Get the free Insurance Refusal to Pay and Bad Faith Claim template

Show details

Insurance Refusal to Pay and Bad Faith Claim: This is a Mississippi form that complies with all Mississippi codes and statutes. A Complaint based on Insurance Refusal to Pay and Bad Faith Claim

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is insurance refusal to pay

An insurance refusal to pay is a formal document stating that an insurance company denies a claim or payment requested by a policyholder.

pdfFiller scores top ratings on review platforms

a little difficult to use at first but it does a nice jo

etter than I imagined. Get court access, and you will be a hero...

Once I got use the new software I was feeling more confident.

For the forms used it was easy to put the text in just the right box

I haD an outstanding issue with CONCERNS AND CHAT SPECIALIST your order and HAS been able to resolve it with PDFfiller directly, Customer Care Resolution service, . RYAN S. WAS GREAT IN RESOLVING MY CONCERNS. THANK YOU,JACQUELINE NESBITT

Excellent! But I'm a farmer and only use it once a year!!!

Who needs insurance refusal to pay?

Explore how professionals across industries use pdfFiller.

Guide to insurance refusal to pay form on pdfFiller

Filling out an insurance refusal to pay form can be a daunting task. This guide will provide you with all the information you need to understand the process and how to fill out the form effectively.

What is insurance refusal?

Insurance refusal refers to an insurance company's decision not to pay a claim filed by a policyholder. This situation can arise for various reasons, often leaving policyholders frustrated and confused.

-

An insurance refusal to pay occurs when an insurer denies a claim requested by a policyholder, claiming the claim does not meet policy requirements.

-

Common reasons include lack of coverage, missing documentation, late submission, or policy exclusions.

-

A refusal can result in financial losses, increased stress, and potential legal action to contest the denial.

What constitutes insurance bad faith?

Insurance bad faith occurs when an insurer does not act in good faith, leading to unjust denials and unfair handling of claims.

-

Insurers are required to treat claims fairly and provide proper reasons for any denials.

-

Victims of bad faith may be entitled to damages beyond the original claim amount, including punitive damages.

Why is the insurance refusal to pay form important?

The insurance refusal to pay form serves as a crucial document in the dispute process, acting as official evidence of a claim's denial.

-

This form helps to create a record of the insurer's denial, which can be vital in any subsequent legal action.

-

Completing this form is an essential step in disputing the insurer's refusal, as it provides a structured argument.

-

Once submitted, the form can carry legal implications and may enforce the insurer to review their decision.

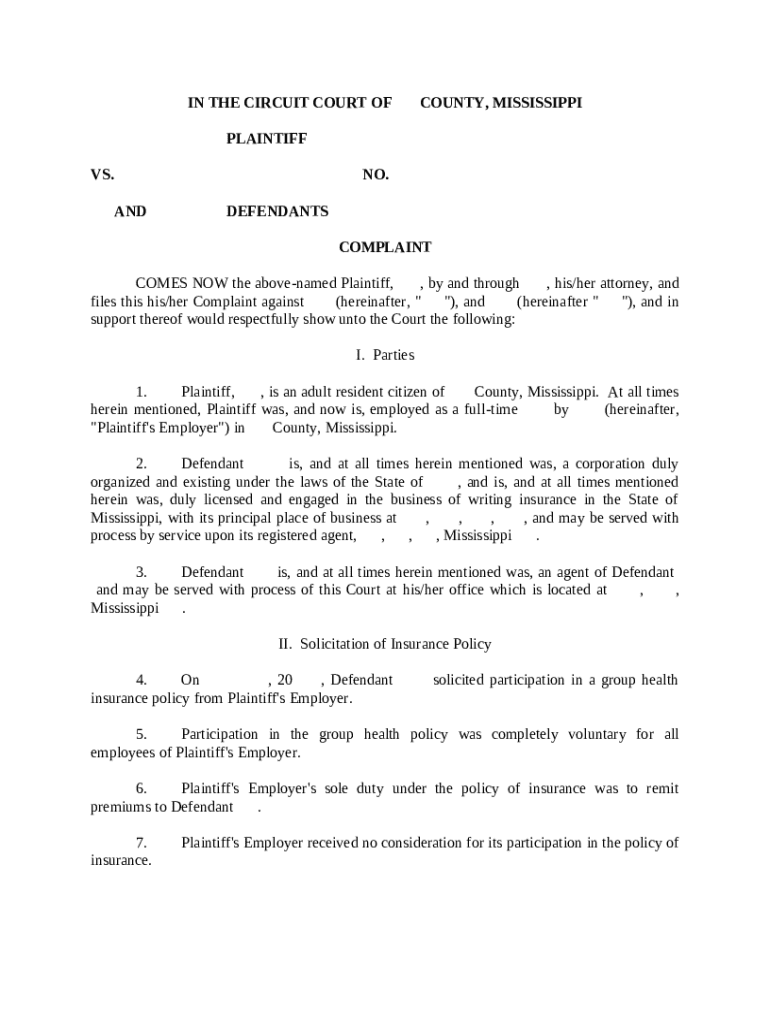

How should fill out the insurance refusal to pay form?

Filling out the form correctly is crucial for your claim's success. Here are steps to guide you.

-

Begin by downloading the form from pdfFiller. Ensure you fill in all required fields accurately.

-

Pay special attention to sections like 'Plaintiff' and 'Defendants', where accurate details strengthen your position.

-

Double-check for missing information or incorrect dates, as these can lead to delay or denial.

How to edit and sign the refusal form on pdfFiller?

pdfFiller provides a user-friendly platform for editing your refusal form and signing it securely.

-

Use the editing tools to add, remove, or modify information directly on the form.

-

Follow the prompts to securely apply your eSignature, ensuring your form is official.

-

Utilize pdfFiller's collaborate feature to seek advice without leaving the platform.

Where should submit the insurance refusal to pay form?

Understanding submission procedures is key, as they can differ by locality.

-

Typically, you submit the form to your insurance company or state insurance department.

-

In Mississippi, familiarize yourself with specific submission deadlines and criteria.

-

Keep a record of your submission confirmation, which may include a tracking number for follow-up.

What to expect after submission?

After you submit your form, it's essential to know what will happen next.

-

Responses can vary, but you should hear back within 30 days based on most policies.

-

Outcomes can range from acceptance of your claim to a repeated denial, requiring further action.

-

If denied, you have the right to appeal, presenting additional evidence to support your claim.

What resources can support my insurance claim?

Various resources are available to assist you during your claims process.

-

In addition to the refusal form, you may need other documents like proof of loss or receipts.

-

Reach out to state insurance regulators to understand your rights and receive guidance on disputes.

-

Seek out legal aid patches in Mississippi for assistance with bad faith insurance claims.

How to fill out the insurance refusal to pay

-

1.Begin by obtaining the 'insurance refusal to pay' form from the insurance company's online portal or customer service.

-

2.Open the PDF document using pdfFiller application to access the editing tools.

-

3.Enter your personal details at the top of the form, including your name, address, and policy number.

-

4.Clearly state the details of your claim, including the date of the claim, the type of coverage, and the amount requested.

-

5.Include the reason provided by the insurance company for the refusal, citing any relevant policy clauses or terms.

-

6.Attach any supporting documents that validate your claim or dispute the denial, such as correspondence or medical records.

-

7.Review your filled form to ensure all sections are complete, accurate, and clearly legible.

-

8.Once verified, save your changes and either print the document for mailing or submit it electronically if available.

-

9.Keep a copy of the completed form and any attachments for your records before submission.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.