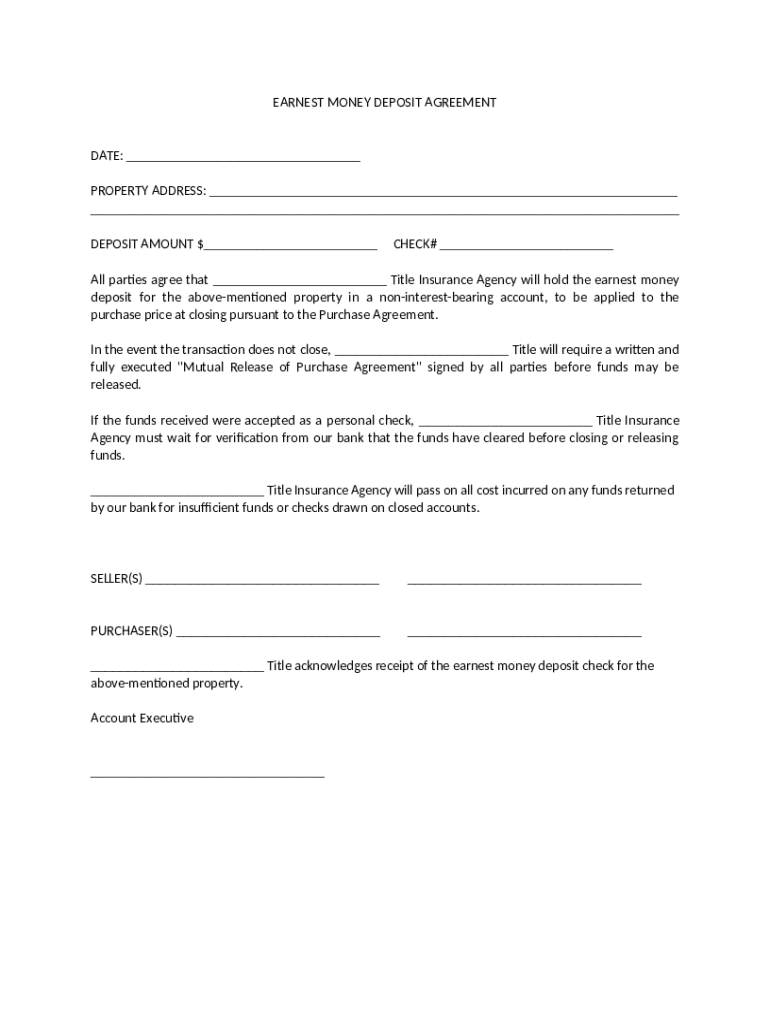

Seller and Buyer agree that a certain title insurance agency will hold the earnest money so that it can be applied to the purchase price at closing.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is earnest money deposit agreement

An earnest money deposit agreement is a legal document that outlines the terms and conditions under which a buyer provides a deposit to a seller as a show of good faith during a real estate transaction.

pdfFiller scores top ratings on review platforms

little complicated

good

GREAT I AM LEARNING

It was a great one off experience but I don't have a need for the long term

ME GUSTA, MAS NECESITO CONOCERLO MEJOR

good

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Understanding the Earnest Money Deposit Agreement Form

An earnest money deposit agreement form is a crucial document in real estate transactions. It solidifies the buyer's commitment to purchase a property by providing a monetary deposit, commonly known as earnest money. This guide will help you understand its components, significance, and the necessary steps to fill it out correctly.

What is an earnest money deposit agreement?

An earnest money deposit agreement is a legal contract between a buyer and seller in a real estate transaction. Its purpose is to signal the buyer's serious intent to purchase the property, ensuring mutual trust in the agreement. This document plays a vital role in protecting both parties, as it outlines the terms under which the deposit is made and the conditions for its forfeiture or return.

What are the key components of the agreement?

-

Critical recitals in the agreement must clearly outline the parties involved, property details, and essential terms. Clear language helps prevent disputes during the transaction.

-

This section emphasizes the expectation that both parties will act in good faith, ensuring a smoother transaction process.

-

The buyer's obligations regarding financial responsibilities are outlined here, as well as the consequences if these obligations are not met.

How do you fill out the earnest money deposit agreement?

-

Ensure the date is accurately filled as it signifies the start of the agreement's terms.

-

Accurate property detail is vital for legal clarity and ensuring all parties are on the same page.

-

Determine a reasonable deposit amount that reflects negotiations and expectations.

-

Follow best practices for noting the check number to easily track the transaction.

What is the role of the title insurance agency?

The title insurance agency plays an essential role in the earnest money deposit process. Responsible for managing funds, they ensure that deposits are made timely and that all parties adhere to the agreement terms. Coordinating with real estate agents and the involved parties, they help facilitate smooth transactions.

What are the conditions for fund release?

-

Funds will be released under certain conditions outlined in the agreement, typically when the transaction successfully closes.

-

If the transaction does not close, the agreement should specify the handling of the earnest money deposit, such as potential forfeiture or return.

What happens in case of modifications and breaches of the agreement?

-

Understanding common issues that result in breaches can prevent disputes, ensuring all parties are aware of their responsibilities.

-

If changes are necessary, they should be made in writing, accompanied by a legal review to ensure compliance.

Who needs to sign the earnest money deposit agreement?

All parties involved in the transaction, typically the buyer and seller, need to sign the agreement. It is crucial that signatures are obtained to validate the contract.

How to manage signatures electronically?

Utilizing electronic signature tools, like those offered by pdfFiller, facilitates gathering signatures remotely. This process streamlines document management and ensures compliance with relevant laws regarding digital signatures.

What final checks should be conducted before submission?

-

Double-check all essential information, such as the buyer's and seller's details, the property address, and the deposit amount to avoid future complications.

-

Confirm that the agreement meets the legal requirements of the state where the transaction occurs.

How does pdfFiller help with earnest money deposit agreements?

pdfFiller provides users with comprehensive features for editing and managing earnest money deposit agreements. Users benefit from collaborative tools that allow for seamless team interactions and cloud-based access, making document handling convenient and efficient.

How to fill out the pdffiller template

-

1.Open the earnest money deposit agreement template in pdfFiller.

-

2.Fill in the date on the top of the document.

-

3.Enter the names and contact information of both the buyer and seller in the respective fields.

-

4.Input the property address and description to specify what is being purchased.

-

5.Indicate the earnest money deposit amount, clearly stating how it will be delivered (e.g., check, wire transfer).

-

6.Specify the time frame for the deposit to be made after the agreement is signed.

-

7.Fill out any contingencies or conditions related to the earnest money.

-

8.Review all sections for accuracy.

-

9.Save the completed form and share it for signatures from both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.