Get the free Submission of Equity Line Mortgage Loan Payoff and Authorization to Cancel Deed of T...

Show details

This letter is from a law firm who is holding funds in a trust account for the purpose of paying off a mortgage equity line of of credit and requesting authorization from the lender to cancel the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is submission of equity line

A submission of equity line is a financial document used to apply for or manage an equity line of credit.

pdfFiller scores top ratings on review platforms

great program and easy to work with

this just works

I am extremely pleased with the…

I am extremely pleased with the services and I recommend pdffiller to everyone who needs to make /remake documents in PDF.

its seamless and great

user friendly and simple

GOOD APPLICATION

Who needs submission of equity line?

Explore how professionals across industries use pdfFiller.

How to effectively submit an equity line form

How do you define an equity line form?

An equity line form is a document required by lenders when seeking to establish a home equity line of credit (HELOC). This form captures essential information about your financial situation and property value, allowing the lender to evaluate your creditworthiness. The submission of this form is critical for initiating the loan processing.

-

It provides lenders with the necessary data to assess your application for a home equity line of credit.

-

Accurate submission is crucial for ensuring faster loan processing and approval.

-

You might submit this form for home improvements, debt consolidation, or unexpected expenses.

What steps are involved in the submission process?

Submitting an equity line form involves several critical steps to ensure that all pertinent information is submitted correctly and comprehensively. Accurate completion means providing necessary documents alongside the form to expedite processing. Let's delve deeper into the necessary elements.

-

Include proof of income, tax returns, and a recent mortgage statement.

-

Understanding each section of the form helps in accurate filling, including identifying information and financial details.

-

Follow a systematic approach to ensure that every section is addressed, minimizing errors.

How does the mortgage loan payoff impact your equity line?

Understanding the mortgage loan payoff is essential when applying for an equity line. The payoff amount must be accurately stated as it can significantly affect your equity position and borrowing limits. An accurate assessment ensures clarity in what equity you can access.

-

Refers to the total amount you owe on your mortgage, which affects your equity.

-

Higher remaining mortgage balances can limit the amount of credit available through an equity line.

-

After submitting, you must monitor your account and comply with ongoing obligations related to your equity line.

What are the legal considerations and compliance requirements?

In North Carolina, specific general statutes govern equity lines, highlighting the importance of compliance when submitting your equity line form. Awareness of these legal requirements can protect you from potential penalties and ensure a smooth application process.

-

North Carolina General Statutes provide regulatory guidance for borrowers and lenders alike.

-

Documents may need to be recorded at the County Register of Deeds, depending on local laws.

-

Failing to adhere to regulations can result in fines or delays in processing.

How should you manage correspondence during submission?

Effective communication with lenders during the equity line form submission is crucial for a seamless process. Adopting the best practices ensures your queries and updates are addressed promptly, reducing the likelihood of application delays.

-

Maintain professionalism and clarity in all correspondence with lenders.

-

Timely follow-ups can prevent stagnation and keep the loan processing on track.

-

Be prepared to discuss additional funds required or any escrow refunds associated with your equity line.

How does pdfFiller improve your submission efficiency?

pdfFiller offers a cloud-based platform that significantly streamlines the equity line form submission process. With robust features for document management and e-signing, users can collaborate more effectively, ensuring that submissions are complete and accurate.

-

Users can easily edit their equity line forms to ensure all details are correct.

-

Signing documents electronically saves time and eliminates the necessity for physical paperwork.

-

Teams can work together in real-time, enhancing the efficiency of the submission process.

What are common submission issues and how can you troubleshoot them?

Facing issues with equity line form submissions is not uncommon, but knowing how to troubleshoot them can save you time and stress. Identifying and addressing these common problems ensures your application progresses smoothly.

-

Understand potential reasons for rejection, such as missing signatures or incomplete information.

-

Check for missing or incorrect data promptly to prevent delays.

-

Utilize pdfFiller's customer service for help with troubleshooting and resolution.

How to finalize your equity line submission?

Confirming the receipt of your equity line form is a critical final step in the submission process. It ensures that your application is in the pipeline for processing and gives you insight into the timeline ahead.

-

Always request confirmation from your lender to verify that your form has been received.

-

Gain an understanding of how long processing typically takes from submission to approval.

-

Stay prompt for any follow-up actions or additional documentation your lender may require.

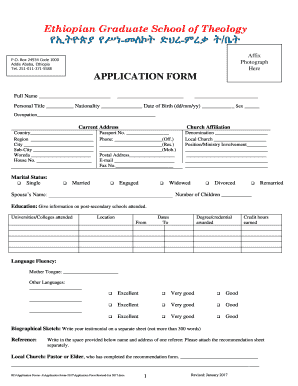

How to fill out the submission of equity line

-

1.Open the PDF document for the submission of equity line using pdfFiller.

-

2.Begin by entering your personal information, including name, address, and contact details in the designated fields.

-

3.Fill in property details accurately, such as the address and type of property being used as collateral.

-

4.Provide specific information regarding your equity line request, including the desired amount and purpose.

-

5.Attach any required documentation, such as proof of income and property valuation, using the upload feature.

-

6.Review all provided information for accuracy and completeness to avoid processing delays.

-

7.Utilize the e-signature feature to sign the document electronically, if required.

-

8.Finally, submit the completed form through pdfFiller's submission process or download it for mailing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.