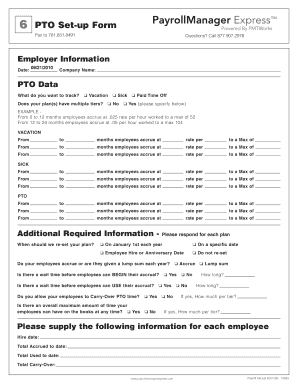

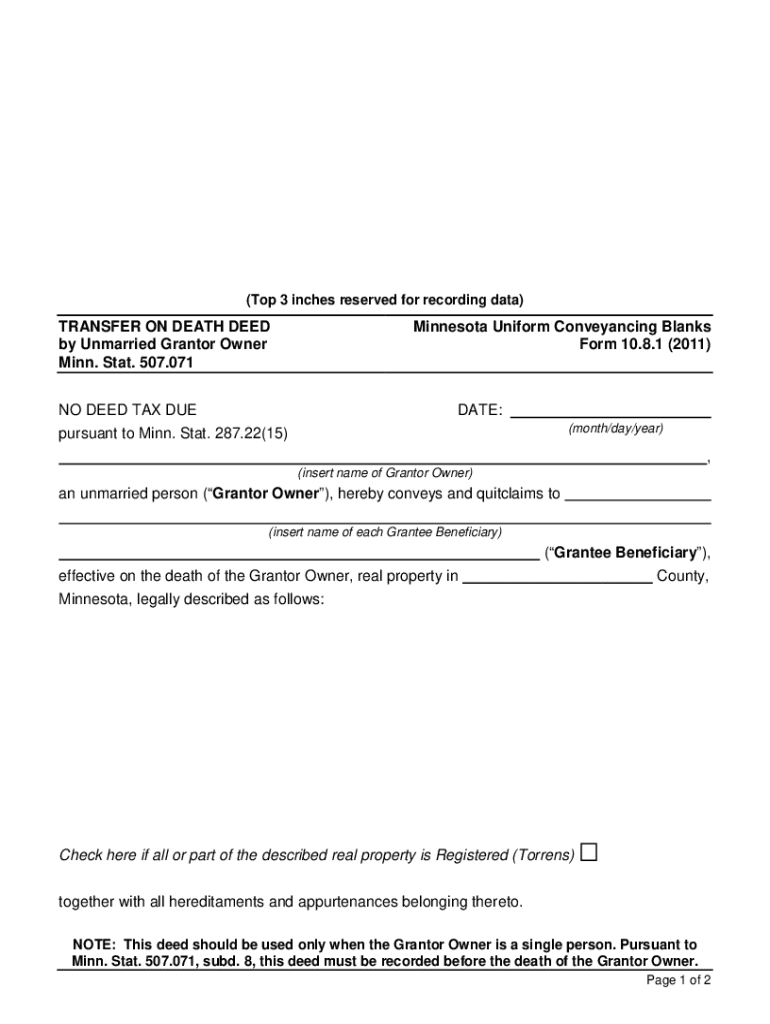

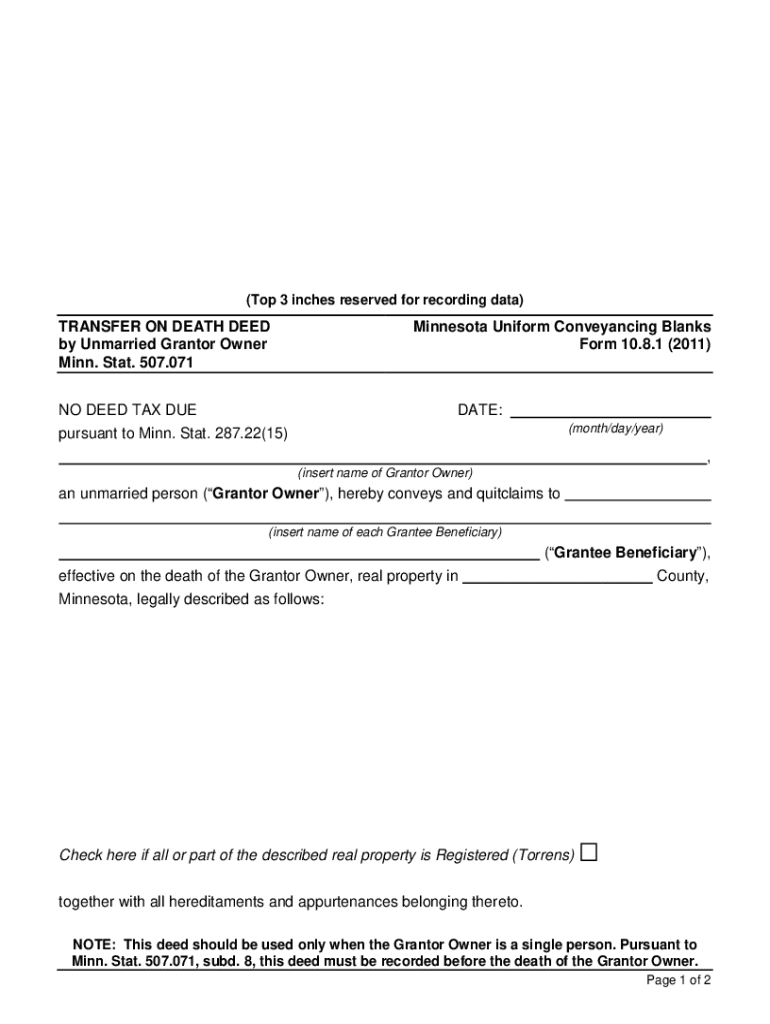

Get the free Transfer on Death Deed by Unmarried Grantor Owner Minn. Stat. 507.071

Show details

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows a property owner to designate beneficiaries to receive their property upon their death, avoiding probate.

pdfFiller scores top ratings on review platforms

It is very practical and resourcefule. I had no issues what so ever and I didn't have to do a tutorial to learn how to navigate since everything is perfectly laid out.

He explorado las diferentes herramientas, me parece practico.

so far I like it my next project is poa...hope we have a template.

perfecto soluciono mi problema pero solo lo necite una vez deberian tener un dia de prueba o cobrar por dia

Its a great service but I don't have a need for so much. One form is not worth me subscribing.

Very Easy to use although I think rotating pages should be a basic funciton of the utility.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form Guide

How can you understand the transfer on death deed?

A Transfer on Death Deed (TODD) allows an individual to transfer property upon their death directly to designated beneficiaries without going through probate.

-

The TODD is a legal document that enables real estate to be transferred to beneficiaries without the complications of probate, simplifying the transfer process for individuals.

-

Under Minnesota Statutes 507.071, the TODD is recognized, granting it a legal framework that validates its use in real estate transactions.

-

This deed is particularly beneficial for unmarried individuals, enabling easy transfer of their property without the intricate legalities often involved with traditional wills.

Who should consider using the transfer on death deed?

It's essential to determine whether you are eligible to use a Transfer on Death Deed and understand its implications.

-

Unmarried individuals or those looking for a straightforward method to designate heirs may find this deed advantageous.

-

Selecting beneficiaries requires careful consideration, as these individuals will inherit the property, and disputes can arise if not communicated clearly.

-

Failing to record the deed in a timely manner may lead to complications or disputes about property transfer after death.

What are the steps for completing the transfer on death deed form?

Completing your TODD form accurately ensures proper property transfer after your passing.

-

Include necessary details such as the grantor's full name, date of execution, and other personal identifiers to establish ownership.

-

Clearly state the names of beneficiaries who will receive the property to avoid any ambiguity or disputes in the future.

-

If you are in Minnesota, ensure you have accurate details about the property to be transferred, including legal descriptions.

-

Consider including optional statements to clarify the interests acquired, especially if there are multiple beneficiaries or conditions.

How can you edit and manage your transfer on death deed?

Utilizing pdfFiller's tools can streamline the editing and managing process for your TODD.

-

pdfFiller offers an array of editing tools that allow you to modify the deed easily and accommodate any changes in beneficiaries or details.

-

With pdfFiller, you can sign the deed digitally, ensuring it's executed properly without needing a physical presence.

-

You can share the document with legal advisers or beneficiaries directly, enhancing the collaborative process for estate planning.

What should you do after completing the transfer on death deed form?

Once you finalize your TODD, understanding the next steps is crucial for ensuring its validity and effectiveness.

-

It's vital to record your TODD at the county office where the property is located in Minnesota to give it legal effect.

-

Failing to record the deed may lead to complications, such as the property reverting to probate court if the grantor passes away without it being filed.

-

Store digital copies in a secure location, using pdfFiller to manage your documents conveniently and access them when necessary.

Where can you find more resources for managing real property transfers?

Knowledge is power, especially when dealing with real estate transfers; access to resources can aid in the process.

-

Staying informed about Minnesota statutes governing Transfer on Death Deeds is essential for compliance and effective estate planning.

-

Explore additional real estate forms available on pdfFiller to ensure comprehensive management of your property and estate.

-

Look for resources specifically designed to assist unmarried individuals in estate planning, offering tailored advice and strategies.

How to fill out the transfer on death deed

-

1.Open the pdfFiller platform and select the transfer on death deed template.

-

2.Fill in the property owner's full name and contact information.

-

3.Enter the legal description of the property being transferred, including address and tax identification number, if applicable.

-

4.List the beneficiaries' names, ensuring accuracy in spelling and relationship to the owner.

-

5.Specify if the transfer is for multiple beneficiaries and outline their respective shares.

-

6.Review all entries for accuracy and completeness to avoid legal issues.

-

7.Sign and date the document in the designated area, and have it notarized if required by your state law.

-

8.Save and download the completed transfer on death deed for your records and follow any necessary filing protocols in your jurisdiction.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.