Get the free Certificate of Redemptions template

Show details

A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes, penalties, fees and interest owed on the

property.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is certificate of redemptions

A certificate of redemptions is a formal document that confirms the redemption of certain financial instruments, typically related to bonds or securities.

pdfFiller scores top ratings on review platforms

Easy to use - Great import form ability - so easy

Great product, used heavily for my job!

Easy & intuitive!

easy breezy

It's been great so far.

Need to train my assistant

Who needs certificate of redemptions template?

Explore how professionals across industries use pdfFiller.

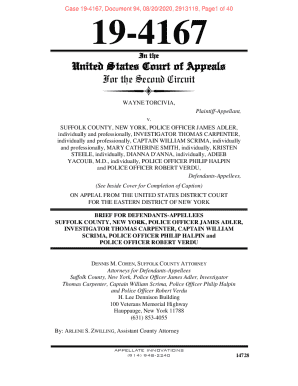

Complete Guide to the Certificate of Redemptions Form

How can understanding the certificate of redemption benefit you?

A Certificate of Redemption is a crucial document in property tax management that signifies the payment of back taxes on a property. It serves as proof that a property owner has cleared their tax obligations, thus allowing them to reclaim their property from tax lien sales. Understanding how to navigate this process can help individuals avoid legal complications and financial penalties.

-

It is a document proving that an owner has redeemed their property from tax liens.

-

It assures that assets are protected from tax sales and future liabilities.

-

Typically, a Certificate of Redemption can be requested after all outstanding taxes and fees have been settled.

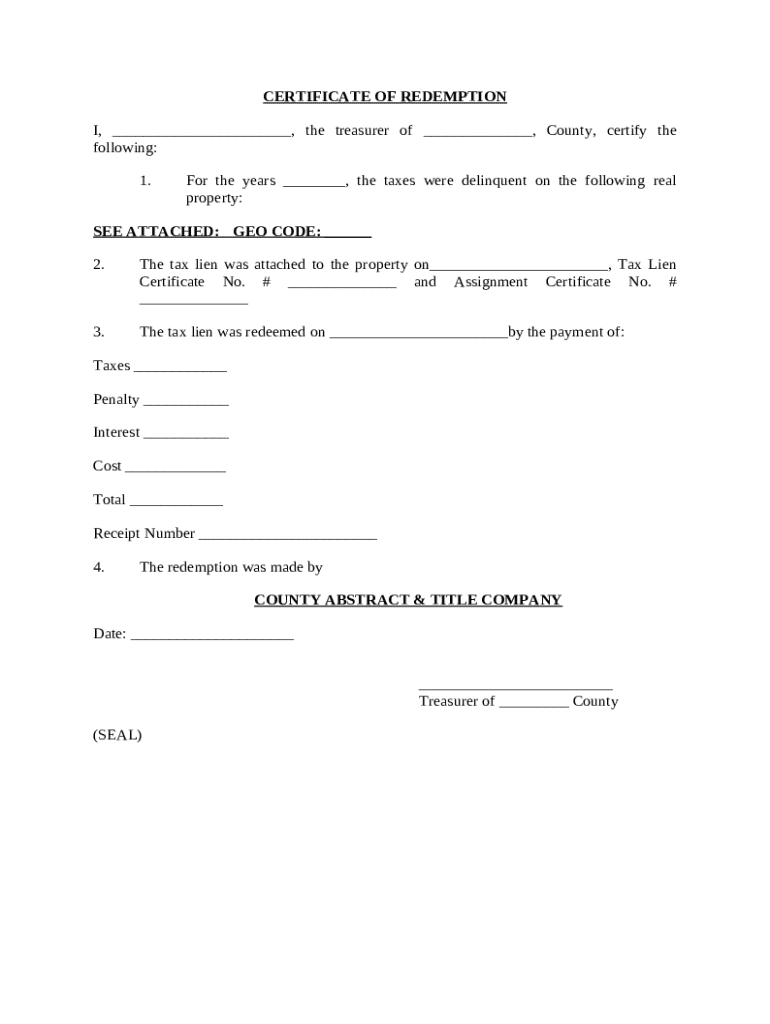

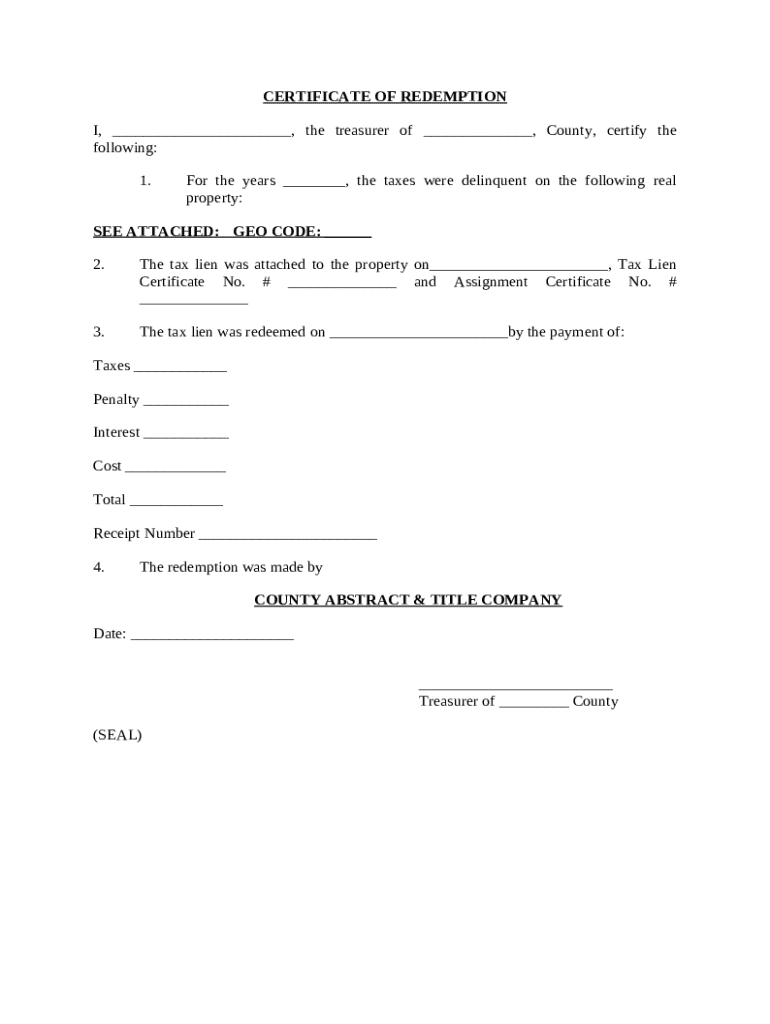

What are the key components of the certificate of redemption?

To properly understand a Certificate of Redemption, it's essential to recognize its key components. These elements provide detailed insights into the financial history of the property and clarify what is needed for accurate completion.

-

A certification attesting to the payment of dues by the property owner, usually signed by the county treasurer.

-

Includes information about the specific tax years for which payments were overdue.

-

Includes certificate numbers related to the lien and important dates for redemption.

-

Breakdowns of what needs to be paid including taxes, penalties, interest, and costs.

What steps are needed to complete the form?

Completing the Certificate of Redemption form correctly is essential to avoid processing delays. The following steps can guide you through obtaining and filling out the form accurately.

-

Forms can typically be found online at your respective regional tax collector's website or in their office.

-

Key sections include taxpayer details, property information, and redemption information.

-

Double-check for accuracy, particularly with figures and property descriptions, to avoid common mistakes.

Where should you submit your certificate of redemption request?

Submitting your Certificate of Redemption correctly will ensure that your request is processed efficiently. Knowledge of local submission procedures is key.

-

Typically, submissions should be made to the local tax collector's office or an online submission portal.

-

Processing times may vary based on location but usually take between 4-6 weeks.

-

After submission, keep track of your request status and confirm with the office if no updates are received within the expected timeframe.

How can you manage your redemption documents effectively?

Effective management of your Certificate of Redemption documents is vital for maintaining accurate records and ensuring compliance. Utilizing modern tools can simplify this process.

-

This allows for easy access and retrieval wherever needed.

-

Collaborative tools facilitate document reviews and revisions among team members efficiently.

-

Secure eSigning ensures that your documents are legally valid and readily available.

What legal and compliance considerations should you be aware of?

Compliance with regional regulations is essential when dealing with Certificates of Redemption. Non-compliance can lead to significant consequences.

-

Understanding the local laws affecting the redemption process is crucial.

-

Failing to comply can result in denied requests or penalties from tax authorities.

-

Ensure all documents are kept up to date and organized to meet compliance standards.

What can you do if your certificate of redemption is denied?

If your Certificate of Redemption is denied, understanding the reasons behind it is crucial to rectify the issue quickly.

-

Issues may include incomplete documentation or outstanding tax obligations.

-

Follow the local guidance for filing an appeal or correcting any issues.

-

Learn from past mistakes to better prepare for subsequent applications.

How to fill out the certificate of redemptions template

-

1.Open the certificate of redemptions template in pdfFiller.

-

2.Start by entering the date of issuance at the top of the document.

-

3.Fill in your name or the name of the entity that is redeeming the securities.

-

4.In the designated area, enter the description of the security being redeemed, including details like the bond number and amount.

-

5.Specify the redemption amount in the appropriate field.

-

6.If required, include any relevant account numbers associated with the transaction.

-

7.Review all entered information for accuracy, ensuring there are no typos or errors.

-

8.Sign the document electronically using pdfFiller’s signing options.

-

9.Save the filled-out certificate of redemptions to your device, and consider sending a copy to relevant parties, such as financial institutions or regulatory bodies.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.