Get the free Nebraska Effective Financing Statement Addendum

Show details

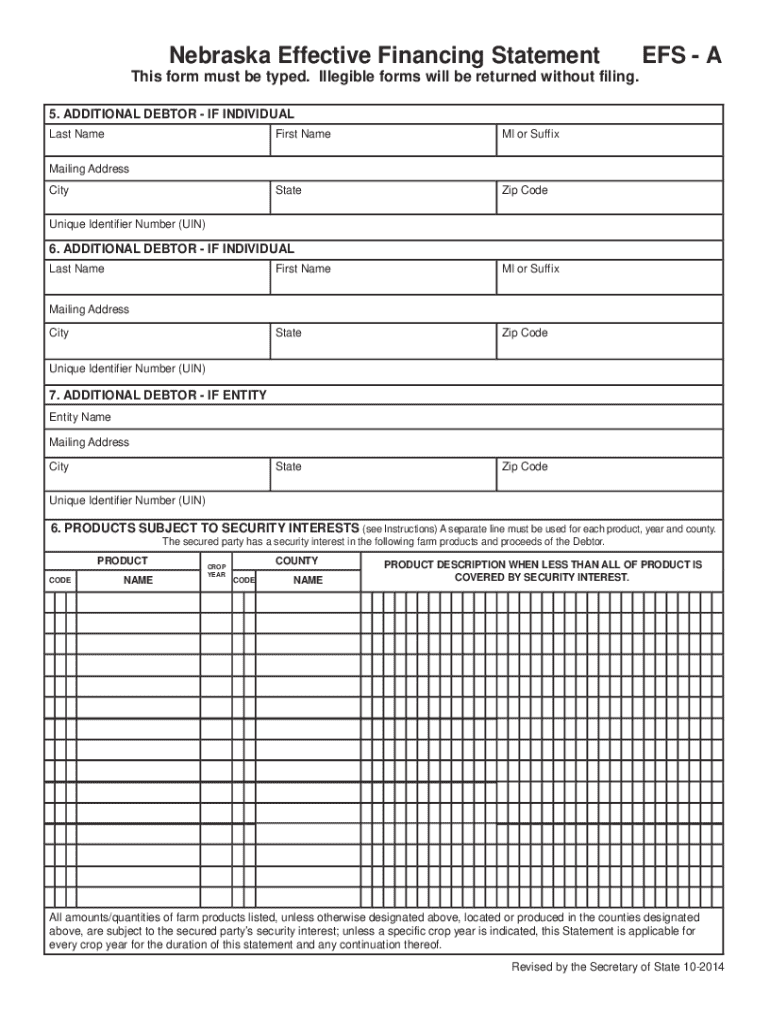

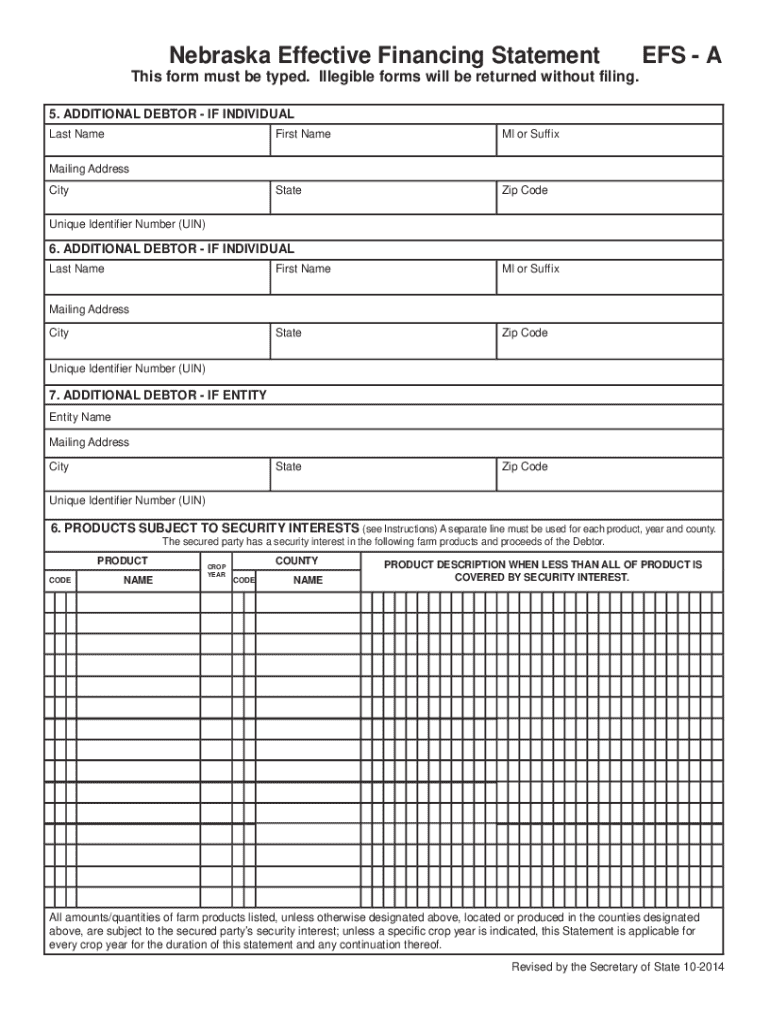

Nebraska Effective Financing Statement Addendum

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is nebraska effective financing statement

A Nebraska effective financing statement is a legal form that secures a lender's interest in a borrower's collateral, ensuring their rights are protected under the Uniform Commercial Code (UCC).

pdfFiller scores top ratings on review platforms

It has been useful to converting documents to other applications such as Word, it has also served its purpose to fill in documents with text.

Helped me to purchase home and maintain my rental agreement.

Not now but sometime in the future. I find it easy to use and it is going to make my work life much more organized and easier.

Always able to find a document needed. Customer service very helpful. I recommend this service to all my family & friends. Very easy to use.

I like it and it is much easier to use that Adobe Acrobat

Very easy to use, to the point, even for a 72 year old!! -keep up the good work!

Who needs nebraska effective financing statement?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Nebraska Effective Financing Statement Form

What is an effective financing statement (EFS)?

An Effective Financing Statement (EFS) is a legal document that provides notice of a secured party's interest in a debtor's collateral, which may include personal property and farm products. It serves as a public declaration of the security interest to inform other potential creditors. This statement is pivotal in secured transactions, ensuring that creditors have a mechanism to protect their financial interests.

What are the key components of the Nebraska EFS form?

-

The EFS form requires both individual and entity debtor details. It is crucial to provide correct information including mandatory fields like the name, address, and unique identification number (UIN).

-

The EFS must clearly outline the products being secured. Accurate coding and descriptions are essential to avoid future disputes regarding ownership or rights.

-

This section specifies the geographical and temporal scope of the security interest, indicating where the collateral is located and the relevant crop year, which can affect leasing agreements and claims.

How to fill out the Nebraska EFS form correctly?

-

Before starting, gather all necessary information regarding the debtor and the collateral. Ensuring all details are accurate is vital.

-

To avoid any ambiguity, utilize typed forms rather than handwritten ones. This reduces the risk of errors due to illegibility.

-

Fill in the debtor's details accurately and specify the exact nature of the security interest to prevent rejections during the filing process.

-

Be cautious of common pitfalls, such as ignoring mandatory fields or incorrect product coding, as these can lead to significant issues.

What is the filing process for the Nebraska EFS form?

-

Determine the appropriate filing office in Nebraska, typically the Secretary of State's office.

-

You can file the EFS online or submit it physically. Each method has different processing times and requirements.

-

Filing fees vary; check the latest fee schedule for accurate payment methods, which can include electronic payment options.

-

Processing times may vary based on the method of submission. Confirmations are usually sent within a few business days.

How to manage your effective financing statement?

-

Understand the procedures for amending or terminating an EFS to keep your records accurate and up-to-date.

-

Utilize state resources to track the status of your EFS filing, ensuring compliance and awareness of any updates.

-

Regularly review your filings to maintain compliance with state requirements and address any discrepancies promptly.

What challenges are associated with Nebraska EFS forms?

-

Common reasons for rejection include incomplete information or incorrect security coding. Winning disputes may rely on timely rectification.

-

Ensure that debtor's information is accurate; incorrect details can lead to legal complications and financial losses.

-

Misfiled statements can cause a loss of priority over collateral and result in significant legal issues, illustrating the importance of accuracy.

Where to find resources for completing your Nebraska EFS?

-

Access official Nebraska EFS templates and compliance guidelines on the Nebraska Secretary of State's website for authoritative instruction.

-

Consider using document management tools like pdfFiller, which allows for easy editing, signing, and managing of your PDFs.

-

When in doubt, consult a legal professional to ensure that your EFS form is completed correctly and complies with local laws.

How to fill out the nebraska effective financing statement

-

1.Access the pdfFiller website and log in or create an account if you do not have one.

-

2.Search for 'Nebraska Effective Financing Statement' in the templates section.

-

3.Select the appropriate form to begin filling it out.

-

4.Enter the debtor's name and address in the designated fields, ensuring accuracy to avoid complications.

-

5.Provide the secured party's name and address as it appears in official records.

-

6.Describe the collateral being secured, ensuring it is specific and comprehensive.

-

7.Review all sections for completeness and accuracy, adjusting any parts that may require clarification or additional details.

-

8.Save the completed form to your pdfFiller account, or choose to print it for physical submission.

-

9.Follow the state’s filing instructions to submit the statement; this may involve electronic submission or mailing it to the appropriate state office.

-

10.Keep a copy of the filed statement for your records, and ensure that confirmation is received from the filing office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.