Get the free Installment Promissory Note template

Show details

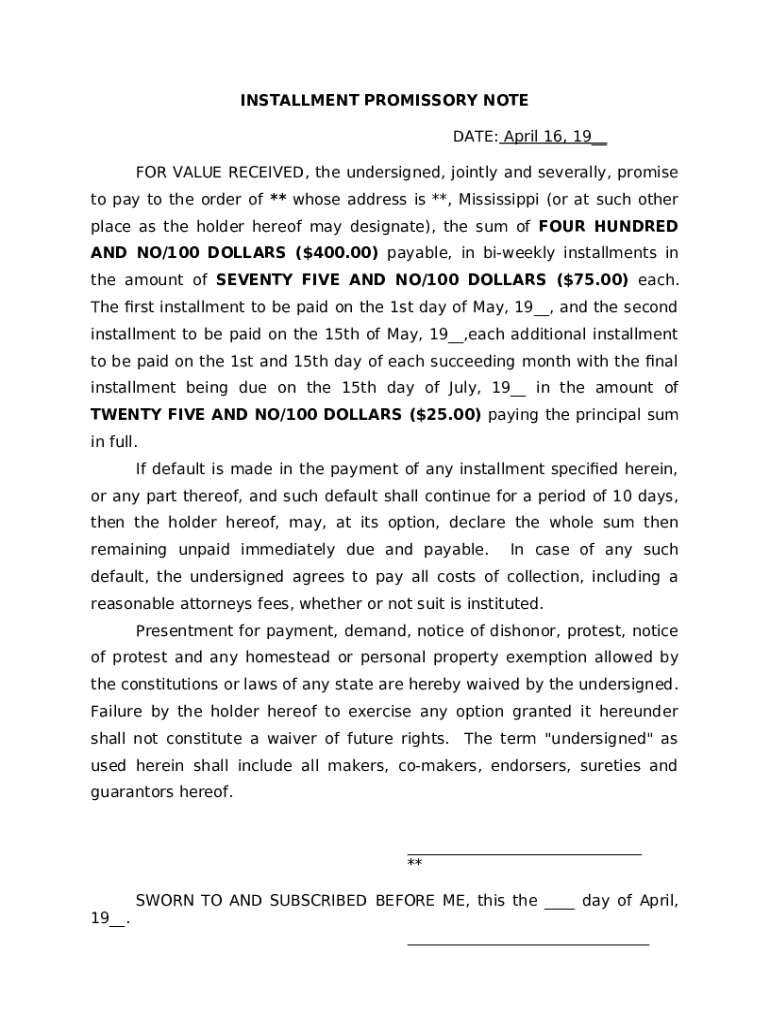

Installment Promissory Note: This is a Mississippi form that complies with all Mississippi codes and statutes. An Installment Promissory Note states that the repayment of the Promissory Note is

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is installment promissory note

An installment promissory note is a written promise to pay a specified amount of money in multiple payments over a designated period.

pdfFiller scores top ratings on review platforms

It's awesome!

Everything is easily updated and saved…

Everything is easily updated and saved with this program. It's easy to use and easily to learn. Thanks!

Reset my password

Reset my password. Easy to do.

Really a good one with many features

great way to fax and we had a document…

great way to fax and we had a document notarized

helpful

helpful, great

Who needs installment promissory note template?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on Installment Promissory Note Form

What is an installment promissory note?

An installment promissory note is a financial document where a borrower agrees to repay a loan in specified installments over time. This form outlines both the borrower and lender's obligations and serves to legally define the terms of the loan. Primarily, installment promissory notes are used by individuals and businesses to formalize lending arrangements.

-

It defines the specific loan conditions agreed upon by both parties.

-

Signing this note enforces legal obligations for repayment, providing remedies for the lender if the borrower defaults.

-

Often utilized in personal loans, business financing, or real estate transactions to ensure clarity and security.

What are the key components of an installment promissory note?

Understanding the essential components of an installment promissory note is crucial for both parties involved in the transaction. Rather than being just an informal agreement, each section of the document provides detailed parameters for repayment and legal recourse.

-

This includes the initial date of agreement, payment amounts, and the schedule for repayments.

-

Names and addresses of both the lender and borrower to avoid confusion.

-

Details what happens if repayments are missed, including potential penalties and legal rights.

-

Signatures are necessary for validation, often requiring notarization to prevent fraud.

How do you fill out the installment promissory note form?

Filling out an installment promissory note form may seem daunting, but it can be accomplished with a clear process. Follow these steps to ensure accuracy in your document.

-

Start by entering the date, then define the parties involved, followed by the payment terms.

-

Ensure all fields are detailed and legible to promote clarity; include specifics about each installment.

-

Avoid errors by double-checking figures, ensuring signatures are present, and reviewing the terms agreed upon verbally.

How can you edit and manage your installment promissory note?

Once the installment promissory note form is completed, it may require modifications over time. Using platforms like pdfFiller, you can efficiently manage and edit your documents.

-

pdfFiller offers a user-friendly interface for making changes to your document easily.

-

You can save your document in the cloud, making it accessible from any device with internet access.

-

Keep a history of edits made to your document for accountability and transparency.

What is the process for e-signing the installment promissory note?

Electronic signatures (or e-signatures) simplify the signing process by enabling you to sign documents online, providing convenience without compromising security.

-

E-signatures are legally recognized in many jurisdictions, making them a viable option for document signing.

-

Utilize pdfFiller’s e-sign feature to sign the document easily and securely.

-

Ensures document integrity through encryption and verification processes.

What compliance considerations should you keep in mind?

Complying with local laws when drafting an installment promissory note is crucial to avoid legal challenges. Whether you're in Mississippi or elsewhere, understanding the regulations is essential.

-

Refer to Mississippi state laws concerning promissory notes to ensure compliance.

-

Be aware of potential issues like failing to include necessary terms, which may invalidate the agreement.

-

Seek legal advice or consult online platforms for guidance tailored to your situation.

What are the benefits of using pdfFiller for your installment promissory note?

Utilizing pdfFiller offers significant advantages when dealing with installment promissory notes, particularly regarding document management and accessibility.

-

Easily access your documents from any location, fostering remote work and collaboration.

-

Work as a team in real-time, enhancing productivity in managing documents.

-

Store your documents securely to meet compliance standards and safeguard sensitive information.

How to fill out the installment promissory note template

-

1.Start by downloading the installment promissory note template from pdfFiller.

-

2.Open the document in pdfFiller and review the fields provided.

-

3.Begin filling in the date of the agreement at the top of the document.

-

4.Enter the name and contact information of the borrower and lender in the designated fields.

-

5.Specify the total loan amount in the relevant section.

-

6.Define the interest rate if applicable, noting whether it is fixed or variable.

-

7.Outline the repayment schedule, including the number of installments and the due date for each payment.

-

8.Include any additional terms related to late fees or penalties for missed payments.

-

9.Add a section for signatures, ensuring both borrower and lender sign the document.

-

10.Review all entries for accuracy, then save the completed document.

-

11.Print or send the note electronically as needed for record-keeping or transactions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.