Get the free Application for Exemption from Ad Valorem Taxes template

Show details

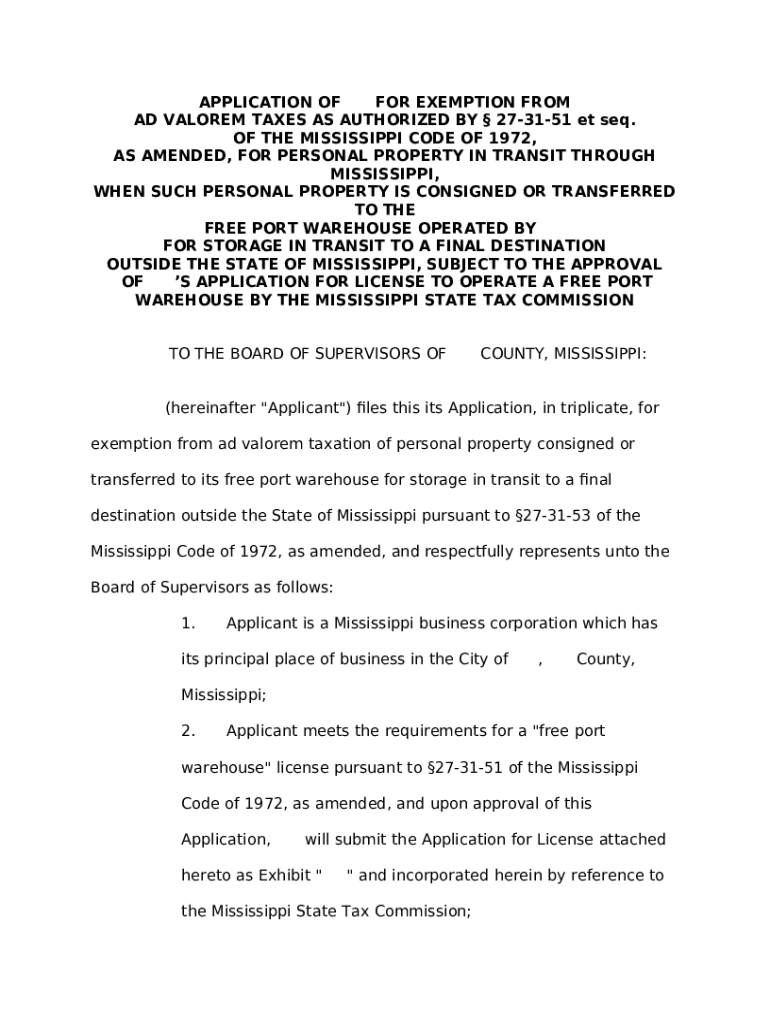

Application of *** for Exemption from Ad Valorem Taxes: This application is used by those wishing to be exempt from ad valorem taxes. The reasoning behind the exemption is that the property is said

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is application for exemption from

An application for exemption from is a formal request to waive certain requirements or regulations imposed by a governing body.

pdfFiller scores top ratings on review platforms

So far it is wonderful but I've got to continue further to see if it is all that and the cake and ice cream at that time I should give 5 Bright Shining Stars!!

AMAZING! would be nice to be able to add other documents to what im editing already

Its working the way it was supposed to so I am very satisfied...

Program is great; although still learning how to navigate through it all.

Very easy to use for converting Pdf Documents to Edible Documents.

The live chat rep answered all of my questions , on how to navigate through your software.

Who needs application for exemption from?

Explore how professionals across industries use pdfFiller.

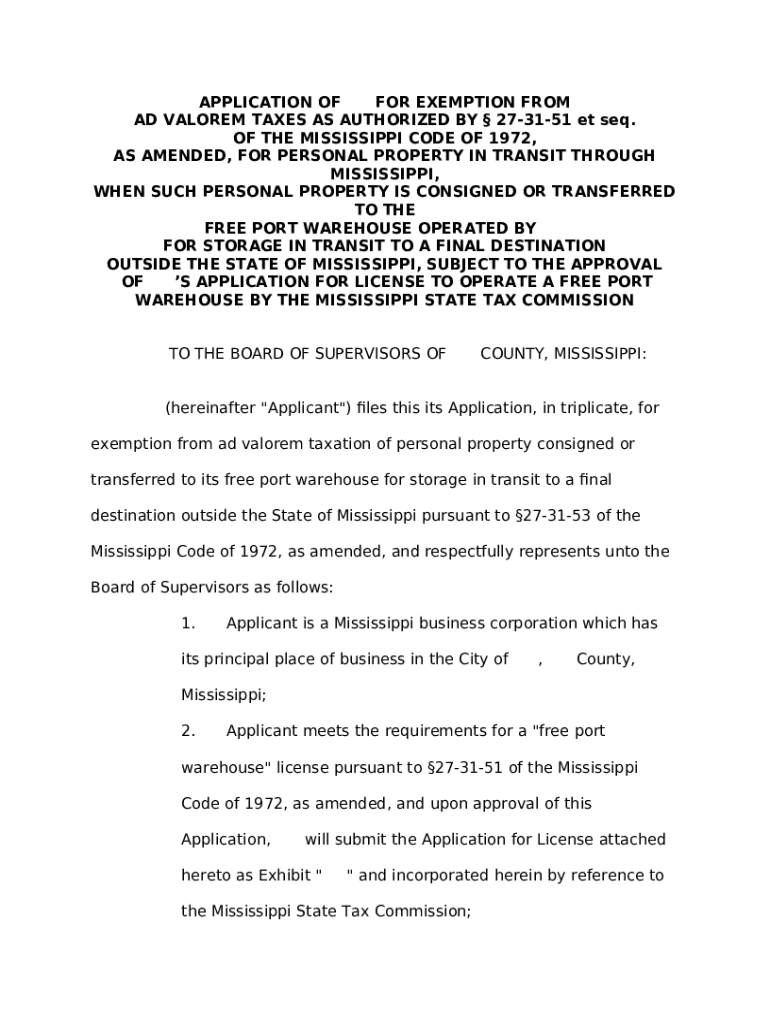

Comprehensive Guide to Application for Exemption from Ad Valorem Taxes

How to fill out an application for exemption from form form?

To successfully fill out an application for exemption from form form, you need to gather necessary documents, complete the application accurately, and submit it to the appropriate authority. This guide will walk you through each step to ensure compliance with local tax regulations and improve your chances of approval.

What is an ad valorem tax exemption?

An ad valorem tax exemption reduces the amount of property tax owed based on the property’s assessed value. These exemptions are crucial for certain entities, such as nonprofit organizations and businesses that meet specific criteria. Understanding the legal framework for these exemptions in your region can help in utilizing them effectively.

-

Ad valorem taxes are based on the assessed value of property. These taxes are common in districts across Mississippi.

-

Mississippi has specific laws governing tax exemptions which applicants must adhere to for their applications.

-

Complying with local tax rules ensures your application is approved and helps avoid penalties.

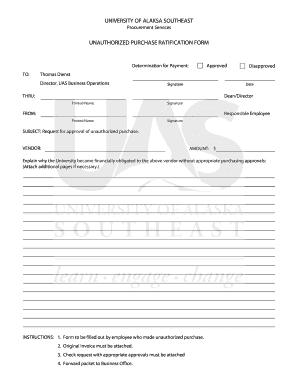

Who is eligible for Free Port Warehouse exemptions?

Eligibility for Free Port Warehouse exemptions is determined by specific criteria outlined by Mississippi's tax laws. Typically, businesses that engage in the transfer or consignment of goods and meet certain operational requirements can apply for these exemptions.

-

Businesses must demonstrate that they are involved in activities eligible for tax exemptions per state regulations.

-

Only certain types of property, such as inventory stored in warehouses, qualify for this exemption.

-

This commission oversees the licensing process and ensures compliance with state tax laws.

What are the steps to complete the application process?

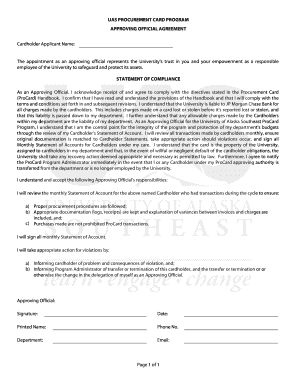

Filling out the Application for Exemption form is the first crucial step in the exemption process. It requires accurate and detailed information to facilitate a smooth submission.

-

Ensure that all fields are completed as per the guidelines provided by tax authorities.

-

Include supporting documents like proof of property ownership and operational licenses.

-

Once completed, the application should be submitted to the Board of Supervisors in your county.

What should you know about the form fields?

The application form contains various fields that require accurate data. Understanding these fields will help avoid common mistakes that could lead to delays.

-

Each field in the exemption application has specific requirements; ensure that you provide complete information.

-

Inaccurate or incomplete information can result in application denial, so double-check all entries.

-

pdfFiller offers editing and eSigning tools that facilitate accurate completion of your documents.

What happens after submitting your application?

Understanding the compliance and approval process is essential after submitting your application. Timelines can vary, and being proactive can help mitigate potential delays.

-

You should receive confirmation of your submission; follow-up may be necessary.

-

Approval times can differ based on workload and completeness of your application.

-

Stay in touch with your local Board of Supervisors for updates and ensure all information is correct.

What are your responsibilities after approval?

After obtaining approval, being aware of your ongoing responsibilities is crucial to maintaining your exemption status. Failure to comply with local laws can lead to penalties, so it’s important to stay informed.

-

You must adhere to ongoing reporting requirements and ensure compliance with local regulations.

-

Maintain accurate records and submit required reports to demonstrate compliance with the exemption guidelines.

-

Non-compliance can result in fines or revocation of the tax exemption status.

What additional forms might you need?

When applying for exemption, additional forms or supporting documents may be needed to complete the process successfully. Knowing what you might need can streamline your application.

-

Some specific scenarios may require extra forms not included in the standard application.

-

Utilize pdfFiller to access and manage all necessary documents efficiently.

-

Explore online resources for further assistance in ensuring continuous compliance.

How to fill out the application for exemption from

-

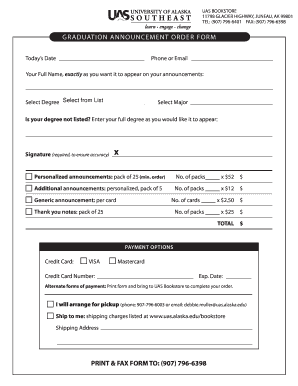

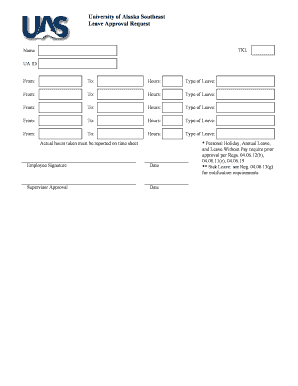

1.Visit the pdfFiller website and log in to your account or create a new account if necessary.

-

2.Search for 'Application for Exemption From' in the template library to find the correct form.

-

3.Select the form and click on 'Fill' to start editing the document.

-

4.Fill in your personal information at the top of the form, including your name, address, and any relevant identification numbers.

-

5.Provide detailed reasons for requesting the exemption in the designated section, ensuring clarity and conciseness.

-

6.Attach any necessary supporting documents that may strengthen your application, such as proof of eligibility or prior correspondence.

-

7.Review the completed application to ensure all fields are accurately filled and all necessary attachments are included.

-

8.Once satisfied, save the document and download it. You may also choose to send it directly from pdfFiller via email to the relevant authority.

-

9.Keep a copy of the submitted application for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.