Get the free Loan Modification Agreement template

Show details

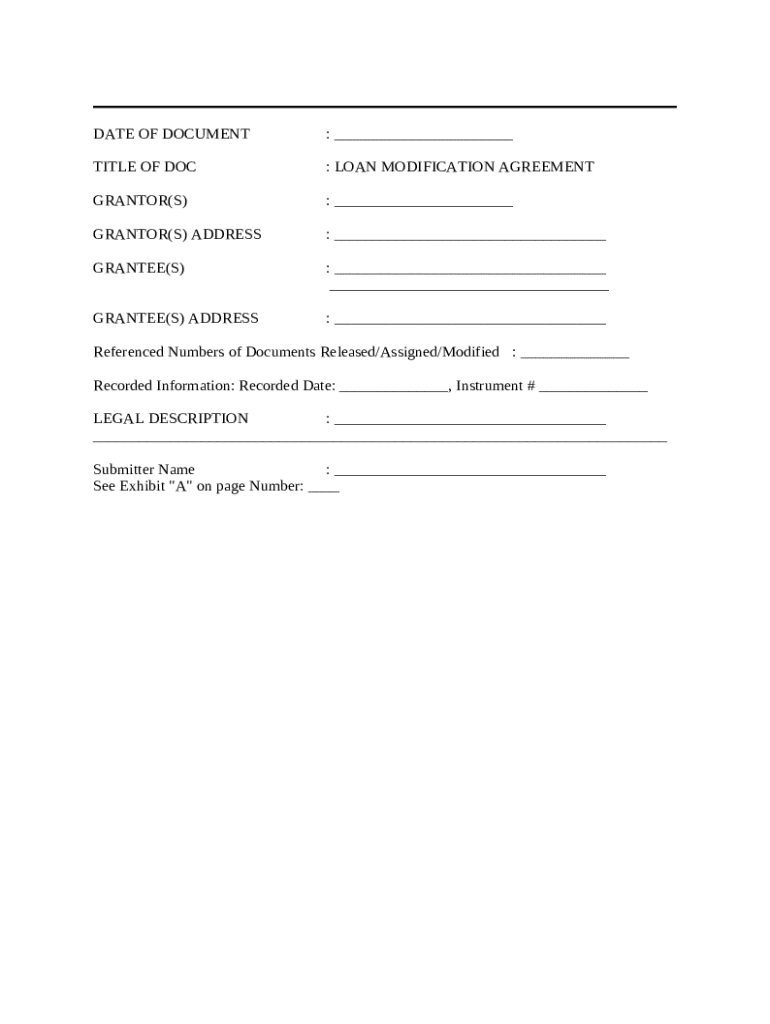

A Loan Modification Agreement is signed by both parties who originally entered into the loan agreement. It states that there have been some modifications to the original agreement, but said modifications

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is loan modification agreement

A loan modification agreement is a legal document that outlines the terms and conditions agreed upon by a borrower and lender to alter the original loan agreement.

pdfFiller scores top ratings on review platforms

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

I've been using PDFfiller regularly for over 2 years now, and it works wonderfully. I'm able to upload documents, add fillable lines, and get electronic signatures seamlessly. Customer service is also great - prompt and friendly in attending to any questions or issues. Makes running my business that much easier.

Who needs loan modification agreement template?

Explore how professionals across industries use pdfFiller.

Your complete guide to filling out a loan modification agreement form

How do you define a loan modification agreement?

A loan modification agreement is a formal document that alters the terms of an existing loan. It is designed to help borrowers avoid foreclosure by adjusting payment amounts or interest rates. Understanding the definition and nuances of this agreement is crucial for both borrowers and lenders.

-

This agreement helps modify the original loan terms to make repayment more feasible for borrowers.

-

Typically involves the borrower (grantor) and the lender (grantee), with the beneficiary being the financial institution.

Why do borrowers need to modify their loans?

Borrowers may seek a loan modification due to financial hardships like job loss or medical emergencies that affect their ability to make regular payments. A loan modification agreement protects both parties' interests by setting new terms that are acceptable to the lender while being more manageable for the borrower.

-

When significant life changes prevent timely loan payments, modifications can provide relief.

-

Lowering the interest rate can significantly reduce monthly payments.

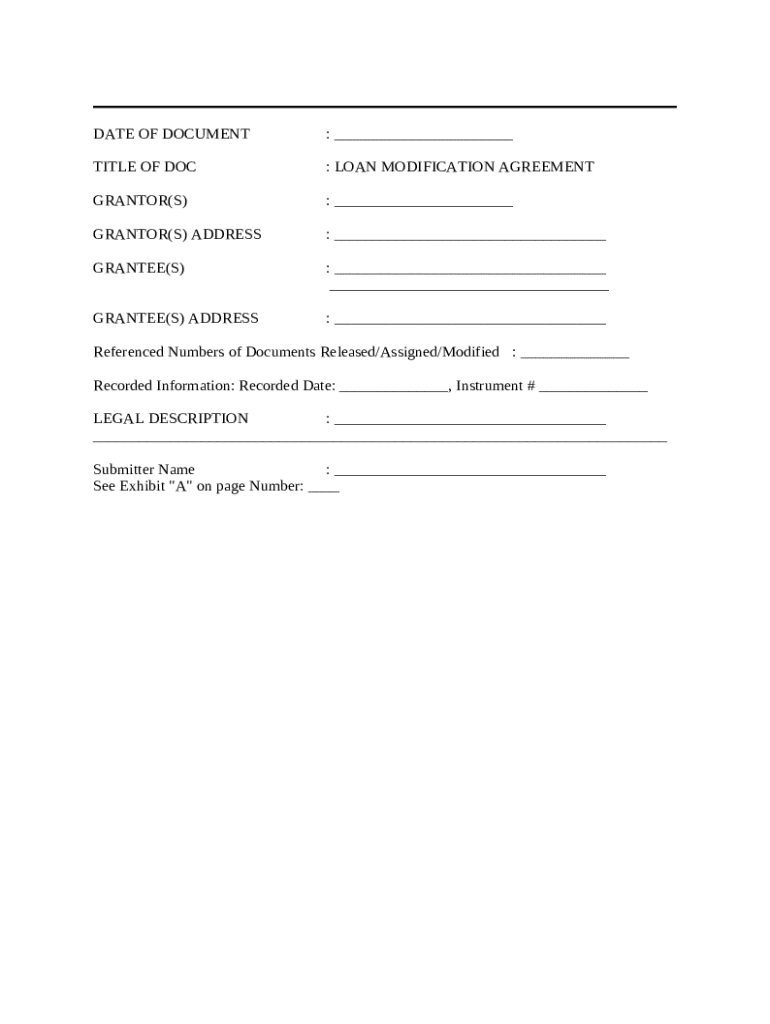

What are the main components of the loan modification agreement?

Key components of a loan modification agreement include the date of the document, essential form fields, and legal descriptions of property. Understanding these sections ensures that both parties are clear about the modification terms and their implications.

-

Establishes when the modifications take effect and is required for legal purposes.

-

Detailed information should be filled out correctly, including borrower and lender details.

-

Accurate property descriptions are crucial to avoid legal disputes in the future.

What is the process for filling out a loan modification agreement form?

Completing the loan modification agreement form requires careful attention to detail. A step-by-step guide is essential for minimizing errors that could delay processing or lead to complications.

-

Follow a systematic process starting from gathering documentation to filling in all required fields accurately.

-

Avoid leaving out critical information, as this can lead to application rejections.

-

Tools on pdfFiller allow for seamless editing and can streamline the form completion process.

How can you edit and customize a loan modification agreement?

Editing a loan modification agreement is vital for ensuring all information is accurate and up-to-date. pdfFiller allows users to customize their PDFs, provide electronic signing options, and collaborate with other parties as needed.

-

Utilize pdfFiller’s editing features to make changes quickly and easily.

-

Incorporate secure electronic signatures to finalize modifications remotely.

-

Share the document with others for input or review to ensure clarity and agreement.

What compliance considerations should be kept in mind?

Before finalizing a loan modification agreement, it's essential to be aware of regional legal requirements, especially those pertaining to loan modifications in your area. Complying with industry best practices can safeguard against common legal pitfalls.

-

Familiarize yourself with specific laws governing loan modifications in your state.

-

Follow established guidelines to create a legally sound and enforceable agreement.

-

Recognize and prevent common issues that can arise from poorly drafted agreements.

What are the next steps after the agreement is signed?

Once a loan modification agreement is signed, borrowers should monitor the repayment terms closely. Engaging with ongoing resources can help maintain compliance and manage the modified loan.

-

Ensure both parties have copies of the signed agreement for future reference.

-

Regularly check if the new payment terms are being adhered to.

-

Utilize pdfFiller’s tools for document management and support throughout the process.

How to fill out the loan modification agreement template

-

1.Download the loan modification agreement template from pdfFiller.

-

2.Open the document in pdfFiller and review the existing fields for name, address, and loan details.

-

3.Begin by entering your personal information accurately, including your full name, address, and contact details in the designated fields.

-

4.Fill in the loan details section, including your account number, loan type, and original loan amount as required by the form.

-

5.Clearly specify the requested modifications such as changes to interest rates, payment terms, or loan duration.

-

6.If applicable, outline any hardship circumstances that prompted the request for modification to provide context to your lender.

-

7.Review all entered information for accuracy and completeness before proceeding to the next step.

-

8.Once you confirm all details are correct, add any necessary signatures as required in the designated signature fields.

-

9.Finally, save the completed agreement and send it to your lender, ensuring you keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.