Get the free Satisfaction of Security Agreement template

Show details

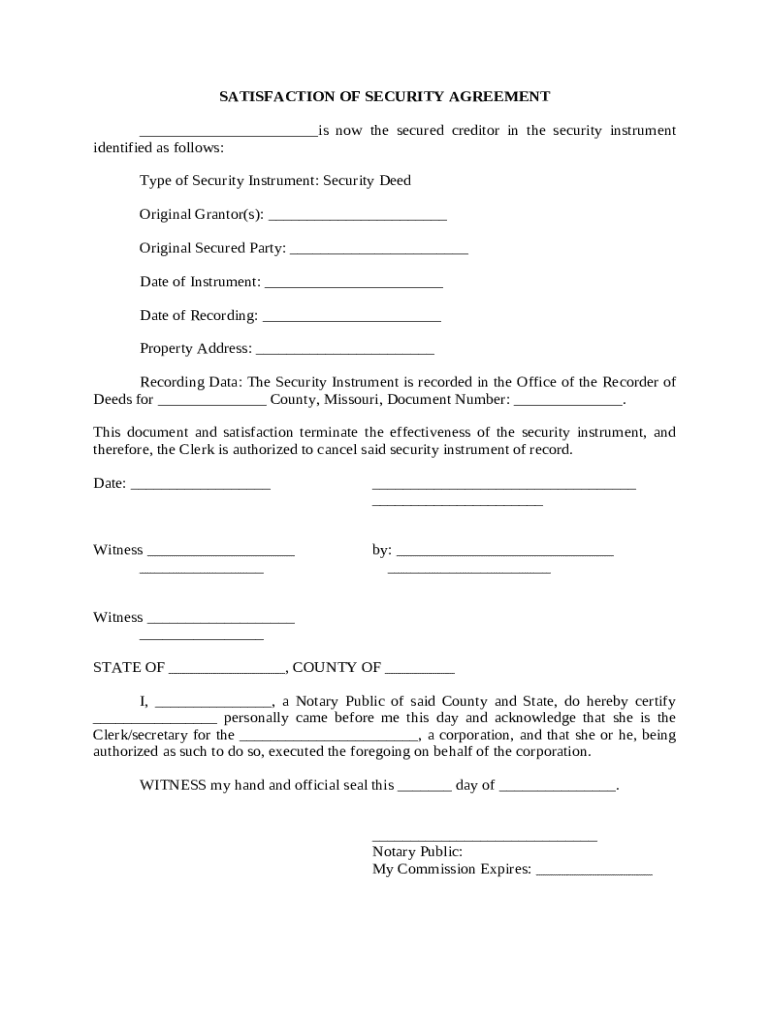

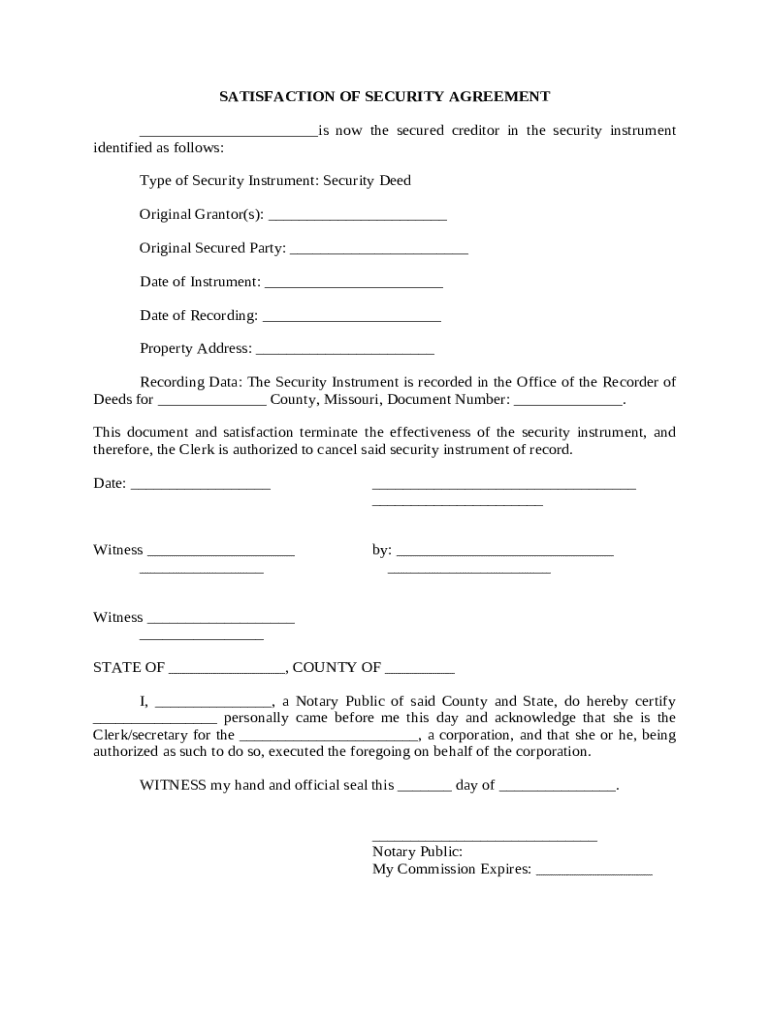

This form is for the satisfaction or release of a deed of trust.

for the state of Missouri by an Individual

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is satisfaction of security agreement

A satisfaction of security agreement is a legal document confirming that a debt obligation secured by a security agreement has been fulfilled.

pdfFiller scores top ratings on review platforms

Super, easy, consistent, fabulous programming, tops

Good. Although billing issue was a bit of a pain but was resolved in a quick and efficient manner. Love the program.

I am STILL having trouble with the text when I am writing in a document

Great extension. Only been using for a day. Only thing so far that I find fault with is that text entered on the android version of the app displays on a single line whereas on the Chromebook extension displays correctly

GOOD EXCEPT DONT KNOW HOW TO DUPLICATE A SINGLE PAGE WITHIN A MULTIPAGE DOCUMENT

Too soon to know. So far, it seems versatile and meets my needs.

Who needs satisfaction of security agreement?

Explore how professionals across industries use pdfFiller.

Understanding the Satisfaction of Security Agreement Form

What is the satisfaction of security agreement?

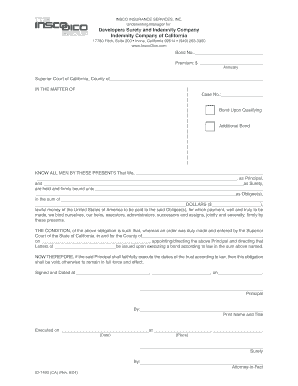

The satisfaction of security agreement form is a legal document used to release a secured creditor's claim against a secured asset once the underlying obligation has been fulfilled.

This document serves as proof that a borrower or grantor has successfully repaid their debt or fulfilled their obligations, thus removing any liens or claims that the creditor may have had on the property.

Having a properly executed satisfaction form is crucial for maintaining clear title to a property, ensuring that future transactions can proceed without encumbrances.

Why is the satisfaction of security agreement form important?

The satisfaction of security agreement is essential for securing transactions because it provides documentation that all obligations have been completed, allowing for the property to be free of claims from creditors.

This form helps ensure trust between parties in a financial transaction, as it demonstrates that the borrower has met the terms of their agreement, thus clearing any legal claims.

-

By providing proof that no debts exist against the property, its marketability increases.

-

Clear title simplifies the process for selling or transferring property ownership in the future.

-

A properly executed satisfaction form protects the borrower from potential legal disputes.

What are the legal implications?

The primary legal implication of the satisfaction of security agreement form hinges on its ability to discharge a creditor's claim. Without this form, creditors can still assert a legal right to the secured property.

Improperly executed satisfactions can lead to complications, including continued liability for the borrower, potential foreclosure proceedings, or disputes over property ownership.

Additionally, some states may have specific regulations governing the execution and filing of this form, necessitating the guidance of legal counsel.

Key components of the satisfaction of security agreement form

-

Includes the name and contact information of the creditor being satisfied.

-

Specifies the type of loan or security that is being discharged.

-

Lists all parties involved in the original agreement.

-

Such as the date of the original instrument and the recording date of the satisfaction.

-

Indicates the specific property that was secured under the agreement.

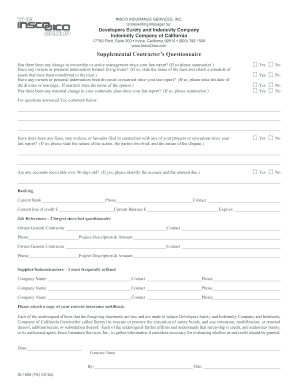

How do you fill out the satisfaction of security agreement form?

-

Before starting to fill out the form, collect all relevant documentation including the original security agreement and personal identification.

-

Carefully input the required information into the form, paying close attention to accuracy.

-

Check the form for any mistakes or missing information which could delay processing.

-

Ensure all parties sign and date the form before submitting to the appropriate authority.

It's also beneficial to consult with a legal professional to ensure all requirements for your state are met when filling out this form.

What are the common mistakes when filling out this form?

-

Failing to include all necessary parties can void the satisfaction process.

-

Dates play a crucial role; inaccuracies can lead to delays or legal disputes.

-

Most states require a notary public's signature to validate the document.

How can pdfFiller assist in managing your form?

pdfFiller offers tools to efficiently manage the satisfaction of security agreement forms, enabling you to edit PDFs directly and electronically sign documents from anywhere.

-

Utilize various editing tools to ensure your form is accurate before submission.

-

Add your signature online without the need for printing or scanning.

-

Share documents with others involved in the transaction for real-time updates and changes.

-

Maintain all your documents in one place for easy access and management.

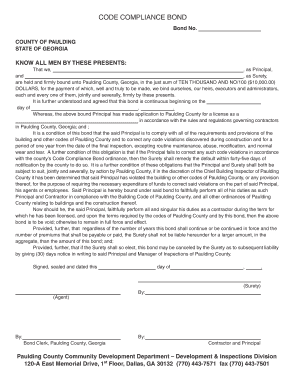

What are the consequences of improperly executed satisfactions?

If a satisfaction of security agreement form is not executed correctly, it can lead to severe financial and legal implications for the borrower. For instance, the creditor may still retain rights to the property, and the borrower may remain liable for the outstanding debt.

Additionally, the presence of a contested satisfaction can result in time-consuming and costly legal disputes.

What steps are involved in confirming cancellation of the security instrument?

To confirm the cancellation of a security instrument, borrowers need to understand the specific process outlined by their county recorder's office. This may include submitting the satisfaction form and any other required documentation.

-

Typically, this involves the satisfaction form and proof of payment or discharge of the loan.

-

While some counties may charge fees for recording, others may process it without any cost.

-

The time taken for cancellation confirmation varies by location; typically, it can range from a few days to several weeks.

How to fill out the satisfaction of security agreement

-

1.Access the pdfFiller website and log in to your account or create a new one.

-

2.Search for 'satisfaction of security agreement' in the template library.

-

3.Select the appropriate template and click 'Fill' to start editing.

-

4.Enter the necessary information, such as the names of the debtor and creditor, the description of the secured interest, and the date of satisfaction.

-

5.Review the information for accuracy before finalizing the document.

-

6.Once complete, save your progress and choose 'Send' to email it directly or download it for your records.

-

7.Consider obtaining signatures from both parties to validate the agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.