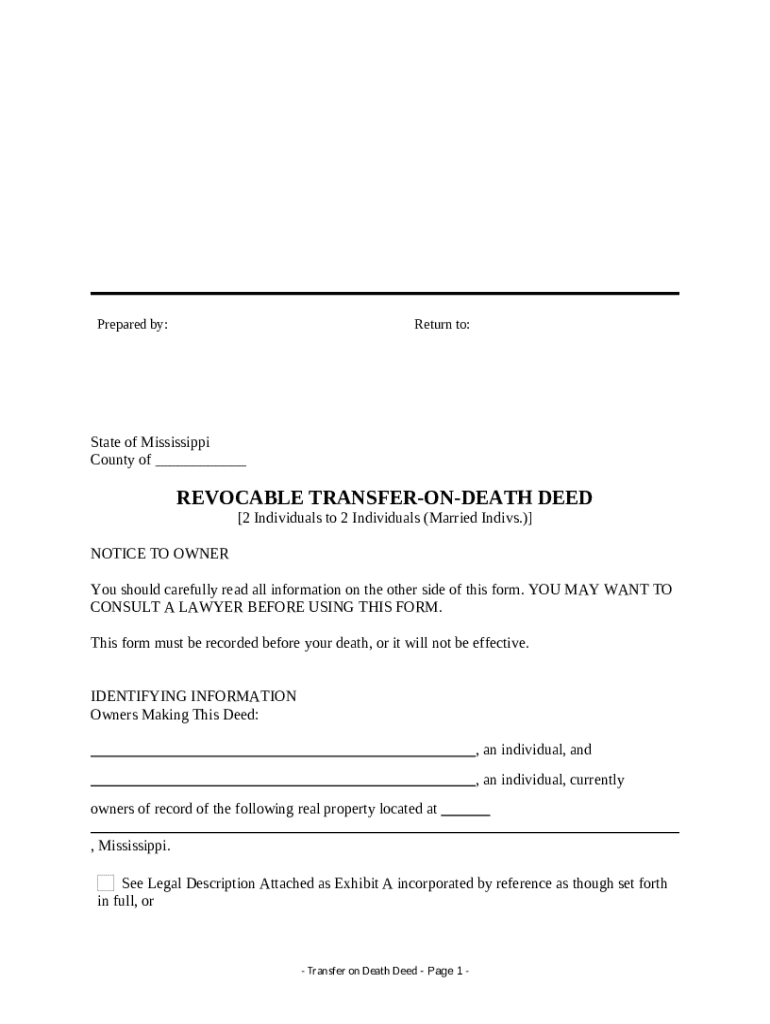

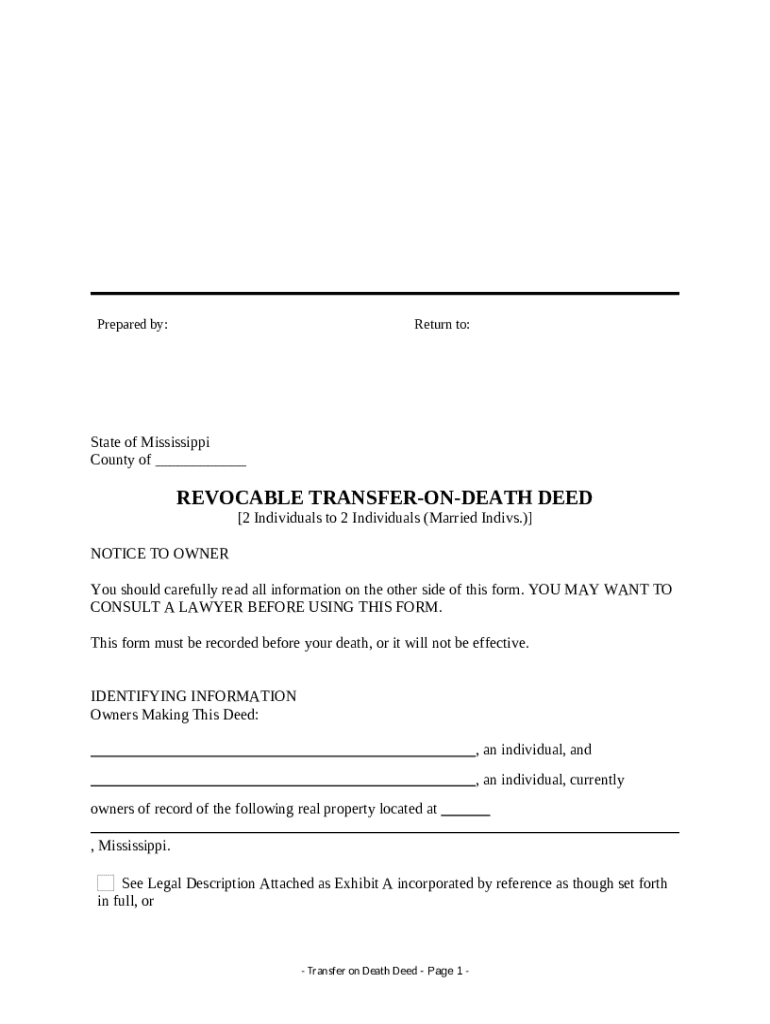

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Two Individuals to Married Bene...

Show details

This deed is used to transfer the ownership or title of a parcel of land, attaching any existing covenants, upon the death of the Grantor to the Grantee. It does not transfer any present ownership

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed is a legal document that allows an individual to transfer real estate property to beneficiaries upon their death without going through probate.

pdfFiller scores top ratings on review platforms

It's a great program. Some parts are difficult to navigate, like figuring out how to download your documents.

Gives option not to handwrite which is great.

BEING ABLE TO FILL A FORM ONLINE IS WONDERFUL. MY ONLY CONCERN IS FINDING THE CORRECT FORMS.

Really easy to use once you get the hang of it. I am using it frequently, especially on State government forms that I previously would have done by hand before. Thank you.

works fine, just hate that PDFfiller does not hold passwords for very long. use this account on two computers and always have to reset password from one to the other!

Just an amazing product and service. It has made managing and editing/updating PDFs a task i am no longer dreading to do. It has saved me SO MUCH TIME and headache working with PDFs.

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Transfer on Death Deed Forms

What is a transfer on death deed?

A transfer on death deed (TOD deed) is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death without going through probate. This type of deed is particularly beneficial in simplifying the transfer process, ensuring that loved ones receive property efficiently. Utilizing a TOD deed within your estate plan allows for a smoother transition of assets while providing control over the property until death.

What are the benefits of using a transfer on death deed?

Using a transfer on death deed offers several advantages including:

-

This deed allows direct transfers to beneficiaries, bypassing the often lengthy and costly probate process.

-

The property owner retains full control of their property during their lifetime, including the right to sell or change beneficiaries.

-

The TOD deed is a straightforward document that can be completed with minimal legal assistance.

-

It provides a means to keep property out of the estate during the owner's lifetime, protecting it from potential creditors.

What key considerations should you keep in mind?

Before executing a transfer on death deed, consider:

-

Different states have varying rules regarding transfer on death deeds; ensure compliance with local laws.

-

Discussing your intentions with beneficiaries can prevent disputes and confusion later.

-

Understand how existing obligations may impact the property and its transfer.

Who can execute a transfer on death deed in Mississippi?

In Mississippi, any property owner aged 18 or older can create a transfer on death deed. There is no need for consent from beneficiaries, but clear communication about the deed's impact is recommended to avoid future issues.

What types of properties are eligible?

Generally, real property such as residential homes, commercial properties, and vacant land can be transferred via a TOD deed. However, certain properties may not qualify, including those held under joint tenancy or with existing mortgages. Consulting a legal expert can clarify these eligibility concerns.

How do you complete a transfer on death deed form?

Filling out a transfer on death deed form requires:

-

Collect necessary details such as your name, the name of the property owners, and the legal description of the property.

-

Clearly define the property being transferred, including its address and legal identification.

-

List primary and alternate beneficiaries. Ensure their names are spelled correctly to avoid any discrepancies.

-

Double-check for accuracy and completeness before finalizing.

-

Submit the completed form to the local county recorder's office to ensure its legal effect.

What important legal notices should be considered?

Consulting with a lawyer regarding your transfer on death deed is crucial. This legal disclaimer ensures you understand any implications before executing the deed, including revocation rights and the need to record the deed. Furthermore, neglecting to record the deed can result in it being rendered invalid, leading to potential disputes among heirs.

What common mistakes should you avoid?

Common mistakes when completing a transfer on death deed include:

-

Ensure all beneficiary details are correct to prevent legal complications.

-

The deed must be signed in the presence of a Notary Public to be valid.

-

Recording the deed as soon as possible is essential to enforce its provisions.

How can pdfFiller assist with your transfer on death deed?

pdfFiller offers an interactive template for the transfer on death deed, allowing users easy access and editing capabilities. With features for customizing, eSigning, and sharing, users can manage their documents effectively from anywhere. pdfFiller empowers users to create seamless, electronic document workflows, ensuring your TOD deed is handled efficiently.

What are the next steps after completing the deed?

Once completed, it's essential to review the deed for any errors. After verifying accuracy, promptly submit it to your local recording office. Retain copies for personal records to ensure you have proof of the transfer and the validity of the deed.

How to fill out the transfer on death deed

-

1.Download the transfer on death deed form from pdfFiller or access it directly on the platform.

-

2.Open the document in pdfFiller and begin by entering your name as the grantor.

-

3.Fill in the details of the property being transferred, including the legal description and address.

-

4.List the names of your chosen beneficiaries who will receive the property upon your death.

-

5.Provide space for the beneficiaries' addresses to ensure proper identification.

-

6.Review all filled information for accuracy one final time before proceeding to sign.

-

7.Sign the document in the designated area, ensuring your signature is clear and visible.

-

8.Include the date of signing to validate the document.

-

9.Complete any additional sections required by your state law, such as notarization if necessary.

-

10.Save the document and consider printing multiple copies for your records and to share with your beneficiaries.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.