Get the free Judgment Confirming Tax Patent template

Show details

Property was sold for ad valorem taxes due and title to the property was acquired by virtue of a Forfeited Tax Land Patent ansd the time for redemption has passed. Fee simple title is herewithin

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is judgment confirming tax patent

A judgment confirming tax patent is a court order that validates the proper collection of taxes based on a patent's ownership rights and obligations.

pdfFiller scores top ratings on review platforms

Very ease to operate and professional processed.

NEW TO THE PRODUCT AND INTERESTED IN LEARNING MORE

Used for filling in forms is rather difficult when it come to aligning the government forms.

Love the simplicity of using it. Still learning, but the experience so far is great! Haven't found any form that I cannot fill in!!

I have enjoyed getting to know this app.

only did one document so far. Have since did more....so the rating is higher now.

Who needs judgment confirming tax patent?

Explore how professionals across industries use pdfFiller.

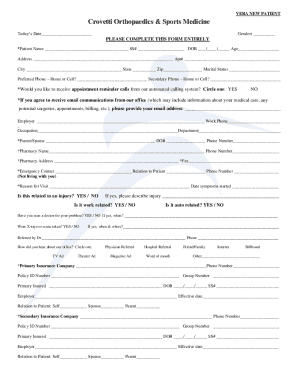

How to fill out the judgment confirming tax patent

-

1.1. Begin by gathering all necessary information related to the tax patent, including the patent number and relevant financial data.

-

2.2. Open pdfFiller and select the 'Create Document' option to start a new form.

-

3.3. Upload the relevant tax patent documents or the established legal form required for the judgment confirmation.

-

4.4. Carefully fill out each field, including your name, address, and any identification numbers associated with the tax patent.

-

5.5. Ensure that any numerical values, such as amounts owed or filed taxes, are accurate and formatted correctly.

-

6.6. Review the document for accuracy and completeness to avoid errors or omissions.

-

7.7. Apply any required digital signatures or dates as may be mandated by your jurisdiction.

-

8.8. Save the completed judgment confirming tax patent as a PDF to ensure document integrity.

-

9.9. Submit the document through the appropriate filing channels or directly to the court as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.