Get the free Notice of State Tax Lien template

Show details

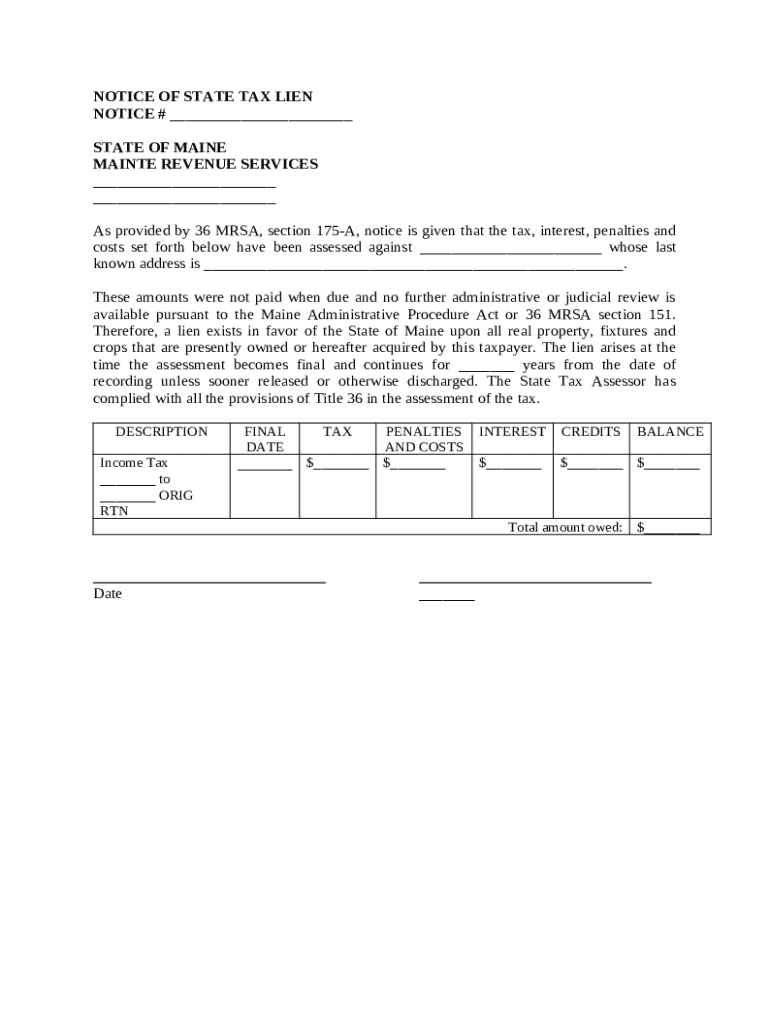

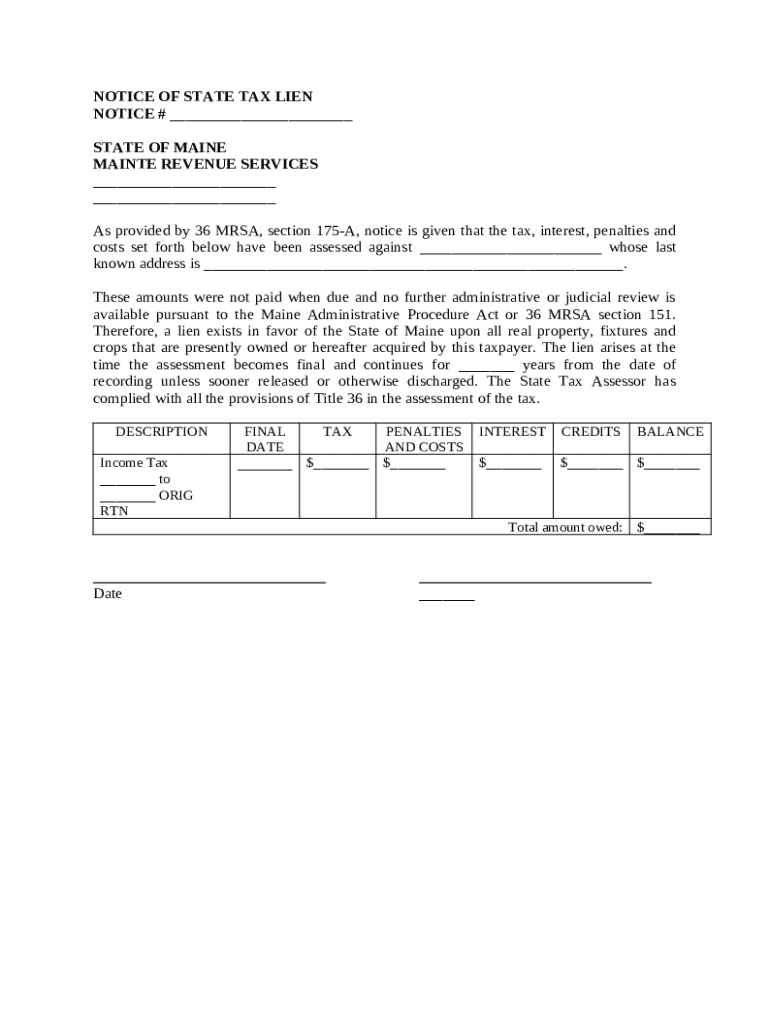

The state tax assessor places a lien on real estate for nonpayment of tax, interest and penalties and costs. No further administration or judicial review options are available.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is notice of state tax

A notice of state tax is a formal communication from a state tax authority regarding tax liabilities, adjustments, or collection actions.

pdfFiller scores top ratings on review platforms

So far I 'am totally amazed @ what I can accomplish!

this is a very easy and efficient system.

Very user friendly-excellent and professional solution to my needs!

Great! my first time using this product and it works just fine, better control of my sheets

Took me a little while on how to take full advantage of it, but now that I know how to; it is awesome!

I had a sharing problem with Google Drive. It was probably my fault as I'm still learning your software. I've needed this for so long. Thank you!

Who needs notice of state tax?

Explore how professionals across industries use pdfFiller.

Guide to the Notice of State Tax Lien Form

Filling out a notice of state tax form form can seem daunting, but with clear instructions, the process becomes manageable. This guide provides essential information, tips, and insights into filling out the Notice of State Tax Lien Form effectively.

What are tax liens?

A tax lien is a legal claim against your property when you fail to pay your taxes. It's crucial to understand tax liens as they can significantly impact property ownership. In Maine, legal requirements related to tax liens are governed under 36 MRSA section 175-A.

-

Tax liens serve as a warning to creditors and potential buyers that there are outstanding obligations on the property.

-

In Maine, understanding the legal obligations and implications of unpaid taxes is essential to maintaining property ownership.

-

Failure to pay dues can lead to the sale of your property to recover owed taxes, which is a significant risk for any property owner.

How do you fill out the Notice of State Tax Lien Form?

To complete the Notice of State Tax Lien Form accurately, follow these step-by-step instructions. Focus on carefully filling in the required details to maintain compliance with state regulations.

-

Begin by thoroughly filling out every section of the form, ensuring no field is skipped.

-

Accurately provide the taxpayer's full name and address to avoid processing delays.

-

Be precise when entering the amounts owed, including any penalties and accrued interest for an accurate balance.

What should you know about navigating the form fields?

Each field in the Notice of State Tax Lien Form serves a specific purpose. Understanding these fields will help avoid common mistakes when filling out the form.

-

This unique number helps to track and reference your lien within state systems.

-

Ensure all dates related to the tax assessment are filled with the utmost accuracy.

-

If required, gather and prepare any supplemental documents to provide with your form for a smoother process.

What are the legal compliance and guidelines for filing?

Understanding the legal requirements for tax notices in Maine helps ensure compliance and protect your rights. Taxpayers have specific rights and obligations throughout the lien process.

-

Make sure to review state laws regarding tax assessments to be fully compliant.

-

Taxpayers have rights that must be upheld during the lien process, which should be respected by all parties involved.

-

Improperly filed notices or neglecting to pay taxes can lead to severe legal repercussions and financial liability.

How does pdfFiller enhance the form filling experience?

pdfFiller offers innovative features that make filling, signing, and managing the Notice of State Tax Lien Form easier. Using pdfFiller allows you to leverage tools designed for efficient document management.

-

The platform streamlines the process of filling and signing forms, saving users time.

-

Users can easily edit and collaborate on their tax forms with others in real time.

-

Keep your tax documents secure and accessible by utilizing pdfFiller’s cloud capabilities for storage.

How to fill out the notice of state tax

-

1.Open the PDF file of the notice of state tax in pdfFiller.

-

2.Review the document to understand your tax obligations and deadlines.

-

3.Fill in your personal details, including name, address, and social security number, if applicable.

-

4.Provide any requested information on income or property relevant to the tax assessment.

-

5.Include any deductions or credits you are claiming, ensuring accuracy.

-

6.Verify that all figures are correct to avoid errors in your tax filing.

-

7.Sign and date the form as required, confirming the accuracy of the information provided.

-

8.Save the completed form and print a copy for your records.

-

9.Submit the form as instructed, either electronically or via mail, by the specified due date.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.