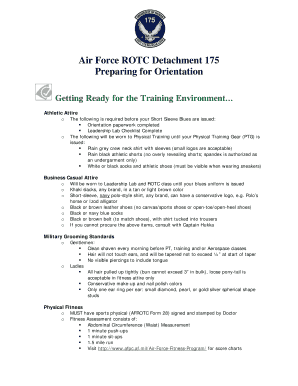

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Married Individuals to Mult...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to designate a beneficiary to receive their property upon their death without the need for probate.

pdfFiller scores top ratings on review platforms

Great for what I needed it for

Needed to complete nursery registration forms for my daughters (which were emailed to me in PDF format), but have no access to a printer, so really appreciate software like this! Was quickly able to complete, and then email back to the nursery.If you are someone who regular needs to complete PDF's online, then you would really benefit from this.Was slightly confusing to begin with, but quickly got my head around it.

Love this software

Love this software ! I totally recommend it.

User friendly

User friendly. Easy to navigate...simply, loved it.

Great software simple to use

Great software simple to useMakes my work a lot easier

Excellent

Excellent! Eliminates the concern of properly providing the essential information on documents. Takes a large load of concern off the mind. Highly recommended.

Trouble with formatting

Trouble with formatting, but I think it is more of a user error. Great for editing documents.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Transfer on Death Deed Form: Comprehensive Guide

What is a transfer on death deed?

A transfer on death deed (TOD deed) is a legal document that allows real estate properties to be transferred directly to designated beneficiaries upon the owner's death, avoiding the probate court. This instrument is especially significant as it provides a straightforward way to pass on assets without the delays and costs typically associated with probate. This method can simplify estate management for individuals who wish to ensure their loved ones receive property promptly.

When and why is the transfer on death deed useful?

The transfer on death deed becomes particularly useful in various scenarios, such as when an individual wants to avoid probate for their property after passing away. This deed allows property owners to maintain full control over their property during their lifetime while ensuring a smooth transition to beneficiaries after their death. Additionally, it simplifies the inheritance process for families during what can be a difficult emotional time.

-

Eliminating the need for probate court saves time and reduces associated costs.

-

Property owners retain control while alive, enabling them to change the deed at will.

-

Beneficiaries receive ownership rights without legal hurdles after the owner’s passing.

How does it compare with other estate planning tools?

When comparing the transfer on death deed to other estate planning tools, it stands out for its simplicity and directness. Unlike a will, which goes through probate, a TOD deed allows for immediate transfer upon death. Other tools, such as trusts, can also facilitate asset transfer but often require more complex arrangements and ongoing management.

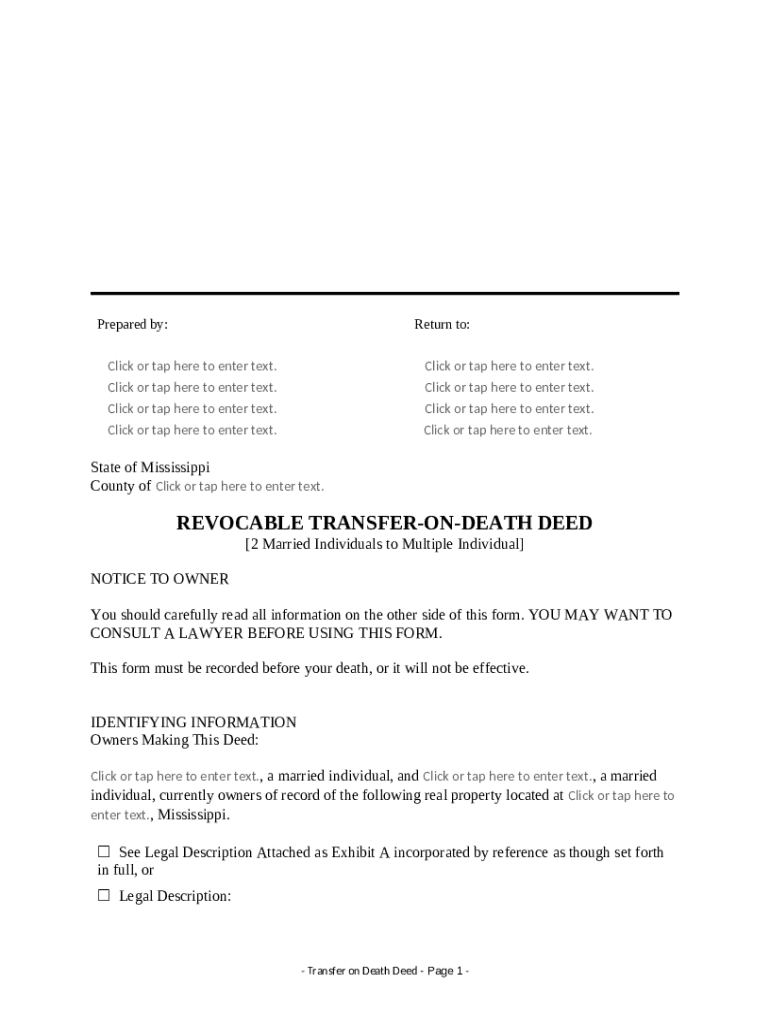

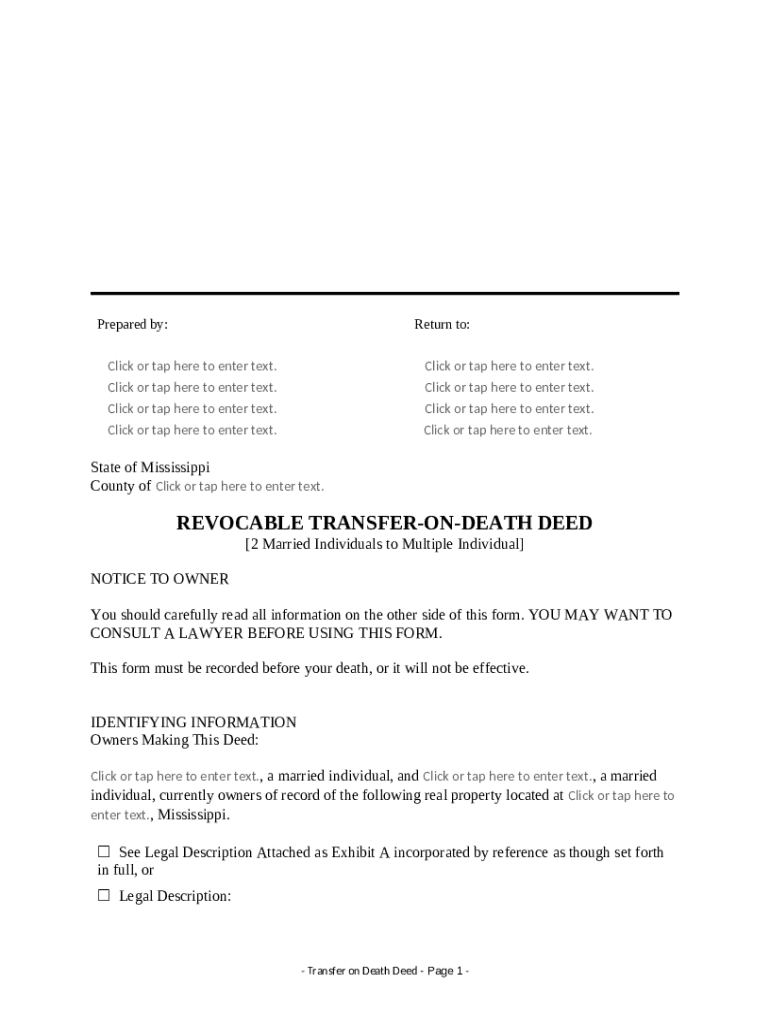

How to prepare your transfer on death deed?

Preparing a transfer on death deed involves several critical steps, beginning with gathering essential identifying information for the deed. This foundation ensures all legal descriptions and property details are correctly incorporated, which is crucial for a valid deed. Utilizing tools like pdfFiller can help simplify and streamline this process, guiding users in filling out necessary fields accurately.

-

Names, addresses, and property details must be collected for all owners and beneficiaries.

-

Accurate property details and legal descriptions are vital for the deed to be enforceable.

-

Online platforms like pdfFiller offer resources for filling, editing, and managing these documents.

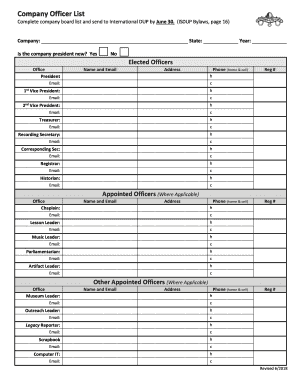

Who are the owners and beneficiaries?

Identifying the owners and beneficiaries is a crucial step in completing the transfer on death deed. This entails accurately entering each owner's name and essential details, as well as designating primary and alternative beneficiaries. Clarity in beneficiaries' rights is critical, including any conditions upon which they will inherit the property.

-

The main individuals who will inherit the property upon the owner’s death.

-

Backup individuals who inherit if primary beneficiaries are unavailable.

-

Explicit terms under which beneficiaries will receive their inheritance are advisable.

What are the step-by-step instructions for completing the form?

Completing the transfer on death deed form involves following a structured approach to ensure accuracy. Start by navigating the fields designated for owner information, ensuring all details are correct. Next, fill in the beneficiary information with equal attention to detail. Pay close attention to incomplete fields or legal notices, as these can compromise the validity of your deed.

-

Enter full names, addresses, and contact information for all property owners.

-

Ensure beneficiary fields are accurately filled to avoid future disputes.

-

Review the document for any missing information or potential legal notices.

What are the key legal considerations?

Recording the transfer on death deed before the owner's death is imperative; it ensures the transfer will be valid and executed. Failing to properly execute the deed can lead to significant complications during estate settlement. Therefore, seeking legal counsel is highly advisable to navigate the nuances and ensure that all aspects of the deed align with state laws.

-

The deed must be officially recorded to be enforceable; failing to do so can invalidate it.

-

Improper execution or lack of recording can sour distributions and lead to legal challenges.

-

Consulting with legal experts can help tailor your deed's provisions to your specific situation.

How to finalize and manage your deed?

Finalizing the transfer on death deed involves the crucial step of recording it with the appropriate authorities. Using pdfFiller offers tools to manage this digital process, making it straightforward to fill out, sign, and store your deed securely. Additionally, if circumstances change, it's essential to know your options for revoking or amending the deed to reflect new wishes.

-

Submit your completed deed to local authorities—ensure it's filed according to local regulations.

-

Utilizing pdfFiller can provide easy access to manage and sign documents electronically.

-

Understand how to legally revoke or amend the deed if life circumstances change.

How to fill out the transfer on death deed

-

1.Visit pdfFiller and log in to your account or create a new one.

-

2.Search for 'transfer on death deed' in the template library.

-

3.Select the appropriate template for your state, as laws vary by location.

-

4.Click 'Fill' to open the document editor.

-

5.Begin by entering your name and the date of the deed at the top of the page.

-

6.Identify and provide the full legal description of the property being transferred including address and legal identifiers.

-

7.Next, designate the beneficiary by entering their name and relationship to you.

-

8.If there are multiple beneficiaries, clarify how the property will be divided or confirm equal shares.

-

9.Include a space for your signature and the date of signing.

-

10.Ensure the document is notarized if required by your state by signing in the presence of a notary public.

-

11.Save and download your completed Transfer on Death Deed, and make copies for your records and the beneficiary.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.