Get the free Release of Mortgage template

Show details

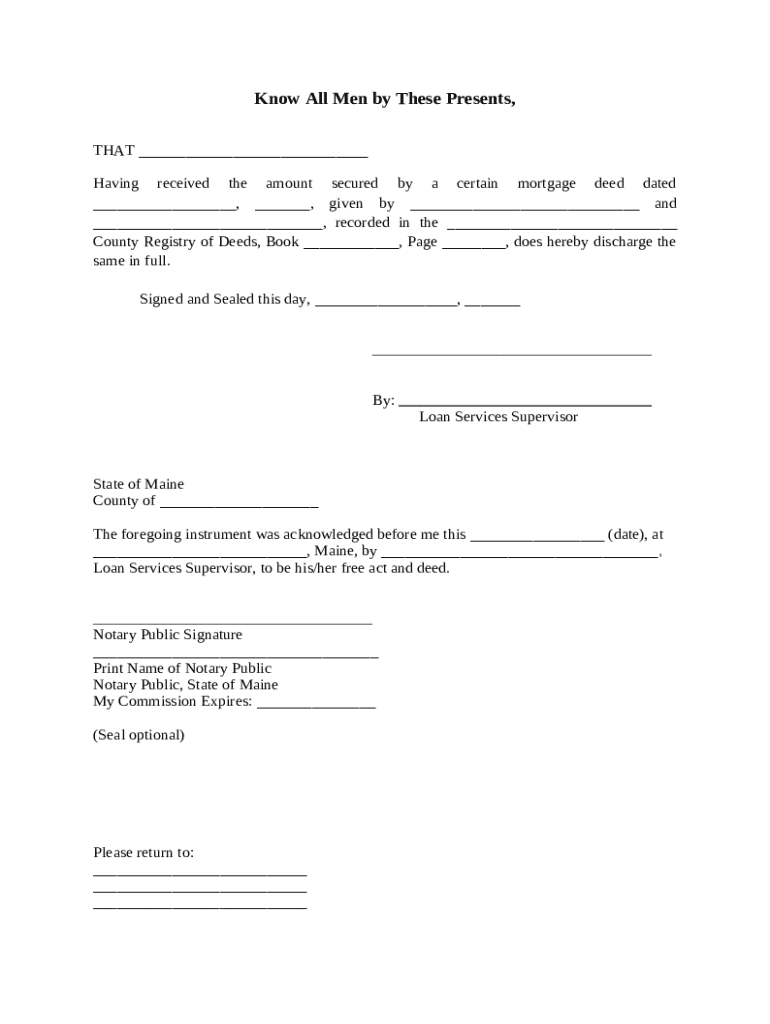

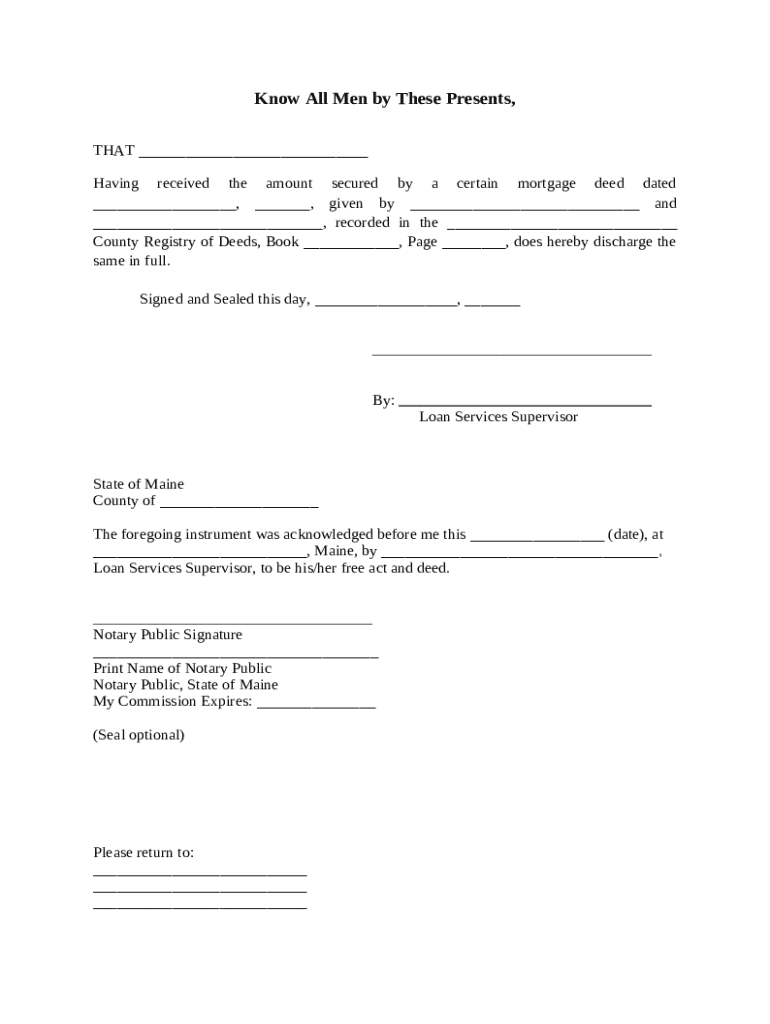

The holder of a mortgage discharges the mortgage for payment in full.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is release of mortgage

A release of mortgage is a legal document that terminates the borrower's obligation to repay the mortgage once the loan has been fully paid off.

pdfFiller scores top ratings on review platforms

Works well now that I have the hang of it.

Quick and easy to fill out. I needed that for the deadline I was approaching.

I just started using it, will let you know

This is easy to use. Since I have only one document to process and a CPA does my taxes, the cost of month-to-month seems high. I do hope it's easy to unsubscribe. I can't stand the way peoplefinders tries to undermine one-time usage. So thanks for your clarity and integrity.

Easy to use. Like it..Only issue so far is ability to save document with a different name after filling it in.

So far great. Just trying to get use to it and learn ways.

Who needs release of mortgage template?

Explore how professionals across industries use pdfFiller.

A Comprehensive Guide to the Release of Mortgage Form on pdfFiller

If you're looking to fill out a release of mortgage form, understanding the process is crucial. This guide will walk you through everything you need to know, from the definition of the form to how to navigate pdfFiller effectively.

Understanding the release of mortgage form

-

A release of mortgage form is a legal document that signifies the discharge of a mortgage obligation by the lender, formally releasing the borrower from the mortgage debt.

-

Discharging your mortgage is essential because it clears your title to the property, enabling you to sell or refinance without complications.

-

Typically, a release is required when a mortgage is paid off, during property transfers, or when refinancing takes place.

Required documents for the release process

-

The original mortgage deed is needed to identify the property and the terms of the mortgage that is being released.

-

You must provide documentation showing that the mortgage balance has been fully paid, such as a final account statement.

-

Personal identification, such as a driver’s license or passport, must be included to verify the identity of the homeowner.

-

Many states require the release form to be notarized to validate the signatures and ensure it meets legal standards.

Steps to complete the release of mortgage form

-

Begin by entering all pertinent details, including the names of parties involved, the date of the release, and the recording information of the mortgage.

-

Double-check all information for accuracy to prevent delays or issues with filing.

-

Both the borrower and lender must sign the document in accordance with local laws to enable the release.

-

Follow state-specific regulations to notarize the document, ensuring its legal validity.

Navigating the pdfFiller platform for your form needs

-

Visit pdfFiller, choose the release of mortgage form template, and start filling it out online.

-

Make use of pdfFiller's range of editing tools and e-sign options to customize your document.

-

Engage with others in your transaction through pdfFiller, allowing for easy collaboration.

-

Store your completed forms in the secure cloud system provided by pdfFiller for easy access and management.

Local compliance and regulatory notes for Maine residents

-

In Maine, specific documentation must be submitted to the local registry of deeds to properly record the release.

-

Understanding how local authorities review and approve releases is vital for timely processing.

-

Each county may have unique requirements, making it crucial to check local guidelines.

Common mistakes to avoid when filing a release of mortgage

-

Incorrect or missing details can lead to delays; always verify your entries.

-

Notarization is often required, and neglecting it may invalidate the release.

-

When in doubt, consulting with a legal expert can save you from potential pitfalls.

-

Submitting the form to the wrong office or incorrect procedure can cause unnecessary delays.

After the release: next steps for homeowners

-

Once you receive the release, ensure that you take action to record it with the appropriate local authorities.

-

Update your property records to reflect the release so that it accurately shows your ownership.

-

Keep copies of the release for your records and future reference during financial transactions.

In conclusion, mastering the release of mortgage form process can provide significant benefits for homeowners. With pdfFiller’s tools, you can efficiently manage your document requirements and ensure compliance with local regulations. By understanding the steps necessary and avoiding common mistakes, you'll streamline the mortgage discharge process.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.