Get the free Subordination Agreement

Show details

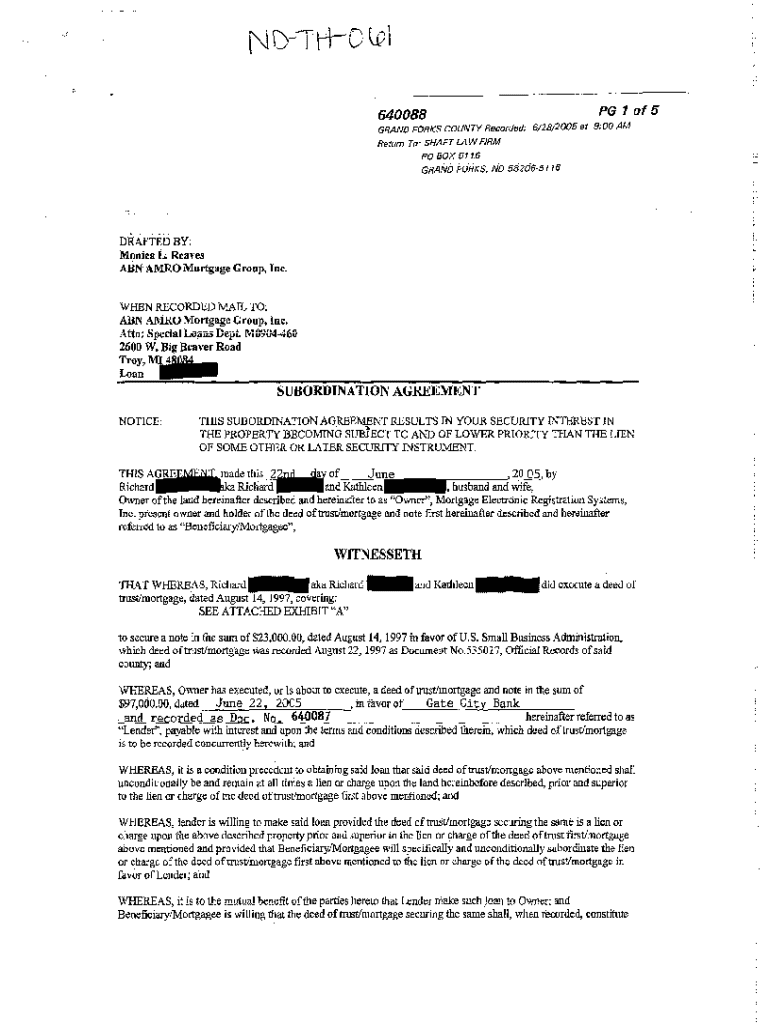

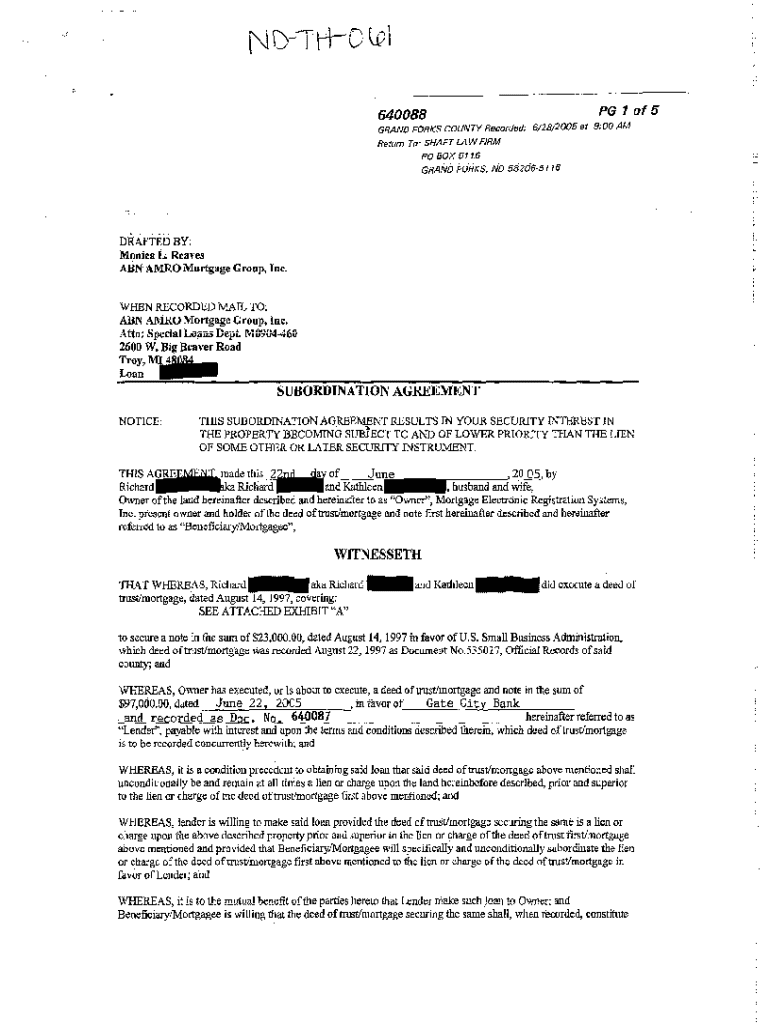

Subordination Agreement

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordination agreement

A subordination agreement is a legal document that establishes the priority of one debt over another in case of default or bankruptcy.

pdfFiller scores top ratings on review platforms

I love being able to complete PDF forms so clean and professional.

my overall experience was great I needed them to change my payment method and they did so promptly

I was glad to be able to copy and paste all the fields and save all pages at the same time.

I'VE BEEN USING IF FOR A FEW DAYS FOR REAL ESTATE CONTRACTS AND LOVE IT. VERY STRAIGHTFORWARD AND USER-FRIENDLY.

I know that most IRS forms are free and can be saved to my files, however sometimes trying to download the forms is difficult to do. PD Filler is much more user friendly and easy to follow.

Using the paid version and it works well. Love having the extra options over the free version. Worth the year subscription.

Who needs subordination agreement?

Explore how professionals across industries use pdfFiller.

How to fill out a subordination agreement form: A step-by-step guide

Understanding subordination agreements

A subordination agreement is a legal document that establishes the order of payment priority for debts in the event of liquidation. This agreement is crucial in financial transactions, serving to clarify which lenders will be repaid first if a borrower defaults. Understanding subordination is essential for all parties involved, particularly lenders and borrowers, as it influences risk assessment and loan terms.

-

Defines the purpose of subordination agreements, which is to outline the order of priority in debt repayment.

-

Covers important concepts such as subordinated debt, which refers to loans that rank below others in case of default, affecting both recovery and investment decisions.

-

Highlights the role of subordination agreements in minimizing risk and clarifying relationships between creditor obligations.

What are the key components of a subordination agreement?

A well-structured subordination agreement contains several critical components necessary for clarity and legal enforceability. Including these elements helps to avoid disputes and ensures all parties are aware of their rights and responsibilities in the financing process.

-

Clearly includes the names and roles of all parties involved to avoid confusion during execution.

-

Specifies the terms, conditions, and amounts of the subordinate debts being agreed upon.

-

Lists promises made by the borrower about their financial conditions, which may affect ability to repay.

-

Describes the specific situations which must be met for the subordination to be recognized and enforced.

Where can find standard FINRA subordination agreement templates?

Standard FINRA subordination agreement templates provide a reliable starting point for creating your own documents. These templates are designed to comply with industry regulations and ensure legal validity.

-

Describes available templates often utilized in the industry, which can save time and ensure compliance.

-

Offers guidance on how to select the right template based on your specific needs and situation.

-

Explains how pdfFiller can be used to easily fill out and modify templates to match unique requirements.

How do fill out the subordination agreement form?

Filling out a subordination agreement form can be a straightforward process if you follow a step-by-step approach. Utilizing platforms like pdfFiller can simplify the task by providing intuitive editing tools.

-

Details the stages involved in filling out the agreement, from gathering necessary information to finalizing the document.

-

Highlights frequent errors that can lead to legal complications or delays in processing.

-

Explains the tools available for customizing the agreement, making the process user-friendly.

What are the guidelines for editing and signing the subordination agreement?

Editing and signing a subordination agreement must comply with legal standards to avoid disputes later on. PdfFiller streamlines this process by providing eSignature options that hold up in court.

-

Describes how users can modify their agreement if changes are needed after the initial completion.

-

Explains the legality and importance of electronic signatures in modern document transactions.

-

Offers tips to ensure that the signing process meets all regulatory requirements.

How do submit requests for subordinated loans?

Submitting requests for subordinated loans requires careful attention to detail and adherence to specific procedures. By understanding the steps involved, you can facilitate a smooth submission process.

-

Outlines the necessary steps from preparing the submission to actual submission of documents.

-

Details the essential documentation needed to support your request.

-

Provides tips on how to follow up on your submission to ensure its progress.

How to fill out the subordination agreement

-

1.Obtain a blank subordination agreement form, preferably in PDF format.

-

2.Begin filling out the document by entering the names and addresses of all parties involved, including lenders and borrowers.

-

3.Clearly specify the details of the original loan agreement, including the loan amount, interest rate, and any relevant dates.

-

4.Indicate the loan or obligation that will be subordinated by providing its details, including lender names and loan recognition.

-

5.Include any specific terms or conditions relevant to the agreement, such as repayment terms or consequences for default.

-

6.Review the agreement to ensure all sections are properly completed and that information is accurate.

-

7.Have all parties sign the document in the designated signature areas, ensuring that each party receives a copy of the signed agreement.

-

8.Finally, consider having the agreement notarized or recorded, depending on local legal requirements, to ensure its enforceability.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.