Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Married Beneficia...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to designate a beneficiary to receive their property upon their death without the need for probate.

pdfFiller scores top ratings on review platforms

Very user friendly

Easy to navigate

A very user-friendly platform for signing and uploading forms!

egfdgdgvdd

So far works like a charm. Very intuitive editing elements.

good

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

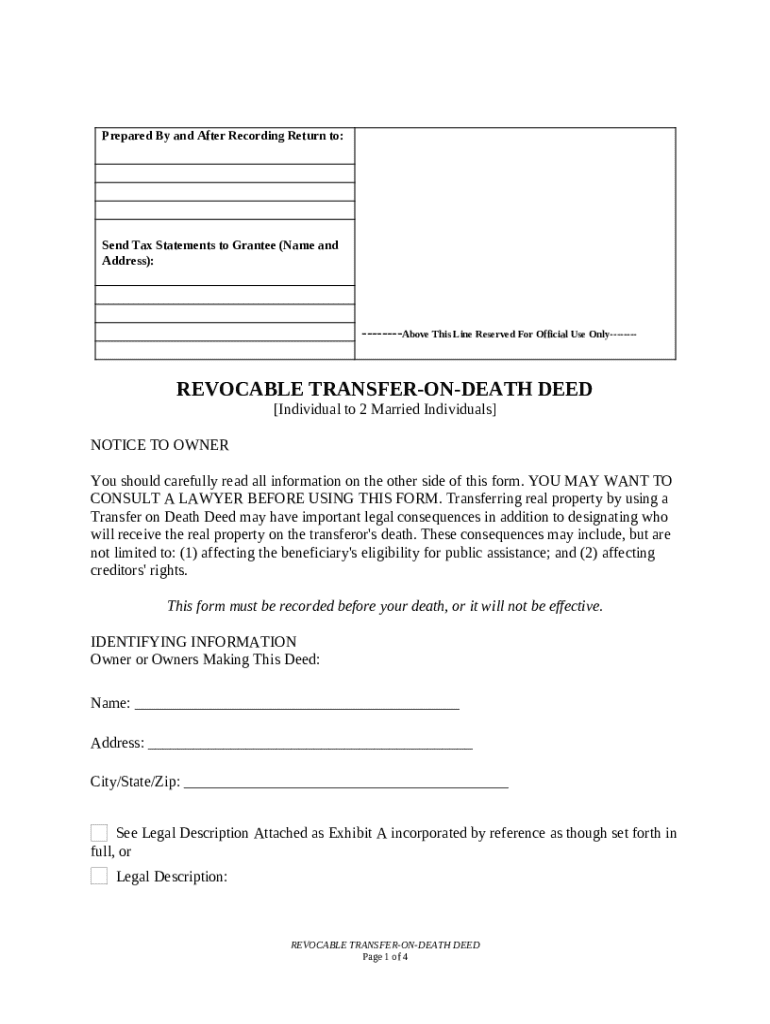

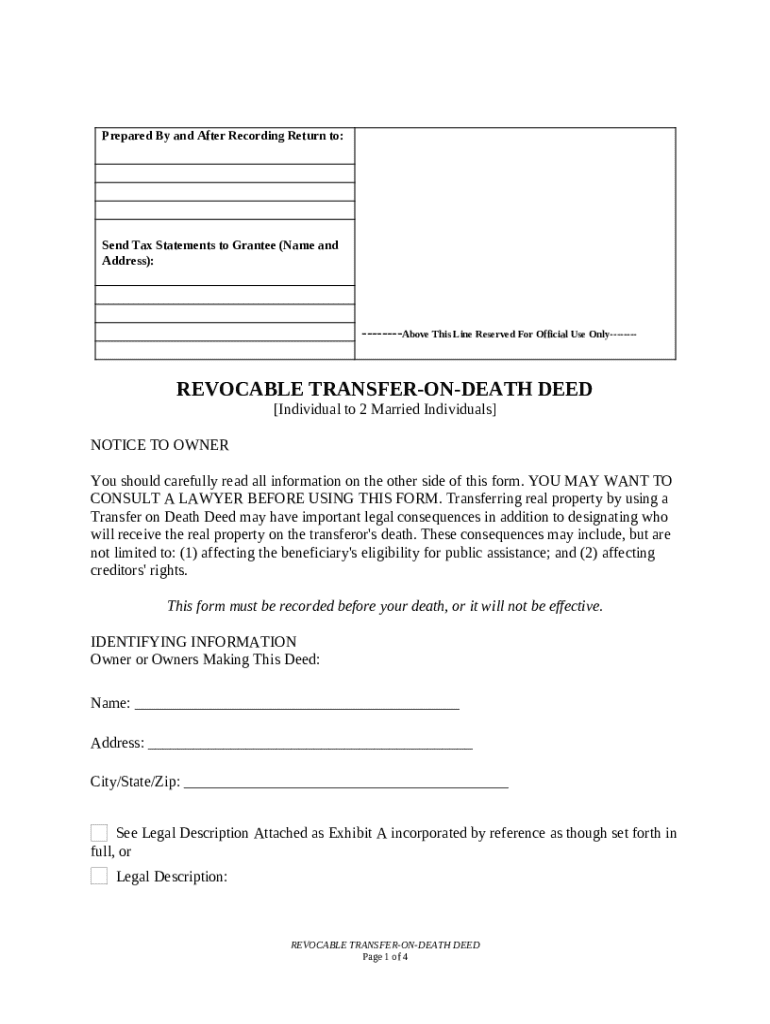

Detailed Guide to Transfer on Death Deed Form

Understanding how to fill out a transfer on death deed form is crucial for anyone looking to bypass probate for their property. This deed allows property owners to pass their real estate directly to their beneficiaries upon death without the assets going through probate.

What is a transfer on death deed?

A Transfer on Death (TOD) Deed is a legal tool that allows individuals to assign their property to a beneficiary to be transferred upon their death. This process helps in avoiding probate, which is the legal process of distributing a deceased person’s assets.

-

The primary purpose is to simplify the transfer of real property, ensuring a smooth transition to loved ones.

-

Advantages include avoiding probate, providing a clear directive for property distribution, and maintaining control over the property during the owner's lifetime.

-

Once executed and recorded, a TOD deed is legally binding, meaning it cannot be revoked without following the proper procedures.

What should you consider before getting started with your deed?

Before you fill out a transfer on death deed form, it’s vital to consider the legal implications and potential consequences.

-

Engaging with legal counsel can help clarify state-specific laws and ensure compliance.

-

Misunderstanding the legal ramifications can lead to unexpected claims on your property, affecting beneficiaries.

-

Consider how this deed affects eligibility for public assistance programs and the rights of creditors over inherited property.

What identifying information is required for the deed?

Proper documentation is essential when completing a transfer on death deed form. You'll need specific details about the property and its owners.

-

Complete names and contact information of the current property owners must be indicated.

-

A precise legal description helps avoid disputes regarding property boundaries and ownership.

-

Each jurisdiction may have unique requirements for the recording of deeds; ensure compliance to prevent issues.

How do you fill out beneficiary information?

Filling out beneficiary information correctly is crucial for ensuring your wishes are honored after your death.

-

Clearly state the primary beneficiary who will receive the property upon your death to avoid confusion.

-

Consider designating alternate beneficiaries in case the primary beneficiary predeceases you.

-

Understand that the rights of beneficiaries differ based on their designation and can be contested under certain circumstances.

What steps are involved in executing the transfer-on-death?

Executing the transfer-on-death deed involves making specific decisions and following formal procedures.

-

Upon the death of the property owner, the transfer occurs automatically without the need for probate.

-

Owners retain the right to revoke the deed while alive, subject to legal procedures outlined by state law.

-

Proper signatures and notarizations are essential to validate the deed and make it legally enforceable.

How do you record your deed?

Recording the deed is the final step in ensuring its effectiveness. You must understand where and how to record your transfer on death deed.

-

Typically, you will record at the County Recorder's Office in the jurisdiction where the property is located.

-

Failing to record your deed before death can lead to complications, potentially nullifying your intentions for beneficiary transfer.

-

Different counties may have varying recording requirements; check with local authorities to ensure compliance.

What common mistakes should you avoid?

Creating a Transfer on Death Deed can be straightforward, but mistakes can lead to costly legal issues.

-

Incomplete forms or unclear beneficiary designations can lead to legal disputes among potential heirs.

-

Double-check all entries for completeness and accuracy before finalizing the document.

-

Utilize resources like the [website] template tools to ensure thorough completion of your deed.

Where can you get more information on transfer on death deeds?

Accessing additional resources can enhance your understanding of transfer on death deeds and their applications.

-

Explore [website] for additional consultation services to aid in completing your transfer on death deed.

-

Engage with additional resources regarding property transfers and estate planning provided by [website].

How to fill out the transfer on death deed

-

1.Obtain the transfer on death deed form from pdfFiller.

-

2.Start by entering the name of the property owner at the top of the form.

-

3.Provide the legal description of the property being transferred in the designated section.

-

4.Clearly state the name and contact information of the beneficiary.

-

5.If there are multiple beneficiaries, outline how the property should be divided or indicate joint ownership.

-

6.Sign the form in the presence of a notary public to ensure its validity.

-

7.Confirm if any additional state-specific requirements are needed, such as witness signatures.

-

8.Submit the completed deed to your local property records office to record it formally.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.