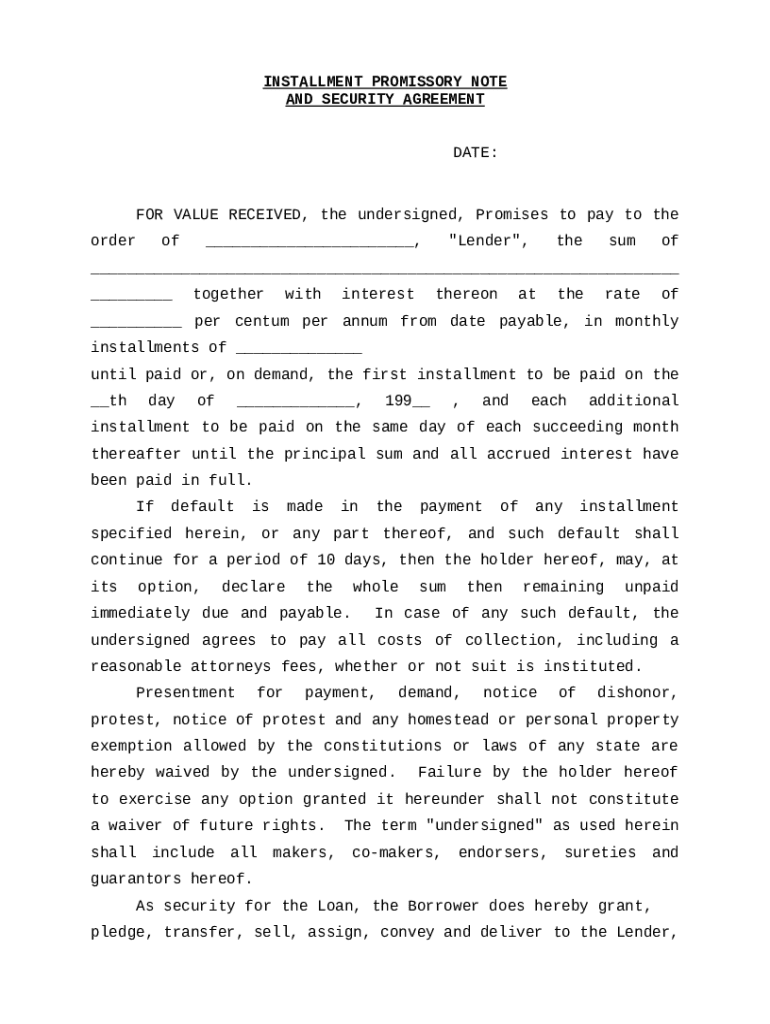

Get the free Installment Promissory Note and Security Agreement template

Show details

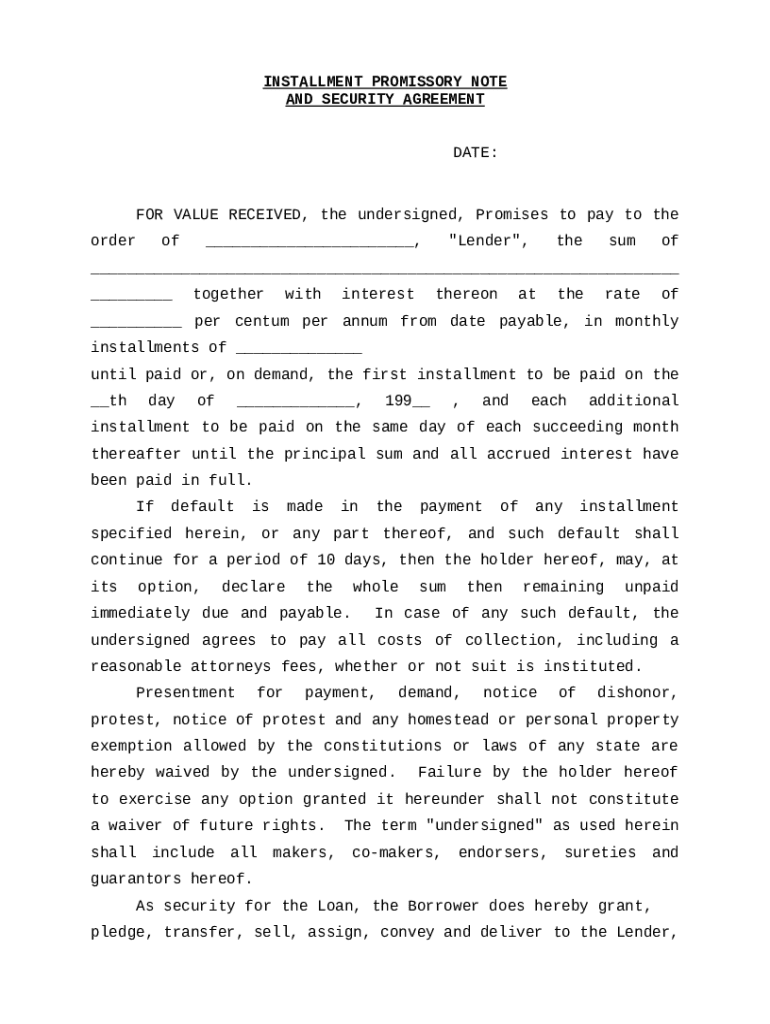

Installment Promissory Note: This is a Mississippi form that complies with all Mississippi codes and statutes. An Installment Promissory Note states that the repayment of the Promissory Note is

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is installment promissory note and

An installment promissory note is a written promise to pay a specified amount in installments over a set period of time.

pdfFiller scores top ratings on review platforms

Easy to use. Wish the auto fill from the 1120s worked for 2018

i like it i would recommend this to someone else..

I've had some problems with the application but overall it meets my business needs.

Easy to use and very useful in today's business world

This is a great tool (and I design systems similar to this). However, I'm just not sure I will use it enough in order to justify the annual price.

I have just started using this program but so far I am happy with it. It is great for completing documents that have been scanned in.

Who needs installment promissory note and?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Installment Promissory Note and Security Agreement

An installment promissory note is a crucial financial document that outlines the terms for repayment of a loan over a defined period. This guide will equip you with all the necessary information on how to navigate and complete this important agreement.

What is an installment promissory note?

An installment promissory note is a written promise to pay a specified amount in regular installments over time. This formal document includes key components such as the loan amount, interest rate, payment schedule, and consequences for late payments.

-

An installment promissory note enables a borrower to repay a loan in scheduled installments, making repayment more manageable.

-

Essential details include the principal amount, interest rate, repayment period, and any collateral specified.

-

This document serves to protect both borrowers and lenders, clearly outlining expectations and reducing the potential for disputes.

What are essential terms and conditions?

Understanding the terms and conditions of your installment promissory note is essential for safeguarding your financial interests.

-

This refers to the borrower signing the note, committing them to the obligations outlined within.

-

Comprehending the interest rate applied ensures borrowers can anticipate the total cost of the loan.

-

Failing to adhere to the payment schedule can lead to severe repercussions, including legal action and loss of collateral.

How does collateral play a role in secured agreements?

Collateral provides a lender with security against default, stipulating what asset can be claimed if payments aren’t met. This can significantly reduce risk for lenders.

-

Collateral is an asset pledged by the borrower to secure a loan.

-

Common forms include real estate, vehicles, or other valuables that can be seized.

-

By lending against collateral, lenders lower their potential losses, encouraging them to offer better terms.

How to fill out the installment promissory note?

Filling out the installment promissory note correctly is vital to avoid complications later on. pdfFiller offers interactive tools to streamline this process.

-

Follow clear, organized steps to input the necessary information accurately.

-

Utilize pdfFiller to simplify filling, editing, and eSigning your document directly online.

-

Watch out for incorrect figures or missing signatures, which can void the agreement.

What are best practices for negotiating terms with your lender?

Negotiating terms with lenders is a crucial part of securing favorable conditions for your loan, including lower interest or better repayment schedules.

-

Present your financial position confidently to encourage lenders to accommodate your requests.

-

Clear communication about your needs can prevent misunderstandings and lead to mutually beneficial terms.

-

Always ensure you fully understand the terms before committing to avoid costly mistakes.

How can you manage your installment payments?

Managing installment payments can be straightforward with the right strategies. Using tools such as pdfFiller can assist in organizing your payment schedule.

-

Regularly monitor your payment dates to ensure you are not late, thus avoiding fines.

-

pdfFiller’s capabilities help in keeping your notes and documents organized and accessible.

-

Create reminders and set alerts to ensure on-time payments, which can improve credit ratings.

What happens in default conditions?

Defaulting on your promissory note can have serious repercussions. It’s essential to know what 'default' entails and how it affects your obligations.

-

'Default' usually refers to failing to make payments as agreed, which can trigger penalties.

-

Waivers may allow for temporary relief in payments, but understanding these terms is critical.

-

Consequences may include legal action, loss of collateral, and damage to your credit score.

What are your rights and obligations?

Both borrowers and lenders possess specific rights and obligations that must be respected to maintain a fair relationship.

-

Borrowers are entitled to clear information and fair treatment according to their agreement.

-

Lenders must comply with applicable laws and treat borrowers with transparency.

-

Using platforms like pdfFiller ensures compliance with regulatory requirements and provides security for both parties.

How does pdfFiller enhance document management?

Leveraging pdfFiller's document management capabilities can greatly improve your experience in creating and handling your installment promissory note.

-

pdfFiller provides tools for editing, eSigning, and collaborating on documents seamlessly.

-

Efficiently work with others in filling out and reviewing your note to ensure accuracy.

-

Managing documents in the cloud offers flexibility and accessibility anywhere you need them.

What should you know about local compliance and regulations?

Understanding local laws and regulations regarding installment promissory notes is crucial for compliance and legal integrity.

-

Each state may have unique regulations governing installment loans that must be adhered to.

-

Different regions may have standard practices regarding loan agreements that can guide your process.

-

It is essential to ensure all aspects of your agreement meet local legal standards to avoid penalties.

How to fill out the installment promissory note and

-

1.Open the installment promissory note template on pdfFiller.

-

2.Fill in the borrower's full name and address in the designated fields.

-

3.Enter the lender's full name and address accurately.

-

4.Specify the principal amount being borrowed clearly.

-

5.Indicate the interest rate, if applicable, to the correct section.

-

6.Set the total number of installments and the due date for each payment.

-

7.Detail any late fees or penalties for missed payments clearly.

-

8.Review all filled fields for accuracy and completeness.

-

9.Sign the document electronically where indicated.

-

10.Save and download the completed installment promissory note for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.