Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Two ...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to designate a beneficiary who will receive real estate upon their death without going through probate.

pdfFiller scores top ratings on review platforms

na

its great to be able to fill out pdf forms

I like it and it allows me to be more productive in my business

IT HELP FILL OUT MY W2 FROM PREVIOUS YEARS.

not for now maybe later would do webinar

Already prepared forms, but editing is a bit iffy

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form

Understanding the transfer on death deed

A Transfer on Death Deed (TODD) allows property owners to designate beneficiaries who will receive their property upon death, avoiding the probate process. This method is increasingly popular for estate planning because it simplifies the transfer of real estate.

Unlike traditional wills, which often require lengthy legal processes, a Transfer on Death Deed is straightforward and immediate. As such, it's essential to recognize its legal implications, which can differ by state.

-

A legal document that names beneficiaries to receive property at the owner's death without probate.

-

TODDs bypass court processes, while wills go through probate.

-

Understanding state-specific laws is crucial for valid execution.

The importance of consulting with a lawyer

Consulting with an attorney is vital when creating a Transfer on Death Deed. A legal expert can provide guidance on the nuances of state laws and how they affect your deed's validity.

Beneficiaries may face legal challenges regarding their rights under a TODD, making legal advice essential to navigate potential disputes.

-

Legal professionals can help ensure that the deed complies with state laws and correctly reflects your intentions.

-

Mistakes in deed filing can lead to legal challenges or disqualification of beneficiaries.

-

Resources for locating an estate planning attorney vary by region but often include local bar associations.

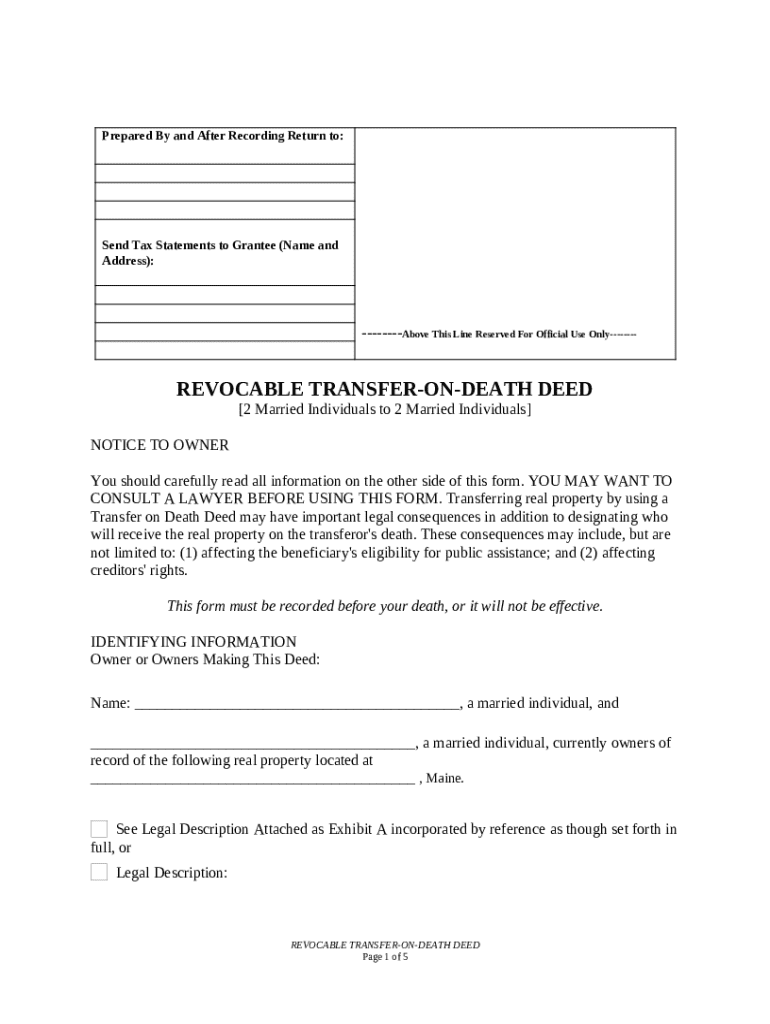

Key components of the deed

When creating a Transfer on Death Deed, certain key components are mandatory for it to be effective and legally binding. These include the identification of the property and any necessary signatures.

-

The deed must include clear identification of the preparer and details on where it will be recorded.

-

Clear and specific property identification is essential to avoid confusion and legal disputes.

-

Each state has specific requirements regarding the recording of TODDs that must be followed.

Filling out the transfer on death deed

Completing the Transfer on Death Deed form correctly is crucial to ensure its validity. Here’s how you can do it effectively.

-

Follow a structured process: gather property details, list beneficiaries, and review state guidelines.

-

Ensure all required fields are completed and verify the accuracy of beneficiary names.

-

Effortlessly complete and manage your TODD forms online—security included.

Beneficiary information: primary and alternate

Designating beneficiaries is one of the most significant aspects of the Transfer on Death Deed. Both primary and alternate beneficiaries should be named to ensure your wishes are honored.

-

Include full legal names and clarify relationships to aid in clarity.

-

They provide backup should the primary beneficiary predecease the owner or decline the inheritance.

-

Be aware of state laws regarding the inheritance and rights of each individual to avoid disputes.

Executing the transfer on death deed

After completing the deed, you must take steps to execute it properly. This includes obtaining necessary signatures and submitting the deed for recording.

-

Typically, all property owners must sign the deed before it can be considered valid.

-

Submit the deed to your local county clerk’s office or Record of Deeds to ensure public record.

-

After the deed is recorded, it becomes a matter of public record, solidifying the intended transfer.

Revocation rights before death

Understanding revocation rights is crucial as life circumstances change. You always have the right to revoke your Transfer on Death Deed before death.

-

As the property owner, you can revoke the deed any time prior to your death.

-

File a new deed stating the revocation and file it with the same office as the original for it to take effect.

-

Familiarize yourself with specific state laws regarding the deed revocation to ensure compliance.

Managing your documents with pdfFiller

Managing legal documents can be daunting. pdfFiller provides an excellent platform for efficiently handling all your forms.

-

With pdfFiller, you can edit and electronically sign your TODDs with ease, ensuring swift execution.

-

Share documents with team members and manage them collaboratively through a secure cloud-based system.

-

Your documents can be accessed from anywhere, making legal processes smoother and more efficient.

Final thoughts on transfer on death deeds

A Transfer on Death Deed can provide numerous benefits for estate planning, including a simplified transfer process and potential tax advantages. Understanding the overall process and effectively using tools like pdfFiller enhances your experience.

In summary, a properly executed TODD can ease the burden on your loved ones during a potentially challenging time, ensuring your wishes are fulfilled. Make sure to utilize resources like pdfFiller to manage your documentation efficiently.

How to fill out the transfer on death deed

-

1.Start by accessing the transfer on death deed template on pdfFiller.

-

2.Enter the title of the document at the top, clearly indicating it as a Transfer on Death Deed.

-

3.Fill in your name as the grantor, ensuring it matches your legal identification.

-

4.Provide a detailed description of the property being transferred, including the address and legal description if available.

-

5.Designate the beneficiary or beneficiaries by full name. If multiple, list their names clearly and specify shares if applicable.

-

6.Include a clause that states the deed is to take effect upon your death, making it clear the transfer only happens then.

-

7.Add the date of signing, and ensure you sign the document in the presence of a notary public to validate it.

-

8.Lastly, ensure the notary completes their section, sealing and signing the document.

-

9.Save the completed document and consider recording it at your local county recorder's office for it to take effect.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.