Get the free Payoff Authorization template

Show details

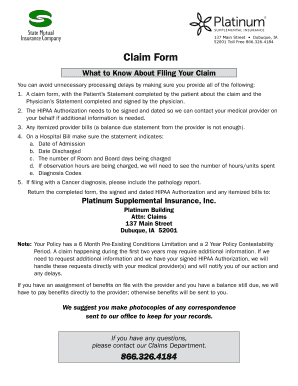

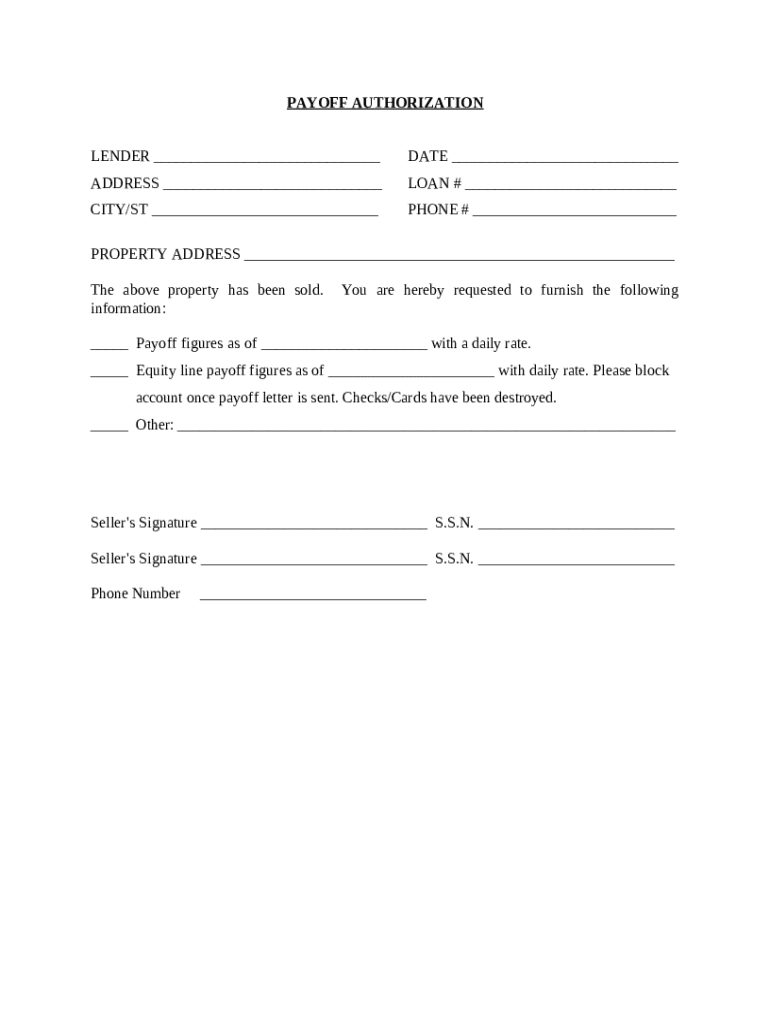

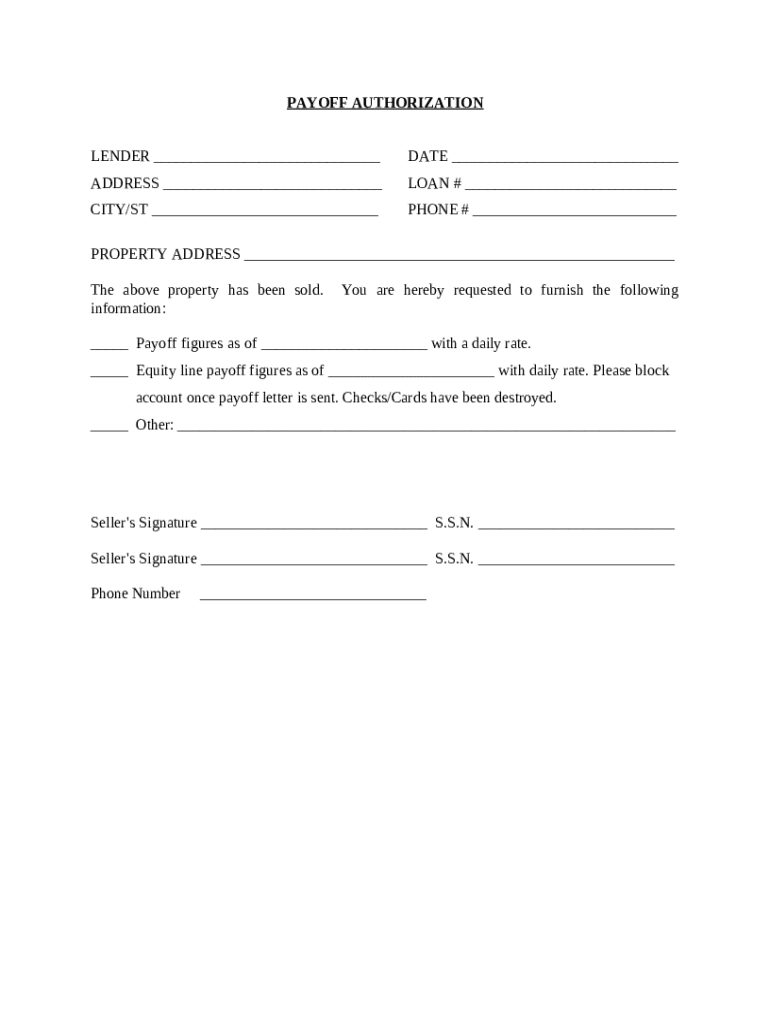

This form is the seller's payoff authorization advising the lender that the property has been sold and requesting a payoff.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is payoff authorization

A payoff authorization is a document that allows a lender to obtain the payoff amount needed to fully satisfy a loan or mortgage obligation.

pdfFiller scores top ratings on review platforms

I found it very easy to work and when the next time I need to use it I hope it is just as easy

so far its really the best i have seen need to know more

I am currently learning how to use the system.

Great for fixing errors in existing pdfs and for completing forms. Very user-friendly

PDFfiler has made office life much easier. It's even come in handy in my personal life a few times as well. Thank you!!

It is great it previews the bottom of the page. But, when I print it out it doesn't print out what it had showed at the bottom of my page in the preview before I printed it out.

Who needs payoff authorization template?

Explore how professionals across industries use pdfFiller.

Comprehensive Payoff Authorization Form Guide

How can you define a payoff authorization form?

A payoff authorization form is a document that allows a borrower to authorize their lender to provide necessary financial information to a third party. This form is crucial during the sale of a property or refinancing, as it facilitates the accurate calculation of outstanding loans and mortgage amounts.

Completing the form accurately is vital, as any mistakes could lead to delays in processing loan payoffs or miscommunications between parties. The use of this form is common in transactions such as home sales, refinancing scenarios, and loan transfers.

What components are essential in a payoff authorization form?

-

Details about the lender must be included, such as their name, address, and contact information for seamless communication.

-

Clear identification of the property is essential, including the complete address to avoid any confusion regarding the loan process.

-

It’s important to clearly indicate the requested payoff amount and relevant dates to ensure that all parties have the correct information.

-

The form should include the seller's name and signature, which ensures that the request is authorized and valid.

How do you complete a payoff authorization form?

-

Begin by entering the lender's name and contact information accurately. This ensures the document is directly connected to the correct financial institution.

-

List the full property address where the loan is secured, which will aid in the identification during the payoff process.

-

Clearly specify the amount to be paid off as well as any relevant dates to avoid miscalculation and maintain timely processing.

-

Ensure that the borrower signs the form and provides a Social Security Number (SSN) for identity verification.

-

Consider noting any details relevant to equity lines of credit and specific instructions for blocking future access to the account.

How can you use pdfFiller for managing your payoff authorization form?

pdfFiller simplifies the management of your payoff authorization form through its cloud-based platform. You can easily upload the completed document for secure storage and management.

-

Utilize your account to access the platform from any device, allowing you to manage your forms conveniently.

-

Easily upload your form to keep all your documents organized and accessible.

-

Take advantage of built-in editing tools to make necessary adjustments to your document quickly.

-

Utilize eSignature features for quick authentication and collaborate with relevant parties directly through the platform.

What are some best practices when submitting your payoff authorization form?

-

Before submission, review the entire form to ensure that all information is accurate and complete, reducing the chances of errors.

-

Follow up with your lender to verify that they have received your form and that no further action is required to process your request.

-

Maintain copies of all submitted documents, as this will help in resolving any issues that may arise later in the process.

Where can you find additional resources for your payoff authorization needs?

-

Visit the pdfFiller form center to find a variety of related forms that may assist in your financial transactions.

-

Reach out to the pdfFiller support team for personalized assistance tailored to your specific needs.

-

Search through related forms that might be relevant to other financial dealings you may be undertaking.

How to fill out the payoff authorization template

-

1.Visit pdfFiller and upload the payoff authorization template.

-

2.Begin by entering the borrower's full name and contact information in the designated fields.

-

3.Provide the account number for the loan that is being paid off to ensure accuracy.

-

4.Input the lender's name and address to identify where the payoff request is directed.

-

5.Specify the loan type, such as mortgage or personal loan, in the appropriate section.

-

6.Verify the date of the request; use today's date for simplicity.

-

7.Sign the authorization section to grant permission for the lender to release the payoff amount.

-

8.Double-check all entered information for accuracy to avoid delays.

-

9.Save the completed document and select the option to either print or electronically send it to the lender.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.