Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to a Tr...

Show details

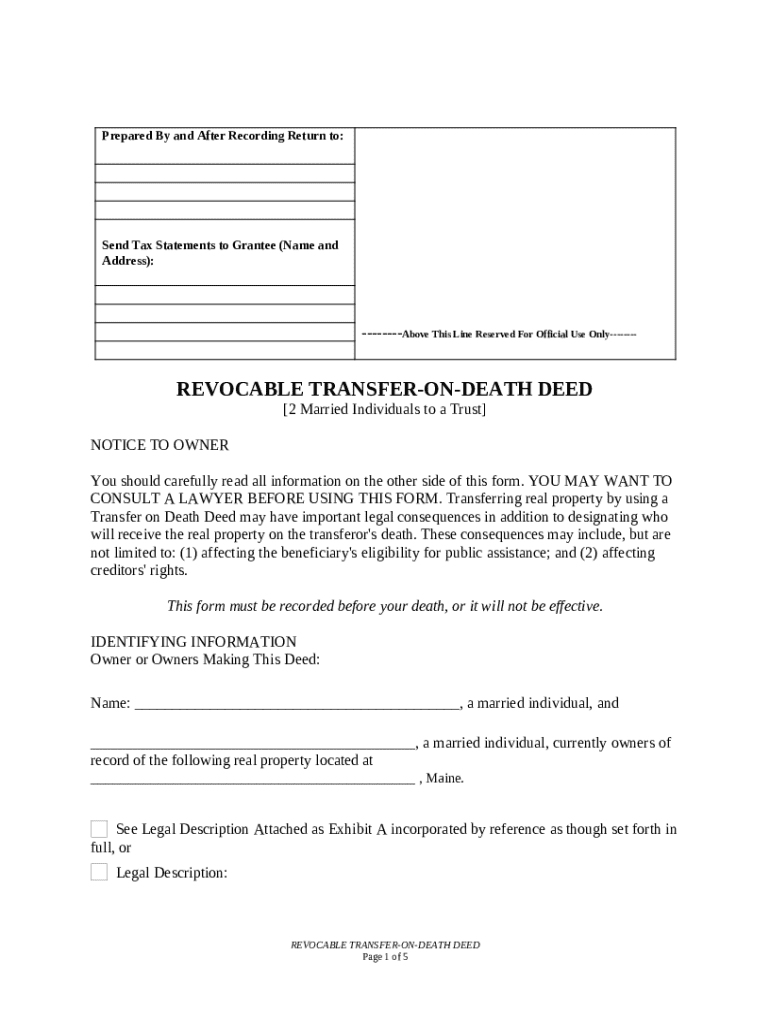

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed (TODD) allows a property owner to designate one or more beneficiaries to receive the property upon their death without going through probate.

pdfFiller scores top ratings on review platforms

easy to use

Exellent

Great application and would like to learn more

Easy to use, good value

Good

not done yet

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form

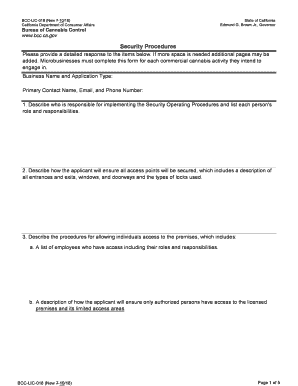

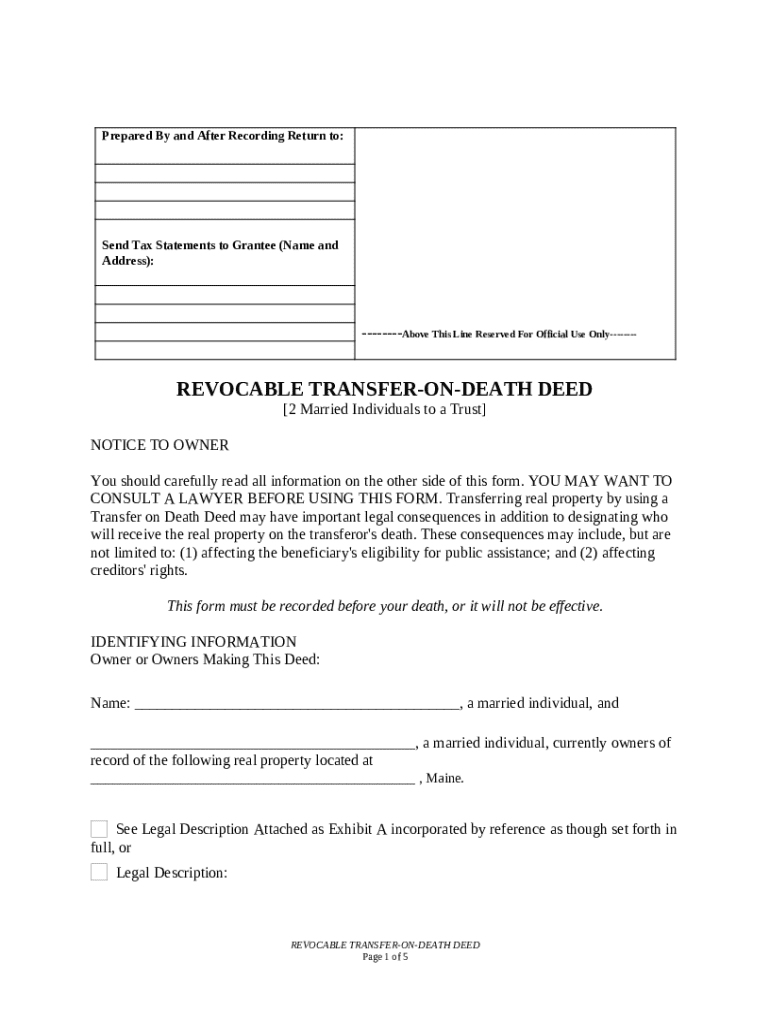

Understanding the Transfer on Death Deed

A Transfer on Death Deed (TODD) is a legal document that allows property owners to transfer real estate to designated beneficiaries upon their death without going through probate court. This deed must be recorded with the appropriate local authorities to be valid. The significance of this document lies in its simplicity and the potential to streamline the inheritance process for loved ones.

-

A TODD facilitates the direct transfer of property from the owner to beneficiaries upon the owner's death.

-

Using a TODD bypasses probate but requires proper execution and recording, which may differ by state.

-

Recording the TODD is crucial to secure the transfer; failure to do so may void the deed.

-

Not following legal protocols can lead to disputes or unintended outcomes regarding property ownership.

Preparation Before You Fill Out the Form

Preparation is key when dealing with a transfer on death deed form. Ensuring you understand the property, the beneficiaries, and the legal requirements can avoid complications later on.

-

Gather necessary information about the property and potential beneficiaries before initiating the form.

-

Discuss with a legal professional to clarify the deed's implications and ensure compliance with local laws.

-

Familiarize yourself with any specific regulations in your region that pertain to property transfers.

-

Understand how the deed may affect eligibility for public assistance and rights of creditors.

Completing the Transfer on Death Deed Form

Filling out the transfer on death deed form correctly is essential for it to be effective. Each step must be followed meticulously to ensure the document's legal standing.

-

Clearly list all current property owners using their full legal names.

-

Provide a comprehensive legal description of the property, including parcel numbers and addresses.

-

List the primary beneficiary who will receive the property upon the owner's death.

-

Optionally indicate an alternate beneficiary in case the primary beneficiary is unable to inherit.

-

Ensure that all signatures are dated and comply with state-specific witness or notarization requirements.

After Completing the Form

Once the form has been filled out, the next steps involve ensuring that it is properly registered and that potential beneficiaries are informed.

-

Submit the completed deed to the county recorder’s office where the property is located to make it official.

-

Keep a copy of the recorded document for your records and for beneficiaries.

-

Inform all beneficiaries about the deed to prevent confusion in the future.

-

Discuss any ongoing management of the property, ensuring rights are preserved after the transfer.

Common Mistakes to Avoid

Understanding common pitfalls when preparing a transfer on death deed can save time and legal headaches.

-

Mistakes in the form can lead to invalidation of the deed.

-

Without proper recording, the deed may not take effect upon death.

-

Beneficiaries should be updated to reflect personal circumstances or relationships.

-

Failing to comply with local regulations may have serious legal consequences.

Resources and Tools for Managing Your Transfer on Death Deed

Utilizing resources can make managing your transfer on death deed seamless and ensure proper documentation.

-

Edit and manage your transfer on death deed form easily with pdfFiller.

-

Securely eSign your documents directly through the pdfFiller platform.

-

Take advantage of pdfFiller's interactive tools to enhance your document management experience.

-

Connect with legal resources through pdfFiller for guidance throughout the property transfer process.

How to fill out the transfer on death deed

-

1.Obtain a blank transfer on death deed template from pdfFiller.

-

2.Open the template in pdfFiller to begin the filling-out process.

-

3.Fill in the property owner's name(s) as listed on the title.

-

4.Provide the address and legal description of the property to be transferred.

-

5.List the beneficiary's name(s) clearly, ensuring correct spelling.

-

6.Decide if you want to designate more than one beneficiary and note how you want the property divided.

-

7.Include your signature and the date on the document.

-

8.Check local jurisdiction requirements for notarization or witness signatures, if necessary.

-

9.Save the completed deed and print it out for signing or for your files.

-

10.File the signed deed with the appropriate local government office, typically the county recorder or land records office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.