Get the free pdffiller

Show details

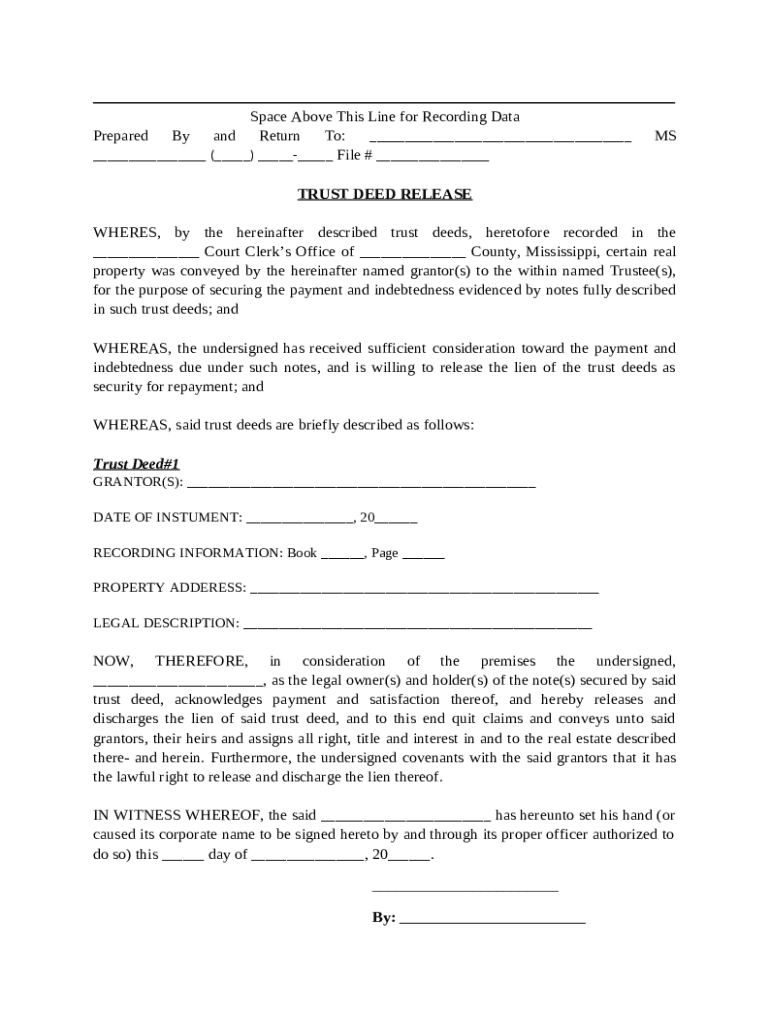

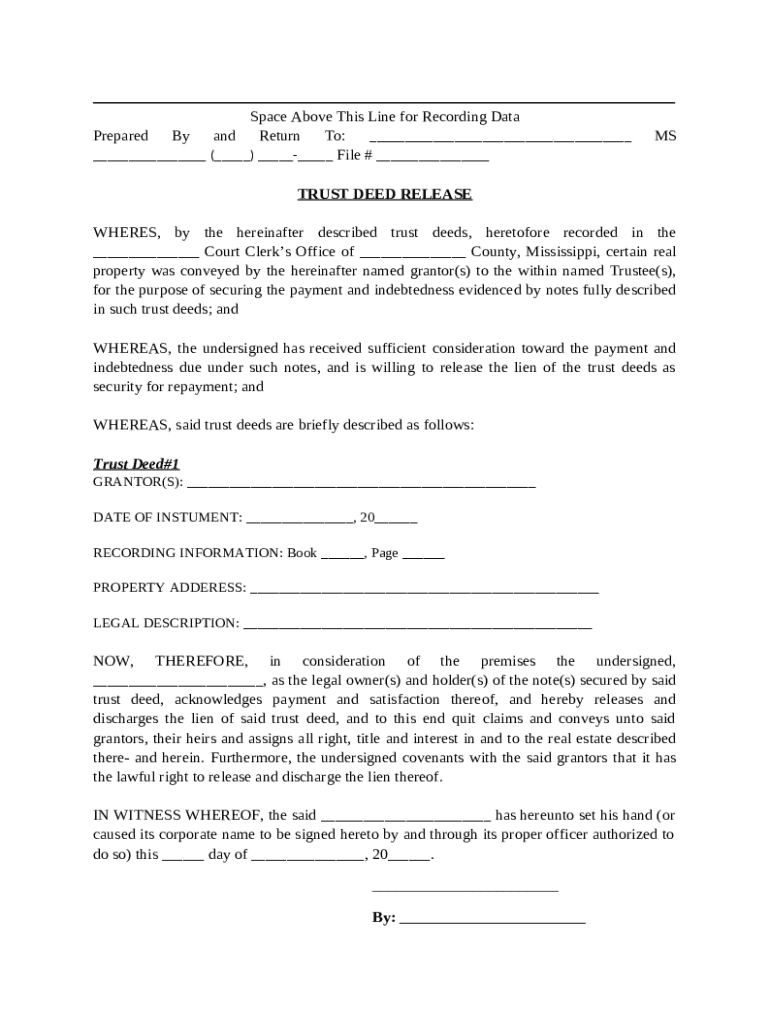

The trustee releases the lien of a trust deed after having received payment for the indebtedness.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is trust deed release

A trust deed release is a legal document that signifies the release of a lien or claim against a property once a loan secured by a trust deed has been paid off.

pdfFiller scores top ratings on review platforms

Easy to understand and manage the steps, to work with the PDF

I thoroughly enjoy as we as this site being extremely beneficial

THIS IS NOT THE ONLY TIME I HAVE HAVE YOUR SERVICES...THIS YEAR WAS SORT OF ...GREAT! LEFT ME WITH NOTHING TO BE DESIRED.

It was slightly hard to navigate trying to do more that one 1099. Other than that I am satisfied.

I find using the service expensive just for the 3 MN SOS CRP forms. May I use it for upcoming 2 leases that I will be renewing? Thank you.

Easy to use! But a bit expensive for a student like me

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Trust deed release form: A comprehensive guide

How to fill out a trust deed release form?

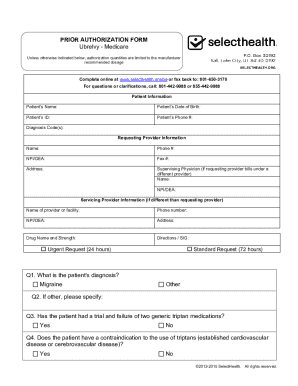

Filling out a trust deed release form involves several steps that ensure the document is accurately completed. Begin by gathering all necessary information, including details of the grantor, trustee, and the property involved. Make sure to follow the instructions carefully for each section to avoid any mistakes.

Understanding trust deeds: An overview

A trust deed serves as a security instrument in real estate transactions, linking the borrower (grantor) to a lender (beneficiary) through a neutral third party (trustee). Its primary purpose is to secure a debt by placing a lien on the property until the debt is repaid.

-

A trust deed is a legal document that creates a security interest in real property.

-

Trust deeds facilitate property transactions by ensuring the lender’s investment is protected.

-

The grantor is the borrower, the trustee is the party who holds the legal title until the debt is settled, and the beneficiary is the lender.

What is the function of a trust deed release form?

A trust deed release form is crucial for releasing the lien on a property once the related debt has been paid. This form verifies that the borrower has fulfilled their financial obligations and that the lender relinquishes any claim to the property.

-

It is a legal document that formally indicates the satisfaction of the debt secured by a trust deed.

-

It becomes necessary once the borrower repays the loan in full or settles the debt.

-

Signing releases the lender's claim, allowing the borrower full ownership rights over the property.

What are the components of a trust deed release form?

Each trust deed release form includes several key components that ensure it is properly filled out and legally compliant. These components facilitate the recording of the release with local authorities.

-

This area is designated for official recording information.

-

This section specifies who prepared the form and where it should be returned after recording.

-

Essential details regarding the original trust deed, such as identifiers and dates, must be included.

-

This states the consideration received for releasing the lien.

-

Names and addresses of the parties involved must be listed.

-

The legal description of the property under the trust deed needs to be clearly outlined.

-

The document must be signed by relevant parties and may require notarization.

How to complete a trust deed release form?

Completing a trust deed release form requires careful attention to detail. Users should go through a step-by-step process to avoid common mistakes that could delay the filing.

-

Follow the provided instructions on the form, filling in each section thoughtfully.

-

Ensure accuracy, particularly in fields for Grantor, Trustee, and Property Address.

-

Double-check entries for spelling and numbers to prevent processing errors.

How to edit and manage your trust deed release form with pdfFiller?

pdfFiller offers a streamlined way to manage your trust deed release form. With its editing tools and eSignature capabilities, users can ensure their forms are correct and secure.

-

Take advantage of editing tools to modify your form as needed.

-

Easily collect signatures and collaborate with other parties in real-time.

-

Keep your documents secure while allowing for easy access and sharing.

-

Access your documents from any device, giving you flexibility and ease of use.

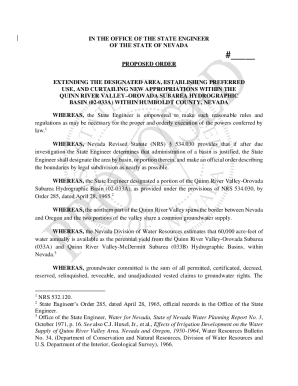

What are the legal considerations when filing a trust deed release?

Understanding the legal considerations surrounding trust deed releases is critical to ensure compliance with local regulations. Each state may have different filing requirements, so checking local laws is necessary.

-

Always review state-specific laws to adhere to proper filing protocols.

-

Notarization may be required for certain trust deed release forms, adding a layer of authenticity.

-

Be aware of potential disputes or claims that may surface after filing the release.

How to ensure your trust deed release is valid and enforceable?

To ensure the validity of a trust deed release, all requirements must be meticulously adhered to. Several key factors play a role in validating the release post-filing.

-

Verify that the debt has been fully paid before filing the release.

-

A properly notarized document is crucial for legal enforceability.

-

An invalid release can lead to continued lien claims, creating legal complications.

How to fill out the pdffiller template

-

1.Download the trust deed release form from pdfFiller.

-

2.Open the form in pdfFiller and review the fields that need to be completed.

-

3.Enter the borrower's name and contact information in the designated sections.

-

4.Provide details about the loan that is being released, including the loan number and property address.

-

5.Fill in the lender's name and contact information, including their address.

-

6.Include the date of loan payoff, ensuring it matches your records.

-

7.Add any necessary notarization details, if required by state law.

-

8.Review all entered information for accuracy before submitting.

-

9.Save the completed form and either email it directly or print it for mailing to the appropriate parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.