Get the free Assumption Agreement of Mortgage and Release of Original Mortgagors template

Show details

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

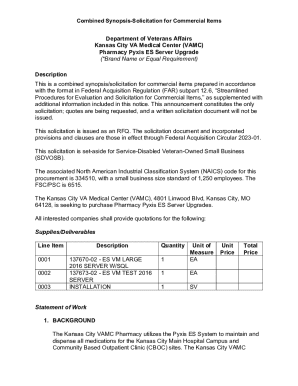

What is assumption agreement of mortgage

An assumption agreement of mortgage is a legal document allowing a new borrower to take over the mortgage obligations from the original borrower.

pdfFiller scores top ratings on review platforms

NOT ALWAYS EASY TO N=KNOW WHAT TO DO NEXT

No issues once I contacted the support department who answered my questions. I understand that you are in business to make money on a service. I just felt it was costly for a piece of paper or two that would cost me 10. Cents at a FedEx or Office Max type business.

I love the ease of typing on the PDF, I'm still learning how to send it to others with fill in blanks. But I like it. Pricey for the redaction ability but I suppose better than Adobe

it is not as smooth as i would liek and the editing capabilites are not strong.

great site.. many things can be done that are otherwise impossible.

Great

Needs better control on the circle option

Who needs assumption agreement of mortgage?

Explore how professionals across industries use pdfFiller.

Assumption Agreement of Mortgage Form Guide

How does an assumption agreement work?

An assumption agreement of mortgage form allows a buyer to take over the existing mortgage of a seller, under specific conditions. This form is crucial in mortgage transfers, helping ensure all parties understand their rights and responsibilities.

-

An assumption agreement is a legal document that permits one party to assume the financial obligations of a loan originally undertaken by another party.

-

These agreements protect both buyers and sellers during the mortgage transfer process, clarifying obligations and reducing potential disputes.

-

Assumption agreements are typically needed when a buyer wishes to take over the mortgage of a seller without applying for a new loan.

What are the essential components of an assumption agreement?

Understanding the components of an assumption agreement is critical for anyone involved in a mortgage transfer. This knowledge helps ensure compliance and avoids misunderstandings.

-

This clause releases the original borrower from future obligations under the mortgage, providing peace of mind during the transfer.

-

A unique identifier assigned to the agreement, ensuring easy reference and management of the document.

-

Essential terms such as the interest rate, payment schedule, and loan balance must be clearly outlined.

-

The agreement should specify the responsibilities of the new borrower, including timely payments and property maintenance.

-

The lender's rights must be detailed, including their ability to call the loan in certain situations.

How do you fill out the assumption agreement form?

Filling out the assumption agreement form accurately is vital for a successful mortgage transfer. Following a structured approach can help mitigate mistakes.

-

Visit the pdfFiller website, search for the assumption agreement of mortgage form, and download it for use.

-

Follow detailed instructions provided with the form to ensure all necessary information is accurately entered.

-

Utilize Word's form fields to streamline filling out the form electronically, reducing the chance for errors.

-

Watch for incomplete fields or incorrect information, as these can delay the transfer process.

What tools can help edit and sign the assumption agreement?

pdfFiller provides a set of tools designed to simplify the editing and signing process for the assumption agreement. This makes it easier for users to manage their documents.

-

The platform allows you to make changes directly in the document without the need for printing.

-

Follow the digital signing instructions within pdfFiller to ensure your document is legally binding.

-

Users can collaborate, store, and manage documents all in one centralized cloud-based platform.

How to manage your assumption agreement after completing it?

Post-completion management of your assumption agreement is just as important as the initial filling out process. It helps ensure that all parties keep track of their responsibilities.

-

Consider cloud storage solutions like pdfFiller to keep your document accessible from anywhere.

-

Use pdfFiller’s sharing features to send the document to involved parties securely.

-

Utilize the platform's tools to keep an updated log of any changes, protecting everyone involved.

What are the compliance notes for Minnesota residents?

Minnesota has specific regulations governing assumption agreements, making awareness of these requirements essential for compliance.

-

Minnesota mandates that all assumption agreements comply with state real estate laws.

-

This emphasizes the need for legal advice to ensure all agreements are valid and enforceable.

-

Check local government websites for comprehensive guides on real estate regulations.

Where can you find additional support?

When filling out an assumption agreement of mortgage form, knowing where to seek help can save time and effort.

-

Local real estate agents and legal professionals can provide invaluable assistance.

-

Familiarize yourself with your rights to avoid future complications during or after the mortgage transfer.

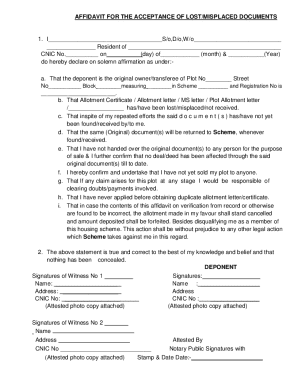

How to fill out the assumption agreement of mortgage

-

1.Obtain a blank assumption agreement of mortgage form from pdfFiller.

-

2.Open the form in pdfFiller and review the sections to understand what information is required.

-

3.Fill in the names and addresses of the original borrower and the new borrower in the designated fields.

-

4.Enter the loan number and details of the mortgage being assumed, including the outstanding balance and payment terms.

-

5.Provide information about the property that secures the mortgage, such as the address and description.

-

6.Review any additional terms or clauses to ensure they meet the agreement between parties.

-

7.Include signatures from both the original borrower and the new borrower at the end of the document.

-

8.Once all information has been filled in accurately, save the document and download it for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.