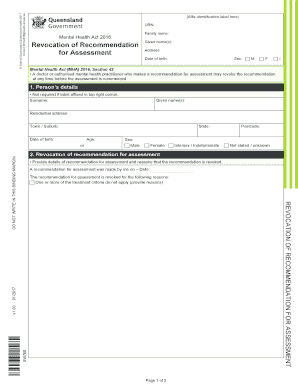

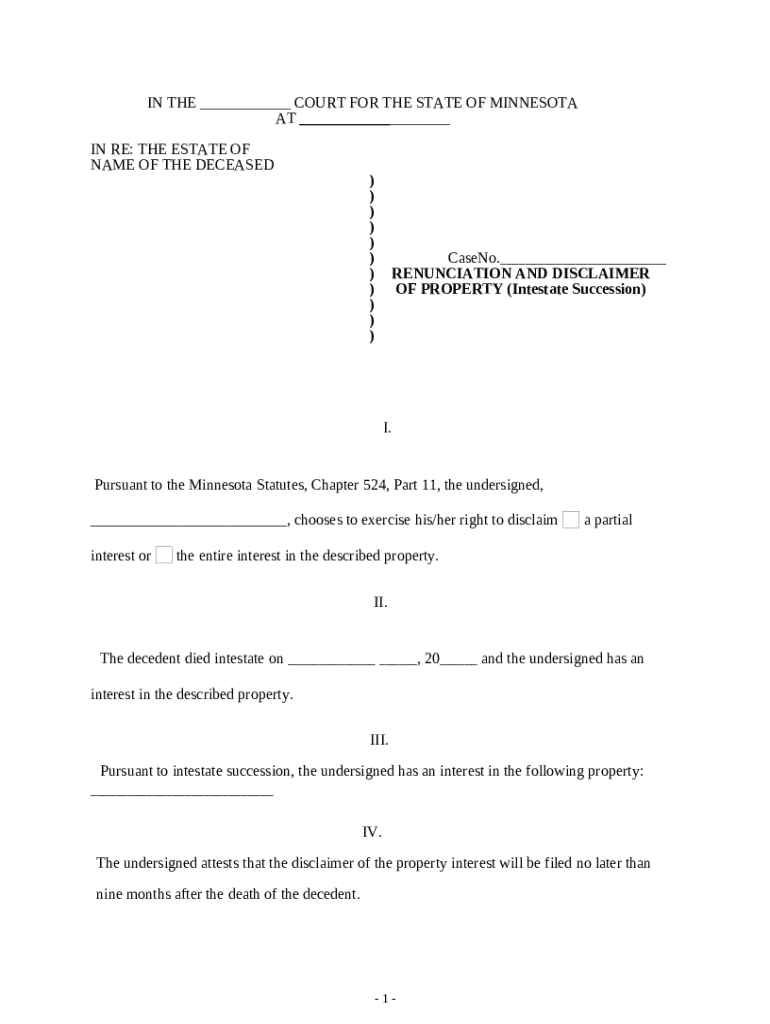

Get the free Renunciation and Disclaimer of Property Received by Intestate Succession template

Show details

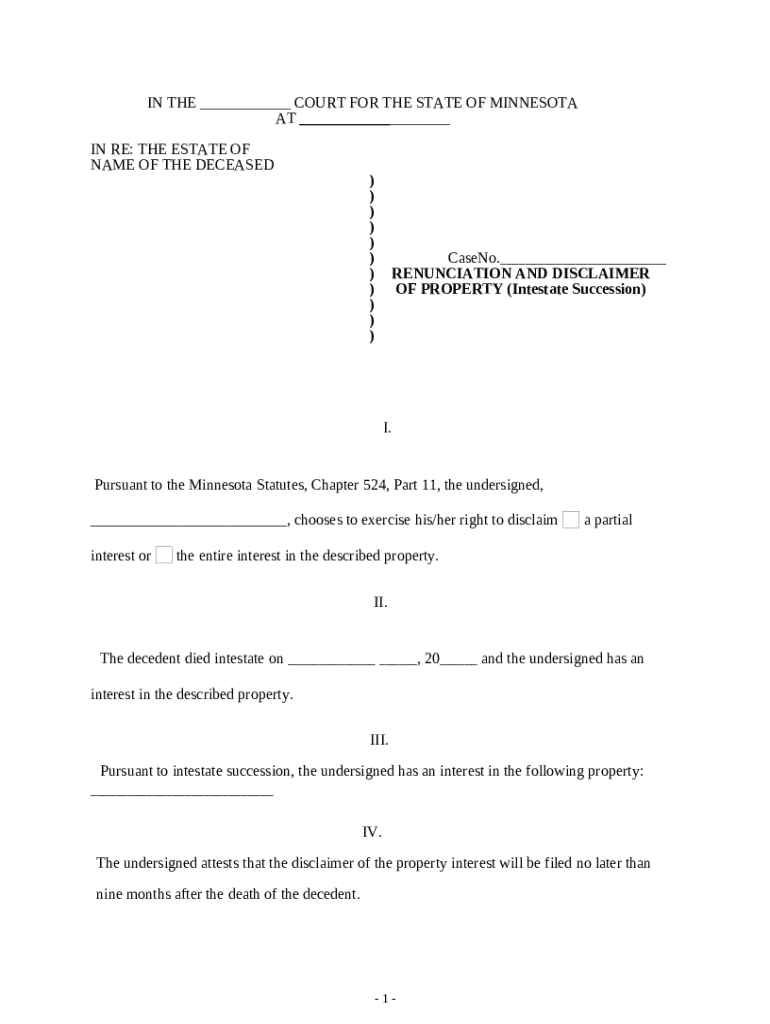

This Renunciation and Disclaimer of Property is received by the beneficiary through intestate succession. The decedent died intestate and the beneficiary is entitled to claim the property described

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is renunciation and disclaimer of

A renunciation and disclaimer of is a legal document whereby an individual formally declines or rejects their interest in a property or inheritance.

pdfFiller scores top ratings on review platforms

It's easy, fun, convenient and very affordable!

Easy to use. love the signature availablity.

Saves time and avoids handwritten errors

I appreciate the ease of using this program. It is very easy to work around. I am enjoying using it. This is my first year doing tax forms on line and I must say, I don't know what took me so long.

Thanks for the service!!

There is a definite learning curve and I guess I'd better read the manual.

Simple, cloud based solution for everything you need!

Who needs renunciation and disclaimer of?

Explore how professionals across industries use pdfFiller.

Renunciation and disclaimer of form form: A complete guide

This guide will help you understand the renunciation and disclaimer of form, a crucial legal document in estate management. You'll learn how to fill it out correctly, manage the document, and navigate associated legalities.

What is renunciation and disclaimer in legal terms?

Renunciation refers to the formal rejection of a right or property, while a disclaimer is a statement that disclaims any interest in an asset, often used in the context of inheritances. Both are essential in estate management, especially in situations where an individual may not wish to accept the property.

Why are these concepts important in estate management?

Understanding renunciation and disclaimer is crucial for individuals managing estates as these concepts can help prevent unwanted tax liabilities and can clarify the intentions of the decedent. It's also essential for ensuring that the property is distributed according to their wishes.

What are the relevant laws in Minnesota?

In Minnesota, laws regarding renunciation and disclaimers are outlined under the Uniform Disclaimer of Property Interests Act. This act provides clear guidance on how to formally renounce an interest in property and the legal effects of such actions.

When and why might an individual choose to renounce or disclaim an interest?

Individuals may choose to renounce or disclaim an interest in property to avoid tax implications associated with inheritance, or when they wish to allow the property to pass to other beneficiaries. It is often a strategic decision in estate planning.

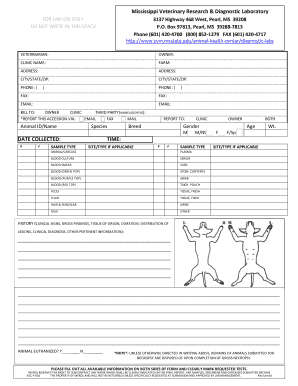

What are the essential components of the renunciation and disclaimer form?

-

Include the decedent's name, case number, and date of death for identification.

-

Clearly describe the property interest you are disclaiming to avoid confusion.

-

Note any legal deadlines for submitting the disclaimer, as failing to do so may affect your rights.

-

Understand how not filing a disclaimer can affect the distribution of property under intestate succession laws.

-

Recognize that disclaiming a property interest is irrevocable and means you cannot accept it later.

-

Ensure that a notary public acknowledges the disclaimer for it to be legally binding.

What are the step-by-step instructions for completing the form?

-

Obtain all required documents about the decedent and the property to fill the form accurately.

-

Download the renunciation and disclaimer form from pdfFiller to start filling it out.

-

Complete all fields carefully, ensuring accuracy to prevent any issues later.

-

Double-check the form for compliance with Minnesota statutes to avoid legal complications.

-

Contact a notary public to have them acknowledge your signature on the form for legal verification.

-

Deliver the completed form to the personal representative or executor handling the estate.

How can you manage documents effectively with pdfFiller?

-

Use the intuitive cloud-based editing tools from pdfFiller to ensure your documents are accurate and up-to-date.

-

Leverage pdfFiller’s platform to work with other parties involved in the document to avoid any discrepancies.

-

Track changes and manage different versions efficiently to maintain clarity in the documentation process.

-

Sign your documents electronically via eSign for a valid and speedy signing process.

What are the payment and submission instructions?

-

Detail how to pay any necessary fees associated with the renunciation and disclaimer process promptly.

-

Outline the different ways to submit your filled form, whether through personal delivery or mail.

-

Always confirm receipt of your form with the personal representative to ensure it is processed.

Who are the important contacts and resources?

-

Identify local courts in Minnesota for inquiries regarding your renunciation and disclaimer.

-

Find relevant laws about disclaimers to understand your rights fully.

-

Seek additional resources for legal help in estate management to navigate potential complexities.

How to fill out the renunciation and disclaimer of

-

1.Access your pdfFiller account and open the renunciation and disclaimer form template.

-

2.Begin by entering your name and contact information at the top of the document.

-

3.Specify the property or interest you wish to disclaim by providing its legal description or details.

-

4.Clearly indicate your intention to renounce the specified interest by ticking the appropriate boxes or stating it in write.

-

5.Include any relevant details about the estate or trust from which you are renouncing.

-

6.Sign the document in the designated area, ensuring your signature matches your printed name.

-

7.If required, add the date of signing next to your signature.

-

8.Save the completed document and download a copy or send it directly to the relevant parties through pdfFiller functionality.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.