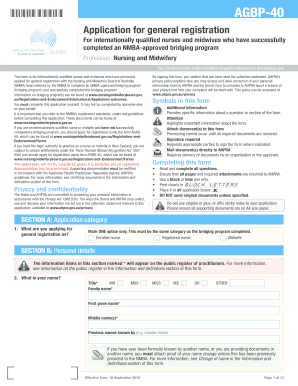

Get the free Promissory Note - Horse Equine s template

Show details

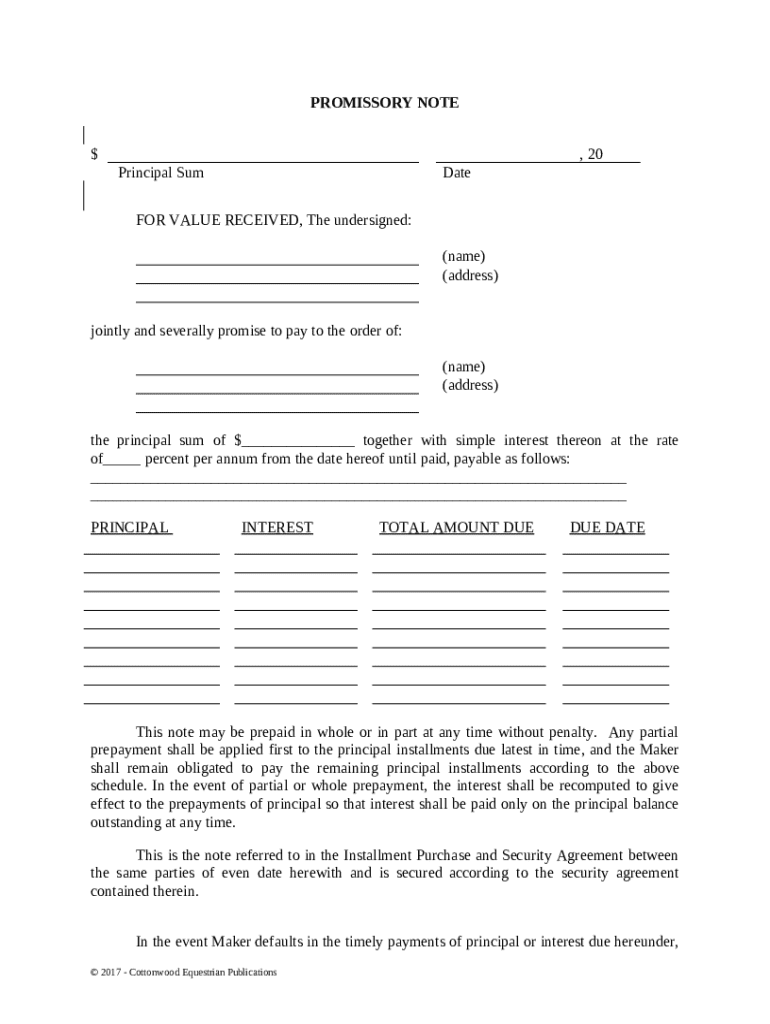

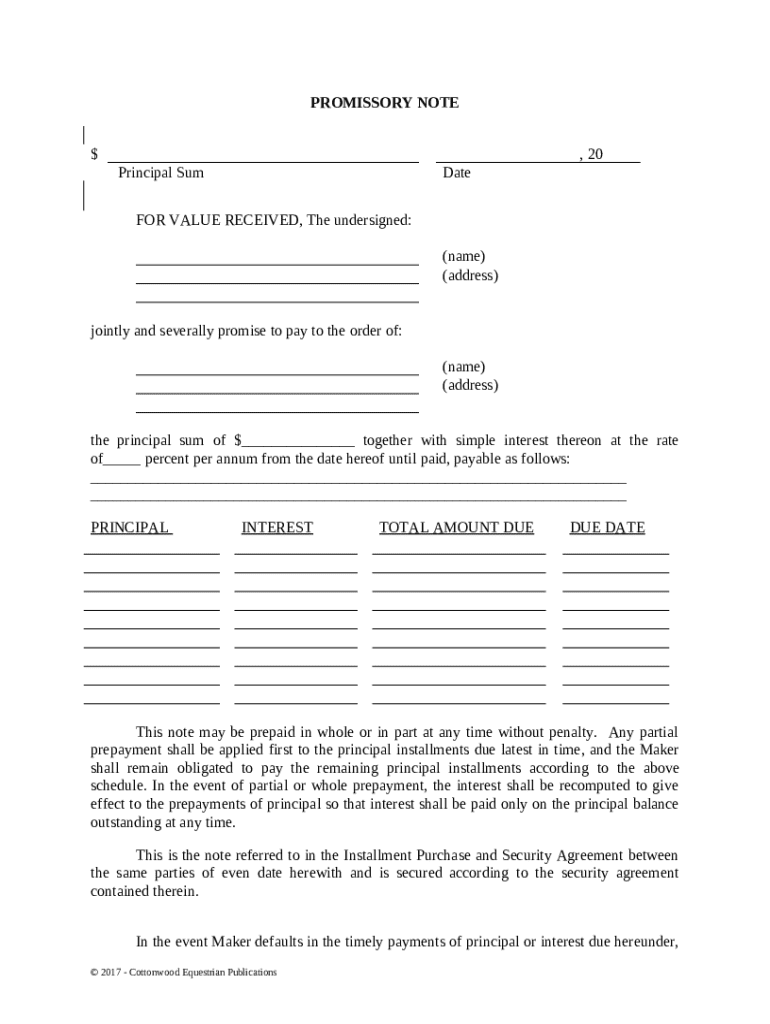

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document wherein one party promises to pay another a specified amount, often related to the sale or loan for a horse.

pdfFiller scores top ratings on review platforms

thank you love the app

great pdf editor- easy to use

wonderful service

it is an easy to use software and worth…

it is an easy to use software and worth the price, but with COVID and the gas issues, I'm tapped out.

Liked the UI and transparency

Liked the UI and transparency. Needed at this stage just for a quick job, but liked the experience a lot. Thumbs up!

working great.

working great.A little difficult to navigate but I'm geting used to it.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Your Guide to Promissory Notes: How to Fill Out a Horse Form

What is a promissory note?

A promissory note is a legally binding document that outlines the terms of a loan between the borrower (Maker) and the lender (Payee). Understanding its basics is essential for anyone involved in financing agreements, especially when considerable sums or personal property are at stake. In the context of a horse form, it specifies the loan for purchasing or leasing a horse.

-

Definition of a promissory note: A legally binding document stating the terms of a loan.

-

Key parties involved: Maker (borrower) and Payee (lender).

-

Importance of a promissory note in financing agreements.

What are the essential elements of a promissory note?

A promissory note includes critical elements necessary for financial clarity and legal compliance. These elements ensure that both parties understand the terms of the agreement. Without them, disputes could arise, making the document ineffective.

-

The amount borrowed, clearly stated in the document.

-

The percentage charged on the principal, which can affect total repayment.

-

Details on how and when payments will occur.

-

Clear stipulations on what occurs if the Maker fails to pay.

How can you fill out a promissory note?

Filling out a promissory note can seem daunting, but following a structured approach makes it manageable. By using the right templates, like those available on pdfFiller, you can ensure your document is professional and legally sound.

-

Download the template from pdfFiller.

-

Input the Principal Sum and Date.

-

Fill in details for the Maker and Payee (name and address).

-

Specify the Interest Rate and Payment Schedule.

-

Review and finalize terms regarding prepayments and defaults.

What tools help in editing and customizing your promissory note?

pdfFiller provides a plethora of editing tools that allow users to customize their promissory notes effortlessly. These tools ensure that you can modify various sections to fit personal or business requirements.

-

Utilize pdfFiller’s editing capability to add, modify, or remove sections as necessary.

-

Save and store your document securely for future reference and retrieval.

How do you ensure legal compliance when eSigning your promissory note?

Understanding the legal aspects of eSigning a promissory note is crucial. With pdfFiller, you can ensure that your eSignature meets legal standards, safeguarding your document’s integrity.

-

eSignatures are legally recognized and simplify the signing process.

-

Follow the process on pdfFiller to eSign, ensuring your document's legality.

-

Check state-specific regulations for electronic signatures.

How to manage your promissory note over time?

Once your promissory note is established, managing it effectively is vital. Tools from pdfFiller enable you to keep track of payment schedules and manage any adjustments that need to be made accordingly.

-

Keep a close eye on payment schedules using pdfFiller.

-

Understand the benefits and necessary steps for handling partial prepayments.

-

Know what to do if a default arises and what the subsequent steps are.

What common pitfalls should you avoid with promissory notes?

There are several common mistakes individuals make when dealing with promissory notes. Avoiding these pitfalls can safeguard your financial interests and ensure a smoother transaction process.

-

Not laying out clear payment terms could lead to confusion.

-

Without a well-defined interest rate, unexpected costs may arise.

-

Lack of clarity around defaults can lead to significant consequences.

Where can you find additional resources for promissory notes?

Accessing further resources on promissory notes can provide invaluable support. pdfFiller and other platforms offer a range of options to ensure you are well-informed.

-

Links for personalized consultations on agreements and legal advice.

-

Discussion groups that focus on financial agreements and shared experiences.

How to fill out the promissory note - horse

-

1.Open the PDF document titled 'promissory note - horse' in pdfFiller.

-

2.Begin by entering the date at the top of the document in the appropriate field.

-

3.Next, fill in the borrower's name and contact information, ensuring it is accurate.

-

4.Proceed to enter the lender's name and contact information, clearly identifying all parties involved.

-

5.Specify the amount of the loan being granted for the horse purchase in the designated field.

-

6.Include details about the horse, such as the breed, age, and any identifying features.

-

7.Set the repayment terms, including the interest rate, payment schedule, and due dates in the relevant sections.

-

8.Review all information entered for accuracy and completeness before saving the document.

-

9.Once verified, use the 'Save' or 'Download' option to keep a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.