Get the free Application for Certificate of Discharge of IRS Lien template

Show details

This is an Application for Certificate of Discharge of IRS Lien, to be used in the State of Mississippi. It is used when one wishes to seek a discharge, or release, from an IRS lien placed upon him/her.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is application for certificate of

An application for certificate of is a formal request document used to obtain a specific certificate from an issuing authority.

pdfFiller scores top ratings on review platforms

I liked it for my needs at the time, but I don't need it on a regular basis.

i just started using it. so far very good. would like to be able to erase exhisting texts on a document

Overall easy to use, however, there are instances where the edits on the pdf become warped, other times its difficult to remove words or characters. There should be a save option versus a Save As, as that navigates you to another screen. Or have an auto save option. Overall good program but still has small defects.

I want to further my experience with pdf filler for business.

Excellent and easy application to use. I use this for military and business situations.

Great product. Allows me to save the cost of a tax preparation software and still produce professional looking forms.

Who needs application for certificate of?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to the application for a certificate of form

How to fill out a certificate of form application

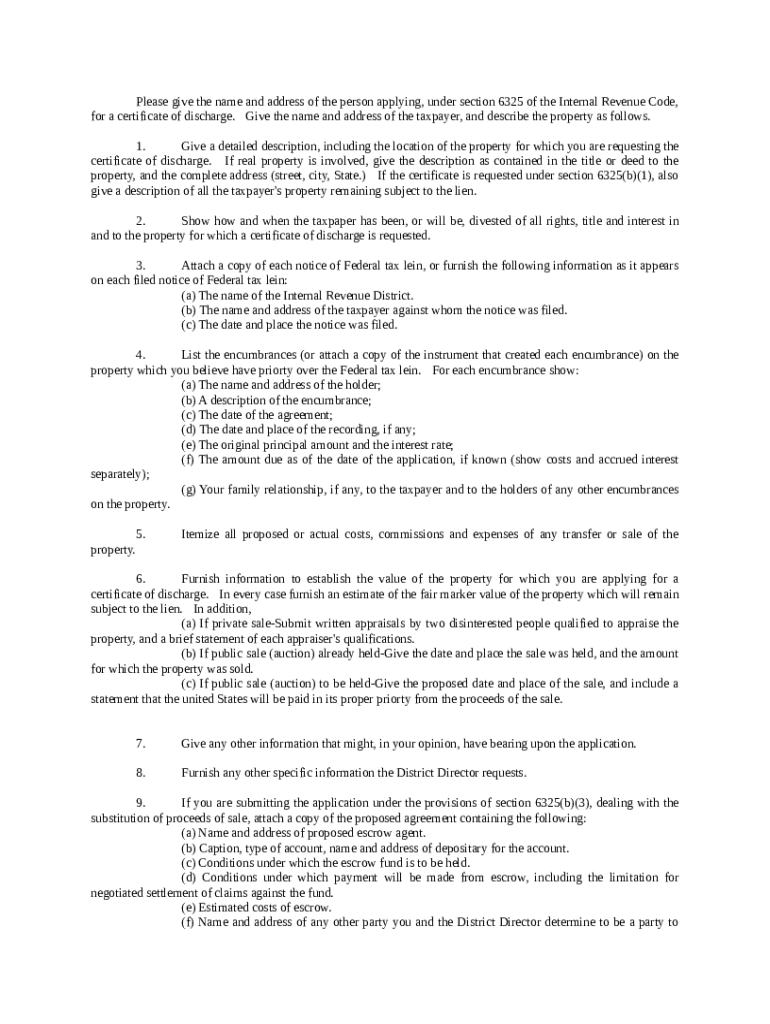

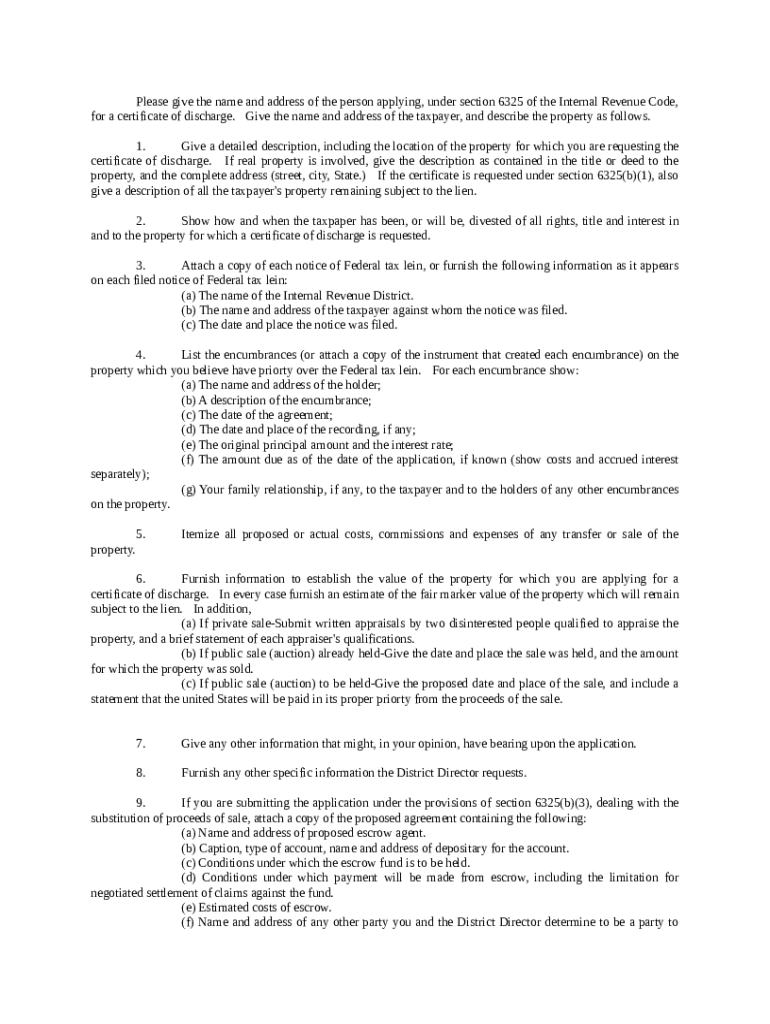

To apply for a certificate of discharge, you'll need to fill out the application form accurately and gather all necessary documentation. This guide will walk you through each step, ensuring you understand the eligibility criteria, how to provide proper property descriptions, and what documentation you need to attach.

Understanding the certificate of discharge

A Certificate of Discharge is an important document issued by the IRS, which absolves a taxpayer of federal tax liabilities associated with certain properties. This document is significant as it clears any federal tax liens against the specified property, thereby allowing for its sale or transfer.

Typically, individuals or teams seeking this certificate include those who are about to sell property or are seeking to obtain financing. Understanding the underlying Internal Revenue Code sections, particularly those related to tax discharges, is crucial for applicants.

Who can apply for a certificate of discharge?

Eligibility for applying for a Certificate of Discharge generally encompasses all taxpayers who have outstanding federal tax liens. Their representatives may also apply on their behalf, assuming they have the proper authorization.

-

Individuals or businesses who wish to resolve tax liabilities affecting their assets may apply.

-

Tax advisors and attorneys can represent taxpayers to facilitate the application process.

It's important to note that some regional laws may impose additional restrictions or guidelines for the application process.

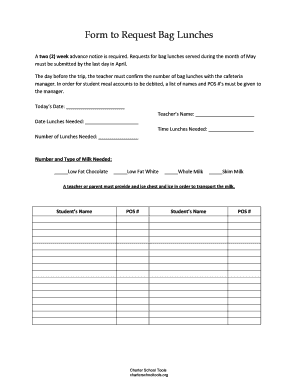

Filling out the application form

Completing the application form correctly is crucial for a successful application. The key to an effective application lies in accurately filling out sections like taxpayer identification, property address, and lien descriptions.

-

Include your name, address, and contact information.

-

Clearly define the property location, size, and any pertinent legal descriptions.

Property description guidelines

When describing the property involved in the application, clarity is key. Accurate descriptions that include legal details about the property’s boundaries help prevent processing delays.

-

State the specific address and identify any distinguishing features.

-

Reference any existing deeds or titles to substantiate your claim.

Avoid common pitfalls such as vague descriptions that can lead to unnecessary complications during the application process.

Required documentation and attachments

Accompanying your application with the right documents is crucial. The submission should include necessary paperwork that demonstrates your tax situation and any liens affecting your property.

-

Documents that detail the lien put on the property due to unpaid taxes.

-

Mortgage statements or property titles that confirm your ownership.

Detailing encumbrances on property

It's also essential to list any encumbrances on the property. This includes mortgages or other claims that might affect the property's title.

-

Ensure to provide all details including the holder's name and the original amount.

-

Use a checklist to ensure you have captured all necessary information accurately.

Submitting your application

Submission of the application can be accomplished through various methods. Depending on your preference and convenience, you can choose to submit online, by mail, or in-person.

-

Utilizing e-filing options is quick and allows for immediate confirmation.

-

Ensure to check postage requirements and allow for longer processing times.

-

Consider visiting local tax offices for direct assistance.

Regardless of the method, tracking the application status is essential for following up on potential issues.

What happens after submission?

Once you've submitted your application, it can lead to different outcomes. The most common results include approval or denial, each with specific next steps.

-

Upon approval, you will receive your Certificate of Discharge, allowing you to proceed with property transactions.

-

If denied, you can appeal the decision, which involves submitting additional information or corrections.

Retaining copies of all submitted documents is recommended, as they may be needed for future reference or appeals.

Utilizing pdfFiller for application management

pdfFiller simplifies the entire document management process. You can easily edit, sign, and manage your application forms directly within a cloud-based environment, enabling secure access from anywhere.

-

Make necessary changes to your application forms quickly and efficiently.

-

Ensure your application is signed electronically for swift submission.

How to fill out the application for certificate of

-

1.Open pdfFiller and upload your blank application for certificate of form.

-

2.Start by entering your personal information, including name, address, and contact details in the designated fields.

-

3.Next, specify the type of certificate you are requesting by selecting from the options available in the dropdown menu.

-

4.Provide any necessary supporting details or documents as instructed on the form, such as identification or payment information.

-

5.Review all the information entered to ensure accuracy and completeness before submission.

-

6.Finally, save your completed application, download it if necessary, and submit it electronically or print it to send by mail to the relevant authority.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.