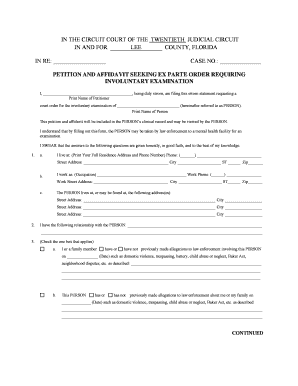

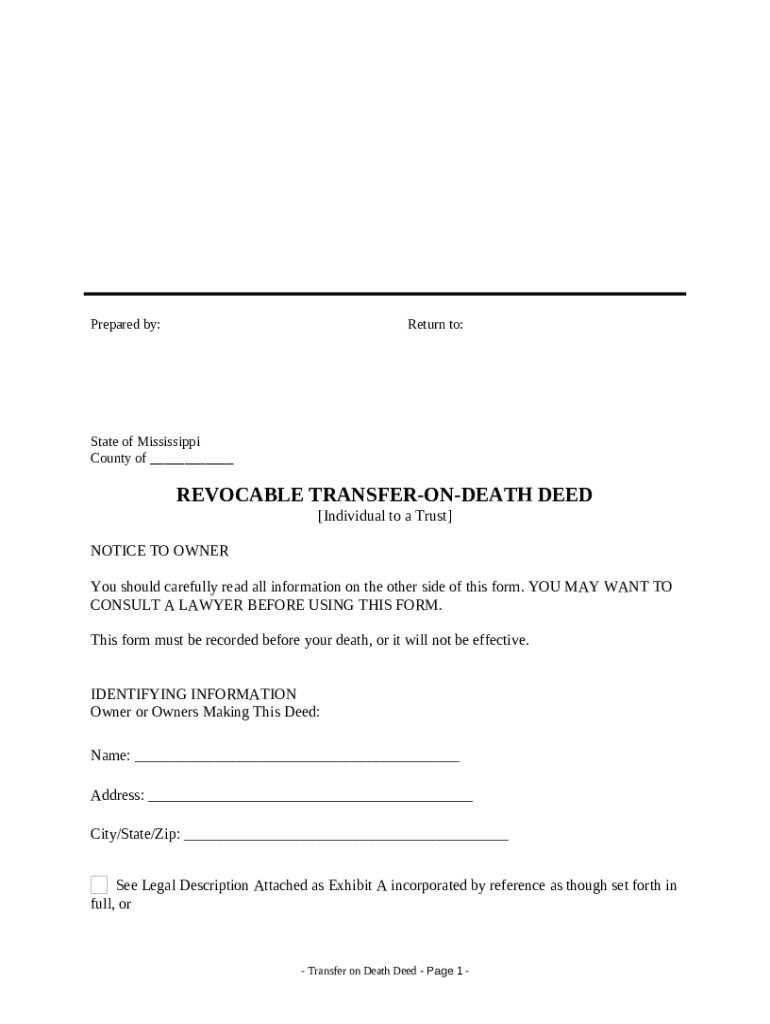

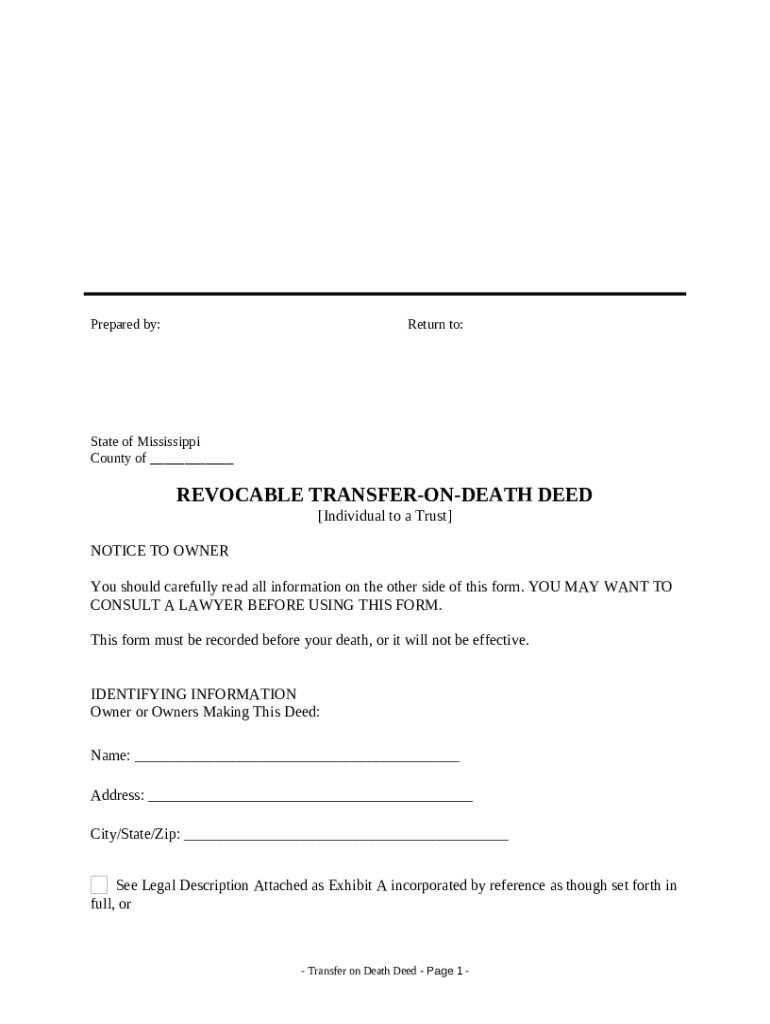

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Individual to a Trust template

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer ownership of real estate to a beneficiary upon their death without going through probate.

pdfFiller scores top ratings on review platforms

Best way to save, secure, and send your forms.

this is awesome - so easy to use - so many applications

I have struggled trying to fill in 1099 forms for 3 days. Decided to Google for a template. Found PDFfiller and I am over the moon on how easy it is to use. Love it!

just started a few days ago. am having trouble getting numbers to line up in certain forms. like tax id

WAS NOT ABLE TO DOWN LOAD AT HOME, BUT DID SO AT WORK.

Makes boring documents less tedious to do!

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

How to fill out a transfer on death deed form

Understanding the Transfer on Death Deed

A Transfer on Death Deed (TODD) is a legal document that allows a property owner to designate a beneficiary who will inherit the property upon the owner's death, bypassing the probate process. Unlike traditional wills, which take effect after death and often require court validation, a TODD acts while the owner is alive but effective at death. Using a TODD is crucial for streamlining estate planning and ensuring that your loved ones retain ownership without unnecessary delays.

Why Use a Transfer on Death Deed?

-

One of the key benefits is the ability to bypass probate, allowing beneficiaries to gain immediate access to the property.

-

It provides property owners flexibility since they retain ownership and can change or revoke the deed during their lifetime.

-

The deed simplifies the estate planning process, making it a favorable option for ensuring a smooth transition of assets.

Before You Get Started: Key Considerations

-

It's wise to consult with an estate planning attorney to understand the implications of a TODD and state laws.

-

Ensure you have all required documentation, such as property deeds and specific beneficiary information, ready for the process.

-

In Mississippi, familiarize yourself with specific legal regulations pertaining to the use of transfer on death deeds.

Preparing the Deed: Step-by-Step Instructions

-

Begin by accurately filling out your name and property details at the top of the deed form.

-

Clearly specify who will inherit the property by naming the primary beneficiary on the deed.

-

Consider adding an alternate beneficiary to ensure that the property is transferred even if the primary beneficiary is unavailable.

-

Note that you have the right to revoke the deed at any time, as long as you are alive.

Recording the Transfer on Death Deed

-

You must record the deed with the local land records office in Mississippi for it to be valid.

-

Recording the deed before your death is crucial to ensure it’s legally enforceable and accessible to your beneficiaries.

-

Follow up after recording to confirm that the deed has been properly filed and no issues arise.

Managing Changes: Revocation and Updates

-

Revoking a TODD can be done through a written document that explicitly states the intent to revoke.

-

Any major life changes, such as marriage or divorce, should prompt a review and potential update of the TODD.

-

Keep records of any revocation or updates for future reference to ensure clarity.

Common Mistakes and Pitfalls

-

One of the most common mistakes is not recording the deed, which can nullify its intended effect.

-

Ensuring that beneficiary details are current and correct is essential to prevent disputes later.

-

Bypassing professional advice can lead to errors or misunderstandings regarding the legal weight of the deed.

Utilizing pdfFiller for Your Transfer on Death Deed

-

pdfFiller makes accessing the transfer on death deed form straightforward; simply navigate to the document section.

-

The platform allows for easy editing and electronic signing, making it convenient to finalize the deed.

-

Engage family members in the process using collaborative features to discuss and manage the deed effectively.

Finalization: The Notary Process

-

Notarization validates the deed, ensuring it meets legal standards and enhances its enforceability.

-

Notaries can typically be found at banks, law offices, or through online directories within Mississippi.

-

The process is usually brief; the notary will verify your identity and witness your signing of the document.

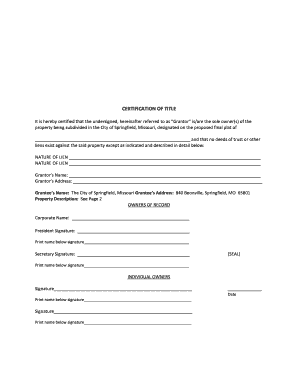

How to fill out the transfer on death deed

-

1.Obtain the transfer on death deed form from pdfFiller or a legal template.

-

2.Fill in your name as the grantor at the top of the form.

-

3.Enter the legal description of the property you wish to transfer.

-

4.Specify the name(s) of the beneficiary or beneficiaries who will receive the property.

-

5.Include the beneficiaries' contact information, if required.

-

6.Sign and date the deed in the appropriate space.

-

7.Ensure that the deed is notarized, as required by your state laws.

-

8.File the completed deed with your local land records office to make it effective.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.