Get the free Minnesota Professional Limited Liability Company PLLC ation Package template

Show details

This Professional Limited Liability Company - PLLC Formation Package state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new Professional

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is minnesota professional limited liability

Minnesota Professional Limited Liability is a specific business entity type that allows licensed professionals to form a limited liability company while ensuring compliance with state regulations.

pdfFiller scores top ratings on review platforms

Very useful when you don't have a printer.

Easy, have not tried to share and sign yet

I'm just starting and finding my way around. All good so far.

Sometimes hard to find form you are looking for.

Our agency management system has crashed this week. PDF filler is saving our business while we wait for it to be repaired. I have recommended it to everyone in our same situation

THIS PROGREAMME MAKES IT SO VERY EASY TO PROCESS DOCUMENTS, ITS GREAT

Who needs minnesota professional limited liability?

Explore how professionals across industries use pdfFiller.

Minnesota Professional Limited Liability Company Form Guide

How Do Limited Liability Companies (LLCs) Work in Minnesota?

Limited Liability Companies are a popular business structure in Minnesota, providing a blend of the operational flexibility of a partnership while offering the limited liability protections typically associated with a corporation. This means that the owners, or 'members,' of the LLC are generally not personally responsible for the company's debts or liabilities.

-

Liability Protection: Members are protected from personal liability for business debts.

-

Tax Flexibility: LLCs can opt to be taxed as a sole proprietor, partnership, or corporation.

-

Simplified Structure: LLCs have fewer formalities compared to corporations.

What Statutes Govern Minnesota LLCs?

In Minnesota, LLCs are governed under specific statutes that outline the legal framework for their formation and operation. Understanding these statutes is essential for compliance and successful business operation.

-

Minnesota Statutes Chapter 322C: This act specifically governs the formation and management of limited liability companies.

-

Minnesota Statutes Chapter 319A: This act pertains to professional firms, including how professional LLCs must operate.

-

Compliance is crucial: LLCs must adhere to the regulations imposed by these statutes to maintain their good standing.

What Are Key Definitions for Minnesota Professional LLCs?

When forming a professional limited liability company in Minnesota, it’s vital to understand the terminology associated with this business structure. This can help clarify legal obligations and operational roles.

-

'Firm': Refers to any professional service provider registered as an LLC.

-

'Disqualified' status means a professional may not operate under their license due to legal reasons.

-

The 'Board' refers to the regulatory body overseeing licensing and professional accountability.

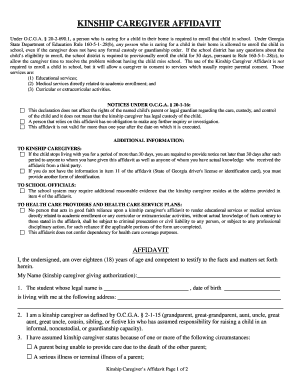

What Steps Are Involved in Registering a Professional in Minnesota?

Establishing a professional LLC in Minnesota involves several crucial steps to ensure compliance with state regulations. Following these steps can streamline the registration process and help avoid complications.

-

Eligibility Requirements: Ensure that all members are licensed professionals in their field.

-

Filing Articles of Organization: Submit this document through the Minnesota Secretary of State's office.

-

Licensing: Secure any necessary licenses specific to your profession from the state board.

-

Ongoing Compliance: Adhere to all regulatory requirements to maintain your LLC's status.

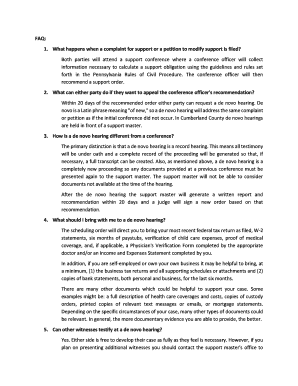

How to Fill Out the Minnesota Professional Limited Liability Company Form?

Completing the Minnesota professional LLC form can be straightforward if you understand the required information. Accuracy is essential to prevent delays in processing.

-

Required Information: You will need to provide details such as the LLC's name, office address, and member information.

-

Step-by-Step Guide: Follow instructions closely when filling out each section of the form.

-

Common Mistakes: Avoid errors such as incorrect member information or forgetting to sign the form.

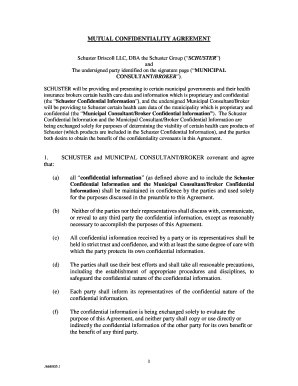

How Can pdfFiller Assist with Managing Your Documents?

pdfFiller offers advanced tools for managing your Minnesota professional LLC documents, ensuring you can easily fill out, edit, and sign necessary forms. This tool can save time and enhance document compliance.

-

PDF Uploads: Easily upload documents related to your LLC for editing.

-

eSigning: Use the eSign feature for secure and legal signatures directly within your documents.

-

Collaboration: Work with team members to edit and finalize documents seamlessly from any location.

What Does It Take to Maintain Your Minnesota Professional Status?

Ongoing compliance is critical to maintaining your Minnesota professional LLC status. Failing to comply with state requirements could jeopardize your business.

-

Annual Renewal: LLCs must complete annual renewals to stay in good standing.

-

Deadlines: Note important dates to avoid penalties or lapses in status.

-

Compliance Tips: Regularly review regulations to ensure ongoing adherence to state laws.

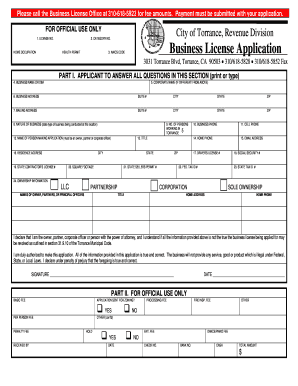

How to fill out the minnesota professional limited liability

-

1.Visit the pdfFiller website and log in or create an account if you don't have one.

-

2.Search for the 'Minnesota Professional Limited Liability' form in the template library.

-

3.Once you have located the form, click on it to open it in the editor.

-

4.Begin by filling in your business name in the designated fields, ensuring it conforms to Minnesota's naming requirements.

-

5.Next, enter the address of your principal office and any other applicable addresses for your business.

-

6.Include all member names and their respective professional licenses to ensure your compliance with state law.

-

7.If required, attach supporting documents, such as proof of professional licensure or certificates.

-

8.Review all entered information for accuracy and completeness before submitting.

-

9.Once confirmed, save the form and follow the provided submission guidelines to file your Minnesota Professional Limited Liability application with the state.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.