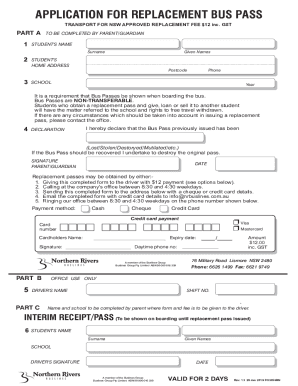

Get the free Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife / Two Individu...

Show details

Transfer on Death Deed - Nebraska - This deed is used to transfer the title of a parcel of land, including any existing liens or covenants, upon the death of the Transferor / Grantor, or last surviving

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is transfer on death deed

A transfer on death deed allows an individual to designate a beneficiary who will receive property upon the owner's death, bypassing probate.

pdfFiller scores top ratings on review platforms

very helpful

Good

It is highly recommended, it is worth every penny invested

Great

Easy to use

Easy to use. Alittle confusing first time user.

Always easy to use!

Always easy to use!

Who needs transfer on death deed?

Explore how professionals across industries use pdfFiller.

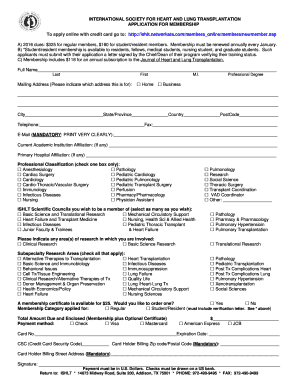

Comprehensive Guide to Transfer on Death Deed Form

A Transfer on Death (TOD) deed form is an important legal document that allows individuals to transfer real property to beneficiaries without undergoing the lengthy and often costly probate process after death. This guide provides a complete overview of the transfer on death deed form, including its purposes, eligibility requirements, and the step-by-step process for completing the form in Nebraska.

What is a Transfer on Death Deed?

A Transfer on Death Deed is a legal instrument that enables the property owner (transferor) to designate one or more beneficiaries to receive real estate upon their death. This deed becomes effective only after the transferor's death, ensuring that the property is passed directly to the beneficiaries, avoiding the probate process.

-

Transfer on Death Deeds are designed to simplify the transfer of property and ensure that loved ones receive assets directly. This can reduce stress and confusion during a time of grieving.

-

The main benefits include avoiding probate, maintaining control over the property during the owner's lifetime, and the simplicity of designating beneficiaries.

-

Terms like 'transferor' (the property owner), 'beneficiary' (the person receiving the property), and 'revocation' (the process of canceling the deed) are crucial in understanding how these deeds function.

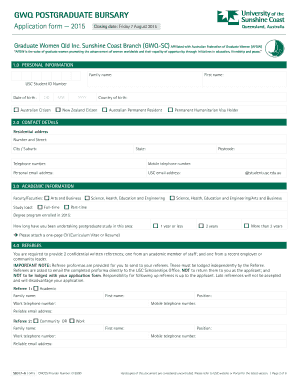

Who is eligible to use a Transfer on Death Deed?

Eligibility for a transfer on death deed in Nebraska is generally straightforward. Any individual who owns real property and is at least 18 years old can execute a TOD deed.

-

Individuals, including sole property owners and co-owners, can utilize a TOD deed as long as they meet the age and ownership requirements.

-

The deed can be used for various property types, such as residential homes, commercial properties, and raw land, provided they are located in Nebraska.

-

To be valid, the form must be properly filled out, signed, and notarized, and it must explicitly state the beneficiaries.

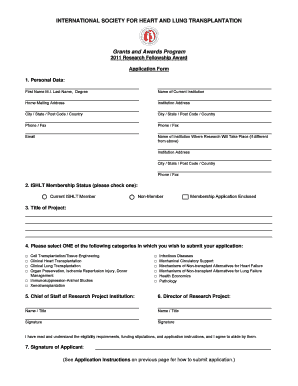

How do complete the Transfer on Death Deed Form?

Completing a transfer on death deed form is a systematic process that ensures all required information is accurately captured. This includes identifying the property, the transferor, and the beneficiaries.

-

Begin by downloading the form from a reliable source. Fill in your name, the names of the beneficiaries, and a complete description of the property, ensuring accuracy to avoid legal issues.

-

Essential fields include the transferor’s information, beneficiary details, and property description. Each section must be filled out carefully.

-

Utilizing pdfFiller’s editing tools can simplify the process. Common mistakes often include missing signatures or incorrect beneficiary names, which could lead to complications.

What steps should follow after completing the form?

Once you complete the transfer on death deed form, it is essential to take further steps to ensure its effectiveness and legality.

-

To make the TOD deed official, you must record it with the local county clerk or recorder's office. This ensures that the deed is part of the public record.

-

You should record the deed within 30 days of execution to ensure its validity. Delaying beyond this period can cause complications.

-

Any filed deed must be recorded with the county where the property is located. Check with your local recorder's office for specific requirements.

What legal considerations should be aware of?

Understanding legal considerations surrounding transfer on death deeds is crucial to avoid potential pitfalls. For example, revocation occurs automatically if the property is sold during the transferor's lifetime.

-

Revocation can occur if the transferor decides to invalidate the TOD deed, often necessitating new documentation and the proper filing process.

-

Common issues include improperly completed forms or failure to record the deed, leading to disputes among beneficiaries.

-

It's advisable to consult an attorney specializing in property law to navigate any complexities and ensure compliance with local laws.

What interactive tools are available on pdfFiller?

pdfFiller offers a range of tools designed to streamline document management, including functionalities that simplify the editing and e-signing processes.

-

Users can easily create, edit, and sign documents from any device, making it convenient to manage the transfer on death deed form.

-

pdfFiller allows team members to collaborate on documents in real-time, enhancing workflow efficiency and accuracy.

-

The platform supports electronic signatures, ensuring that the signed documents are legally binding and verifiable.

How to fill out the transfer on death deed

-

1.Open the transfer on death deed template on pdfFiller.

-

2.Enter the full names and addresses of the property owner(s).

-

3.Provide the legal description of the property, ensuring accuracy.

-

4.List the beneficiary's full name and address, checking for spelling errors.

-

5.Include any necessary additional information regarding co-owners if applicable.

-

6.Review the document for completeness, ensuring all required fields are filled.

-

7.Sign the deed in the presence of a notary public to validate it legally.

-

8.File the completed deed with the local land records office to make it effective.

-

9.Keep a copy of the deed for personal records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.