Get the free Hypothecated Security Addendum to Deed of Trust template

Show details

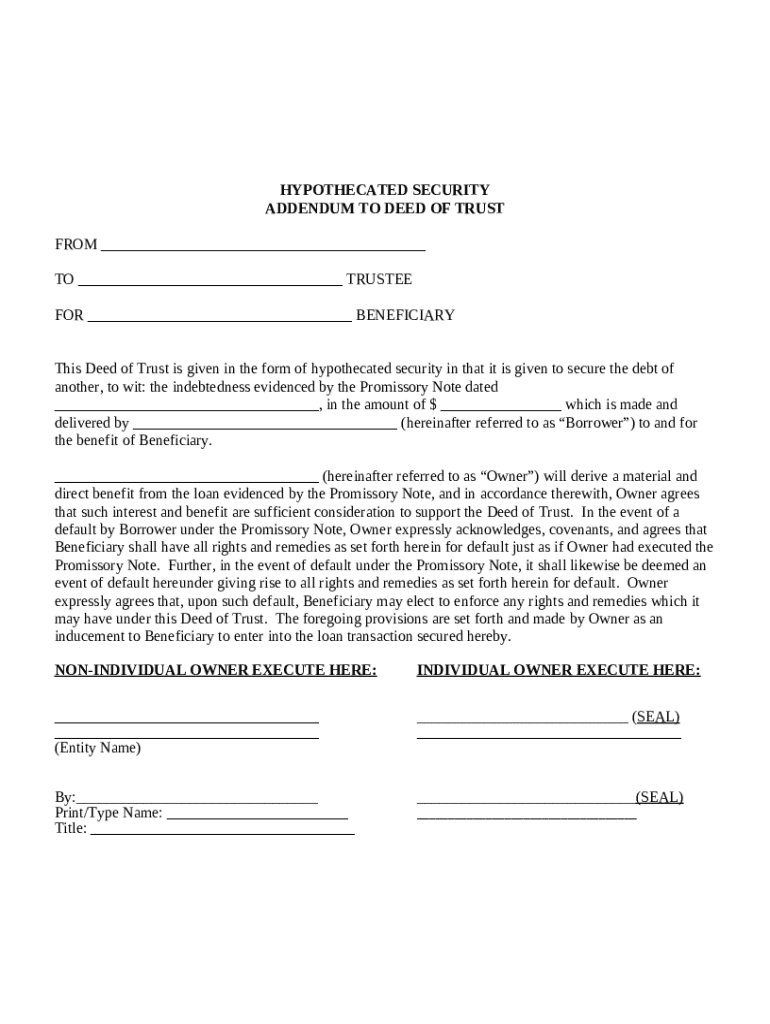

This Deed of Trust is given in the form of hypothecated security in that it is given to secure the debt of another as evidenced by a particular promissory note.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

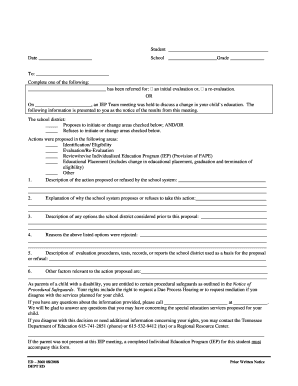

What is hypoformcated security addendum to

A hypoformcated security addendum to is a legal document that outlines additional security terms to an existing agreement, particularly for financial transactions.

pdfFiller scores top ratings on review platforms

It has made both of my jobs more convenient to keep records and email forms

Very easy to understand and very helpful, it also save the information even if the computer log out for a minute. Thank you

Instructions were easy to follow. Although, I have not yet completed my form, I know I will be guided easily. Thanks.

PDF Filler has been extremely easy to use and navigate. It has all the features that I need to fill out pdf forms. I've been using the service for over a year now and have never had any complaints.

So far so good. I love the way I can edit now.

this is awesome website, provides very helpful tools to edit any documents in any format.

Who needs hypoformcated security addendum to?

Explore how professionals across industries use pdfFiller.

How to fill out a hypothecated security addendum to form effectively

What is a hypothecated security addendum?

A hypothecated security addendum is a legal document used in real estate transactions that outlines how a debtor can secure a loan by pledging property or assets as collateral. This form protects the lender in case of default by establishing a claim on the hypothecated property. Understanding its importance is critical for all parties involved in securing a debt.

What are the key components of the hypothecated security addendum?

-

This clause identifies the owner (the borrower) and the beneficiary (the lender), establishing who is involved in the agreement.

-

The trustee acts as an intermediary who holds the hypothecated assets and ensures that both parties' rights are respected.

-

A Promissory Note details the borrower's commitment to repay the loan, forming the basis for the hypothecation.

How do you fill out the hypothecated security addendum?

Filling out a hypothecated security addendum requires attention to detail and can be broken down into manageable steps. Start with the 'Owner' section, followed by the 'Beneficiary,' and ensure all details regarding the Borrower and the Promissory Note are accurate to avoid future issues.

-

Take time to review and ensure all required fields are filled accurately to avoid common pitfalls.

-

Verify the spelling of the names and the values stated in the agreement to ensure clarity.

-

Consult with a legal professional if you feel uncertain about any part of the process.

What rights and remedies exist in default situations?

In the event of a default under the Promissory Note, specific rights and obligations come into play for both the owner and the beneficiary. The owner has an obligation to mitigate damages, while the beneficiary has rights that include the ability to enforce the hypothecation and seek remedies available under the law.

-

Understanding various default scenarios assists both parties to prepare for potential financial issues.

-

The owner must fulfill their responsibilities even in case of a default, ensuring compliance with agreement terms.

-

The beneficiary maintains the right to initiate foreclosure proceedings if the owner fails to comply.

How is the hypothecated security addendum executed?

The execution of a hypothecated security addendum requires signatures from the involved parties, and it's essential to understand the distinction between individual and non-individual owner signatures. In many instances, this document benefits from notarization and appropriate seals to ensure legal validity.

-

Ensure that signatures are clearly written to avoid disputes over identity.

-

Notarizing the document can offer additional legal weight and prevent challenges to its validity.

-

Abide by local regulations that may affect the execution process.

What are the advantages of using a hypothecated security addendum?

Utilizing a hypothecated security addendum presents several advantages for lenders and borrowers alike. This agreement allows lenders to secure their loans more effectively by collateralizing the borrower's property, reducing their risk while also streamlining the transaction process and offering a form of protection for all parties involved.

-

Lenders are more secure in their investments, which can lead to lower interest rates for borrowers.

-

Beneficiaries can avoid significant losses through secured interests ideally tailored to meet lending standards.

-

Hypothecation can help limit liabilities in real estate transactions, making it a beneficial arrangement.

How can you annex the hypothecated security addendum to mortgage agreements?

Integrating the hypothecated security addendum with standard mortgage agreements is crucial for clarity in real estate transactions. Proper attachment involves careful consideration of legal implications, including ensuring that all parties understand their rights and obligations post-integration.

-

Remain diligent and guided when attaching supplementary documents to avoid misunderstandings or incomplete expectations.

-

Consider the regional legal frameworks that may affect the integration process.

-

Look for case studies or examples of effective integrations within local real estate practices.

How to fill out the hypoformcated security addendum to

-

1.Open pdfFiller and upload the hypoformcated security addendum form.

-

2.Start by filling in the header section with the name of the parties involved and the agreement date.

-

3.Provide any relevant reference numbers associated with the primary agreement to which this addendum applies.

-

4.In the security terms section, clearly outline the specific additional security measures or requirements being proposed.

-

5.Include any necessary clauses regarding default and remedies for breaches of the addendum.

-

6.If applicable, provide spaces for signatures along with printed names and dates for both parties.

-

7.Review the filled document for accuracy and completeness before submission.

-

8.Save the completed form as a PDF or print it directly for distribution to the involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.