Get the free Renunciation And Disclaimer of Real Property Interest template

Show details

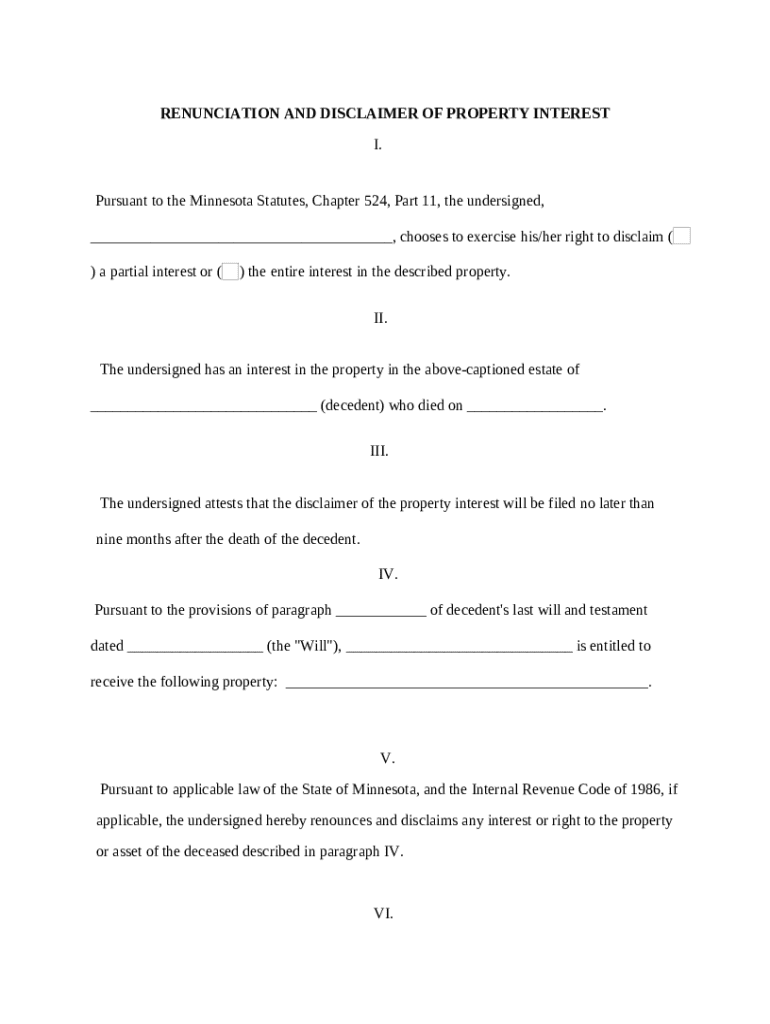

This form is a Renunciation and Disclaimer of Real Property. The beneficiary gained an interest in real property upon the death of the decedent. However, pursuant to Minnesota Statutes, Chapter 524,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is renunciation and disclaimer of

A renunciation and disclaimer of is a legal document in which an individual formally refuses to accept a benefit or interest, typically related to an estate or inheritance.

pdfFiller scores top ratings on review platforms

Awesome service.

great

....still getting acquainted with this software...very new to me..

Very easy to use.

SO FAR ITS WORKING AS IT SHOULD

Fast and effective

Who needs renunciation and disclaimer of?

Explore how professionals across industries use pdfFiller.

How to fill out a renunciation and disclaimer of form form

Understanding renunciation and disclaimer of property interests

Renunciation and disclaimer play pivotal roles in property law, particularly concerning estate planning and asset distribution. A renunciation is a formal declaration made by an individual or entity rejecting their legal entitlement to property, whereas a disclaimer functions similarly but is often invoked in inheritance contexts. In Minnesota, the legal framework surrounding these actions is defined by state statutes that outline how individuals can relinquish their rights to inherited property without incurring tax liabilities.

-

A formal rejection of a property interest, which may allow the renouncer to avoid certain tax repercussions.

-

Essential for removing inheritance from a deceased's estate, providing beneficiaries the option not to accept property.

-

State laws govern how renunciations and disclaimers should be processed, ensuring proper legal compliance.

Who is eligible to file a renunciation and disclaimer?

Eligibility for filing a renunciation and disclaimer is essential to ensure that the right parties exercise this legal action. Typically, both individuals and entities may file a renunciation, provided they are recognized heirs or beneficiaries under the decedent's will or applicable laws. Situations such as receiving an inheritance or being gifted property often warrant a disclaimer, especially if accepting the property would lead to undesirable tax implications.

-

Individuals or entities designated as beneficiaries in a will or by law may file a disclaimer.

-

Common scenarios include inheritances or gifts where acceptance may have financial drawbacks.

-

The disclaimer must be filed within a specific period (usually 9 months) after the decedent's death to be valid.

Key components of the renunciation and disclaimer form

A well-structured renunciation and disclaimer form is vital for ensuring clarity and compliance with legal standards. Below are the critical sections of this form, each addressing specific details required for proper submission. Understanding these components will help filers complete the document accurately and avoid complications.

-

Clearly states the intention to renounce an interest in particular property.

-

Details the specific property or interest being disclaimed to avoid ambiguity.

-

Affirms that the disclaimer is submitted within the required legal timeframe.

-

Links the disclaimer to the original will to ensure context and validity.

-

Establishes the legal grounds for the disclaimer in accordance with Minnesota law.

-

Outlines how renouncing the property affects distribution among other heirs.

-

Instructions on how to properly submit the disclaimer to the relevant authority.

How to fill out the renunciation and disclaimer form

Filling out the renunciation and disclaimer form accurately is crucial to avoid legal issues down the line. Following a systematic approach to complete each section enhances thoroughness and compliance. It's advisable to begin with a blank form and utilize a checklist to ensure all required information is included.

-

Begin by reading the instructions thoroughly to understand what information is needed for each section.

-

Double-check all entries, especially personal information and legal terms, to avoid ambiguities.

-

Avoid omitting signatures or failing to file within the designated timeframe, as these can invalidate the disclaimer.

Navigating the filing process for the renunciation and disclaimer form

Successfully submitting your renunciation and disclaimer form is as important as completing it correctly. Understanding where and how to file the document is essential. In Minnesota, specific courts handle these filings, and accompanying documentation may vary based on the circumstances of the disclaimer.

-

Typically filed with the probate court overseeing the decedent's estate.

-

Include the original will, a death certificate, and any additional relevant forms required by the local jurisdiction.

-

Generally, courts process disclaimers within a few weeks; however, check local guidelines for specifics.

Understanding legal implications and rights after filing

Filing a renunciation and disclaimer has significant legal implications, particularly regarding the disclaimed property. Understanding these consequences can prevent potential disputes and ensure all parties are informed of their rights and responsibilities. Notably, disclaimed property is no longer an entitlement of the disclaiming party, affecting how assets are distributed among remaining heirs.

-

Once filed, the disclaimant forfeits any claim to the disclaimed property, ensuring clear boundaries regarding ownership.

-

May alter the distribution of assets among heirs, necessitating clear communication with all involved parties.

-

Disclaiming property is a permanent decision, thus requiring careful consideration before proceeding.

Engaging PDF tools for document management

Utilizing advanced PDF tools can significantly streamline the process of filling, signing, and managing your renunciation and disclaimer form. pdfFiller's platform offers features that simplify this process, allowing users to complete the form conveniently online. These functionalities not only enhance productivity but also offer a secure way to manage important legal documents.

-

pdfFiller enables users to fill out all required sections efficiently using an intuitive interface.

-

The platform supports electronic signatures, ensuring the disclaimer is legally binding without the need for printing.

-

Store all documents securely in the cloud for easy access, sharing, and collaborative management.

How to fill out the renunciation and disclaimer of

-

1.Obtain the renunciation and disclaimer of form from pdfFiller.

-

2.Open the document in pdfFiller and review the fields that need to be filled out.

-

3.Enter your personal information such as name, address, and contact details in the designated fields.

-

4.Provide the details of the estate or assets you are renouncing and disclaiming, including descriptions and values.

-

5.Include the date of the renunciation and disclaimer.

-

6.Ensure you have the necessary signature fields completed, signing where required.

-

7.If applicable, have the document notarized to validate your signature and ensure legal compliance.

-

8.Save the completed document in your preferred format, and then print or submit it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.