Get the free Promissory Note - Horse Equine s template

Show details

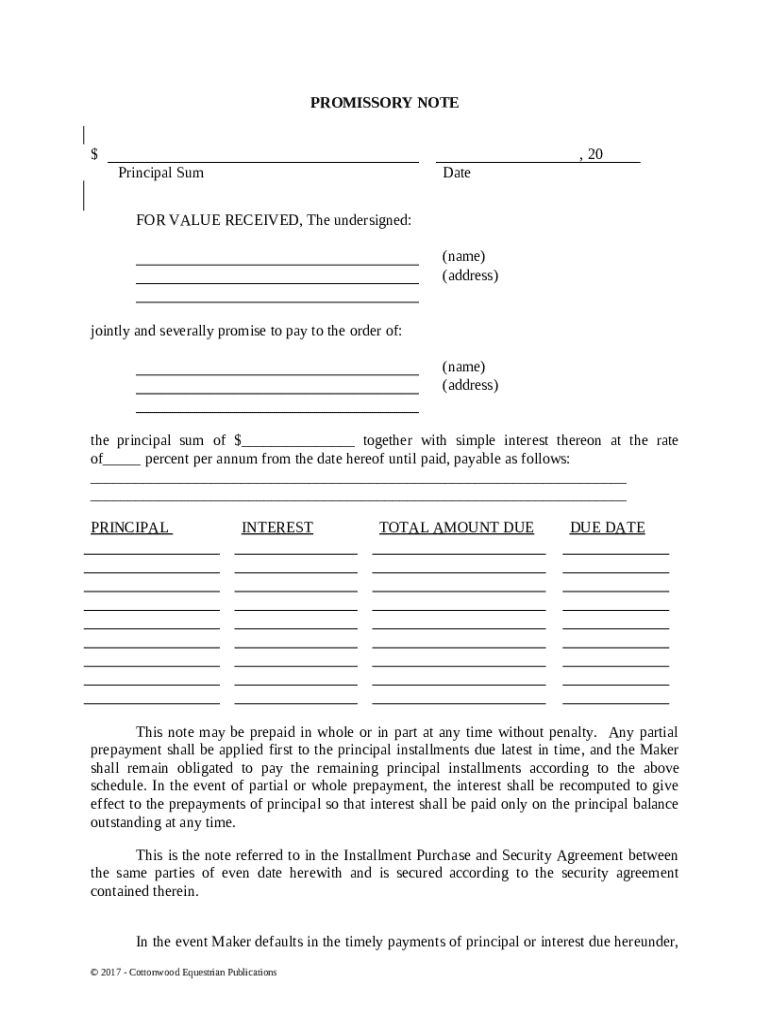

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a written promise to pay a specified amount of money for the purchase or lease of a horse.

pdfFiller scores top ratings on review platforms

Pdffiller is a life saver but not everyone will accept the electronic signature.

The directons on which button to use for what a bit confusing

User friendly and reasonable price. Must haves for the business owner!

It is a great service. It takes some time to get through the detailed forms.

need a button to add paper work from computer to pdffille

LITTLE bit of a learning curve (my first time using a service like this) ... but LOVING all of the functionality and capabilities.

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

Guidelines for filling out a promissory note - horse form

What is a promissory note and why is it important for horse transactions?

A promissory note is a written promise to pay a specified amount to a designated party, and its legal significance cannot be understated, especially within financial transactions involving valuable assets like horses. For horse transactions, utilizing a promissory note provides both buyers and sellers with a structured repayment plan and legal recourse in case of defaults. Specific fields within a horse form tailor the general principles of this note to the nuances of the equestrian industry, ensuring better clarity and accountability.

What are the key components of a promissory note?

-

This refers to the total amount borrowed, which must be clearly stated and agreed upon to prevent any disputes down the line.

-

Accurate recording of the date when the note is executed is crucial. This establishes the timeline for repayments and any relevant penalties.

-

Ensure to fill in the full name and address of the borrower, providing necessary identification for repayment tracking.

-

Likewise, the lender's name and address must be clearly stated to maintain transparency and responsibility.

How can you specify interest rates in a promissory note?

Interest rates in promissory notes can significantly impact the total amount payable. They can be expressed in terms of simple interest, calculated based on the principal over time. When setting an interest rate for horse-related loans, market trends, and the specifics of horse trading should be considered to ensure rates are competitive and fair.

How should a payment schedule be outlined?

-

Clearly outline the repayment terms, ensuring they are understandable to both parties. This helps prevent confusion.

-

Make sure to mention the total amount due at the time of payment, including any accrued interest.

-

Choosing reasonable payment due dates is essential, particularly in the context of horse transactions, where economic conditions can vary.

What prepayment options are there?

Including prepayment options in your promissory note can offer flexibility to borrowers. Specifying terms can be beneficial if the borrower chooses to pay off the loan early, but you must also outline any penalties that may apply to such actions, as well as how any partial payments will affect the principal and interest.

What are the consequences of defaulting on payments?

-

Clearly outline the definition of a default in your promissory note. This can include late payments or missed payments.

-

Discuss the possible legal actions that may arise, including the acceleration of total due amounts in the event of default.

-

The promissory note should specify what interest rates apply to late payments, along with any legal maximums.

How can legal compliance and best practices be maintained?

Legal requirements governing promissory notes differ by region, so ensure your note complies with applicable laws. It is advisable to consult a legal expert familiar with equestrian transactions to avoid pitfalls. Adopting best practices for executing the document will foster enforceability and protect the interests of both parties.

How can pdfFiller assist in managing promissory notes?

-

pdfFiller allows you to easily edit and customize your promissory note, ensuring all fields meet your specific needs.

-

The platform facilitates direct eSigning, making the agreement process quicker and more efficient.

-

Manage multiple agreements with pdfFiller's collaborative tools, streamlining document management for individuals and teams.

How to fill out the promissory note - horse

-

1.Begin by downloading the promissory note template from pdfFiller.

-

2.Open the document in pdfFiller to access the editing tools.

-

3.Fill in the date at the top of the document where indicated.

-

4.Enter the name and address of the borrower in the appropriate fields.

-

5.Provide the lender's name and address similarly.

-

6.Specify the amount being borrowed in the designated area.

-

7.Clearly define the interest rate, if applicable, using a percentage.

-

8.Include repayment terms, indicating how and when payments will be made.

-

9.Add any collateral information, specifically detailing the horse involved.

-

10.Sign the document electronically or print it to sign manually.

-

11.Ensure all parties involved receive a copy of the signed promissory note.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.