Get the free Transfer on Death Deed or TOD - Beneficiary Deed for One Individual to Multiple Indi...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

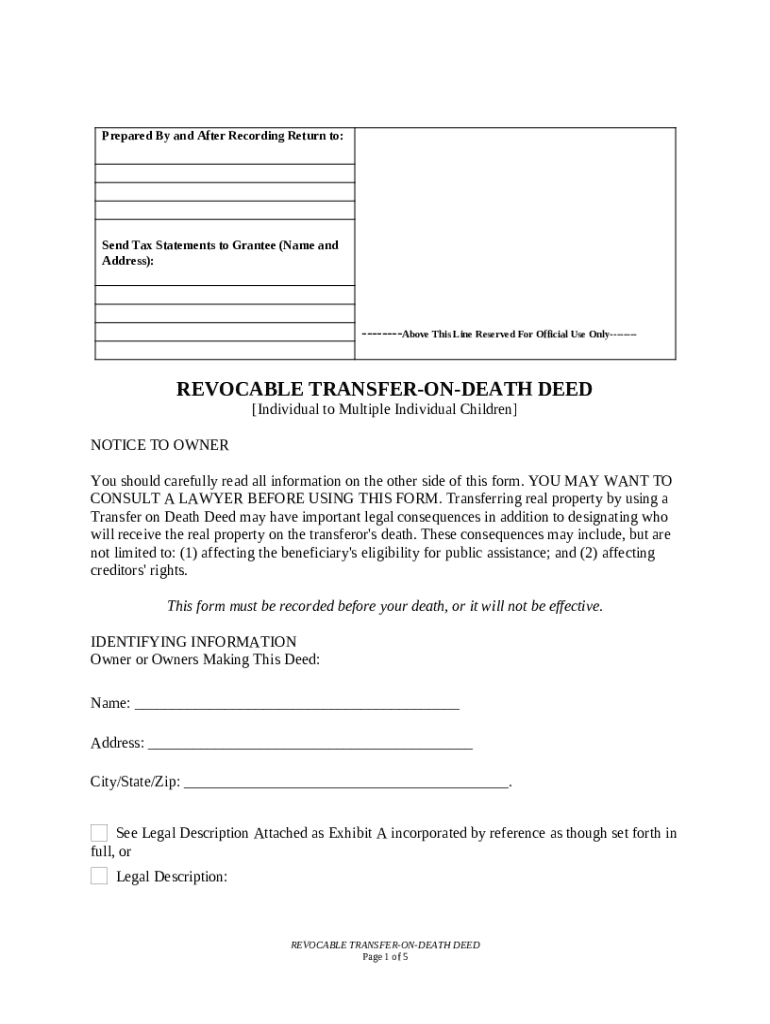

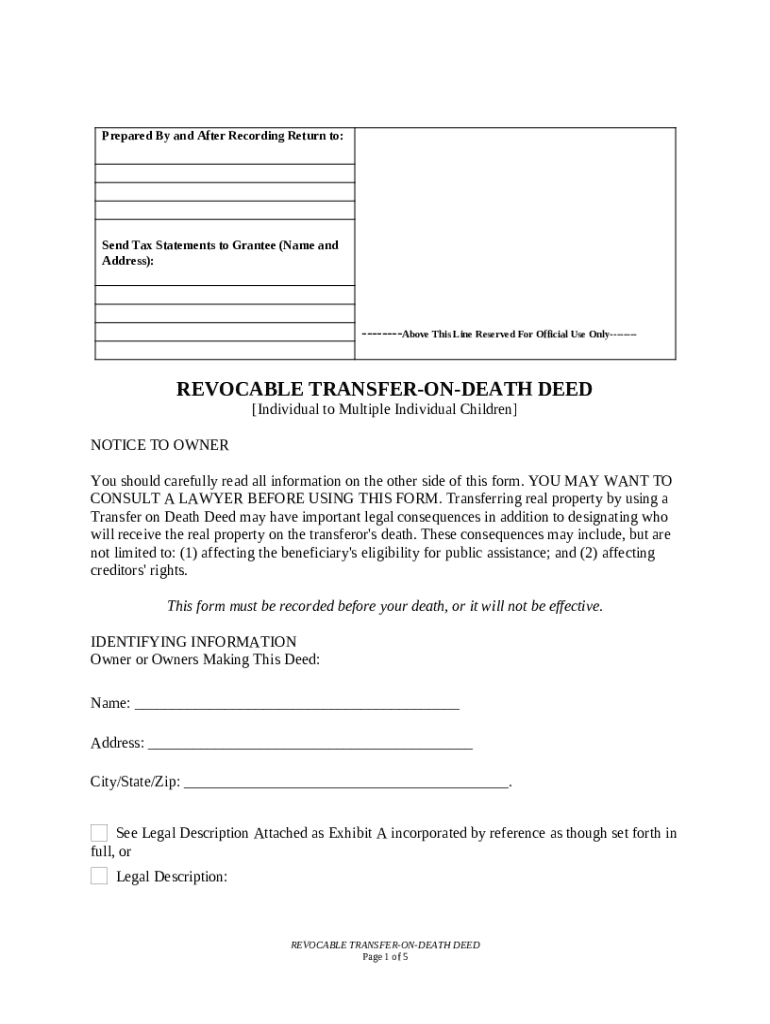

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Very good.

so far so good

I like the program but need help with making usps slips

What do you like best?

I like that all certificates on Insurance are in the same place, easy to find and I like the ability to duplicate certs

What do you dislike?

Can't find new documents very easily on the program

What problems are you solving with the product? What benefits have you realized?

It a one stop for get our certificates out to our insured, I like that we can now email and fax from the site

What do you like best?

The ease of converting documents to pdf to fill out online.

What do you dislike?

Download to my documents is not always simple. However usually can manage.

Recommendations to others considering the product:

Do it. Wonderful tool for business.

What problems are you solving with the product? What benefits have you realized?

I receive documents often from vendors, customers and regulators that require downloading and filling out. PDFfiller makes this so simple. Download, send to pdfFiller and fill out (often sign), done.

So far so good.

So far, so good. This has been a great, useful tool for me filling out docs that I desperately need in during times like this.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

How does a transfer on death deed work?

A Transfer on Death Deed (TODD) allows property owners to pass their property directly to designated beneficiaries upon death, avoiding probate. This document serves as a legal tool for estate planning, ensuring that loved ones can inherit real estate without going through lengthy court processes. Essentially, the deed revokes any previous arrangements for property transfer.

What should you prepare before filling out the form?

-

Obtaining personalized advice can provide clarity on legal stipulations and ensure that your intentions are accurately represented in the deed.

-

This includes the legal description of the property, which identifies the exact boundaries and features—essential for proper documentation.

-

Take time to learn about how the TODD might affect public benefits or creditor rights; these factors can significantly influence your decision.

How do you fill out the transfer on death deed form?

Filling out the transfer on death deed form requires attention to detail. Start with the Owner Information section; provide accurate names and addresses to ensure proper identification of the property owner.

-

Please fill in your name, address, and any necessary details as required to validate ownership.

-

Choose your primary and alternate beneficiaries carefully; they will inherit your property upon your death.

-

Clearly note how the transfer will happen upon death to prevent any ambiguity.

Why is recording the transfer on death deed essential?

Recording the deed before the owner's death is crucial for its legitimacy and enforcement. Delaying this can lead to complications that may prevent the designated beneficiaries from obtaining the property as intended.

-

Different locations have varying rules regarding where to file; ensure compliance to avoid issues.

-

Recording fees can differ across counties; familiarize yourself with costs to budget accordingly.

How can you maintain and revoke the deed?

The process of revoking or maintaining your Transfer on Death Deed revolves around clear communication and documentation. Owners can revoke their deed as long as they are alive, but specific procedures must be followed to ensure legality.

-

Make sure to understand the specific legal requirements for revocation in your state.

-

If a beneficiary predeceases the owner, updates need to be made to reflect new arrangements.

-

Regularly review your recorded deed to ensure it reflects your current wishes and conditions.

What are common issues and considerations?

When utilizing a transfer on death deed, several pitfalls may arise. It’s crucial to remain aware of all tax implications that may be incurred by beneficiaries, as well as fluctuations in laws that may impact the deed's validity.

-

Challenges such as miscommunication regarding the deed or misunderstanding its implications can arise.

-

Beneficiaries may face unexpected taxes upon property transfer, which should be discussed with a tax professional.

-

Stay informed about any changes in legislation that could affect your deed's enforcement.

How to fill out the transfer on death deed

-

1.Access pdfFiller and upload your transfer on death deed template.

-

2.Start by entering your full name and the date at the top of the document.

-

3.In the designated section, provide the legal description of the property you wish to transfer.

-

4.Next, clearly fill in the name of the beneficiary you intend to designate for the property.

-

5.If applicable, add an alternate beneficiary to ensure the transfer if the primary beneficiary is unavailable.

-

6.Ensure to list any conditions that may apply to the transfer, if desired.

-

7.Review all the information for accuracy to avoid any potential disputes.

-

8.Sign the document in the presence of a notary public to make it valid.

-

9.Finally, provide a copy to the beneficiary and keep one for your records to confirm the transfer.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.