Get the free pdffiller

Show details

Deed of Distribution from Personal Representative of Deceased to Grantee Beneficiaries.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

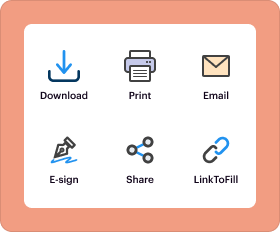

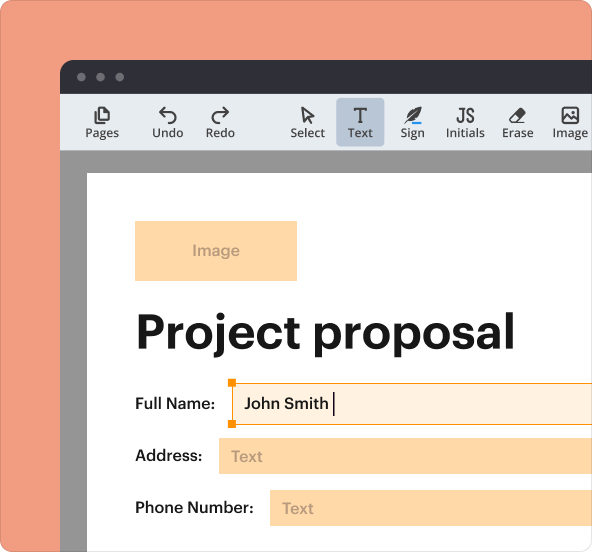

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed of distribution

A deed of distribution is a legal document outlining the allocation of an estate's assets among beneficiaries after the executor settles debts and taxes.

pdfFiller scores top ratings on review platforms

you program has met all my needs up to this point

I HAD TO USE THIS FOR 1500 AND UB-04, IT MADE THE FORM VERY EASY TO FILL OUT WITH THE STEP BY STEP PROCESS

I have really been impressed with the capabilities of this program.

good, just problems with contacting customer service but not bad

App produces error during install for smartphones. Should favor browser entry, or at least make link more prominent.

Also, the way that some of the advanced features are not available to a subscription is a bit misleading they way they are presented IMO... At the very least, the base subscription should provide limited quantities of some of the more advanced features... (monthly counter etc.) ~ Because the casual user may really benefit from these features (in low volume.) And there's little incentive to not just "get by" with the free services if they're not available.

Found it relatively easy to prepare and save W-2Cs

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Deed of Distribution Form

A deed of distribution form is a legal document that facilitates the transfer of property from an estate to its beneficiaries. It serves as a formal declaration of how the estate's assets will be distributed according to the will or local laws. This guide will provide essential insights and practical steps for preparing, filing, and executing a deed of distribution.

What is a deed of distribution?

A deed of distribution is a legal tool used primarily in estate proceedings to outline how a deceased individual’s property is to be distributed among heirs. The purpose of this document is to ensure transparency and legality in the transfer of assets from the deceased's estate to the rightful beneficiaries. Key legal implications include the need for proper execution and potential challenges that may arise if not filled out correctly.

Why is it important in estate resolution and property distribution?

The deed of distribution is crucial in estate resolution as it provides official notice of the distribution of assets, which can help prevent disputes among beneficiaries. By clearly detailing each beneficiary's share, it promotes fairness and transparency, which are vital for maintaining harmony among heirs. Moreover, it is often a required document in probate court proceedings.

The key legal implications involved in a deed of distribution include potential challenges to the document’s validity, tax liabilities, and responsibilities of the personal representative overseeing the distribution.

What essential details are required in the deed of distribution form?

-

You should clearly state the execution date, which is the date the document is signed, to clarify when the wishes outlined take effect.

-

This includes detailing the representative's name and their duties, which may involve overseeing the distribution process and ensuring compliance with legal requirements.

-

Essential information such as cause number and court details must be incorporated to link the deed to the probate case.

-

It's critical to verify the estate's obligations, including any outstanding debts and ensuring tax clearance before assets can be distributed.

How do you complete the deed of distribution form?

-

Clearly list the grantor, typically the deceased estate, and each grantee, who are the beneficiaries of the property.

-

Provide detailed descriptions of each property you are distributing, including addresses and parcel numbers to avoid confusion.

-

To legally execute the document, it should be signed by all relevant parties, and in some jurisdictions, notarization is required.

What common mistakes should you avoid when filling out the deed of distribution?

-

Failing to provide necessary details can lead to the deed being deemed invalid.

-

Ensure all descriptions are accurate; mistakes can cause legal disputes or delays.

-

Make sure that all signatures are collected in a timely manner to prevent challenges later on.

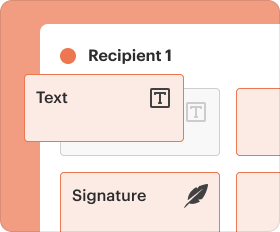

How to utilize pdfFiller for your deed of distribution needs?

-

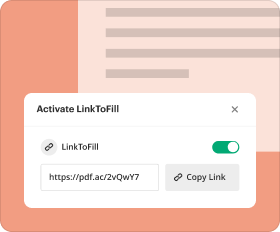

With pdfFiller, you can easily edit existing PDF forms, ensuring the deed is customized to your requirements.

-

Team members can collaboratively edit and review the document in real-time, making coordination more efficient.

-

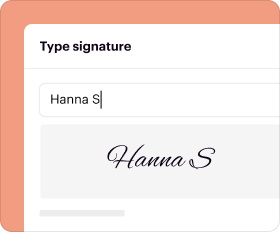

With built-in eSigning features, approvals can be obtained quickly and securely, streamlining the distribution process.

What are the legal considerations in Montana for deed of distribution?

Montana has specific probate laws impacting how deeds of distribution are processed. Understanding these laws is essential for compliance to avoid potential legal complications.

-

Montana's laws dictate the probate process, including the required documents needed for a deed of distribution.

-

It's important to perform compliance checks to ensure all legal requirements are satisfied prior to distribution.

-

Utilize local resources and legal advice available in Montana for further assistance with your deed of distribution.

What final steps must be taken in distributing estate property?

-

Notarization of the deed is a crucial step in validating the document; ensure you follow local procedures.

-

Store the signed deed securely, as it is a critical document related to the estate.

-

After execution, notify all beneficiaries of their entitlements and any next steps they need to consider.

How to fill out the pdffiller template

-

1.Access pdfFiller and upload the deed of distribution template.

-

2.Begin by entering your name and contact information at the top of the document.

-

3.Provide details about the decedent, including their full name and date of death.

-

4.List the beneficiaries and their relationship to the decedent, ensuring accurate identification.

-

5.Outline the specific assets being distributed, noting their value and any associated liabilities.

-

6.Detail how each asset is to be divided among the beneficiaries, pointing out exact shares or individual items.

-

7.Include a declaration that all debts and taxes have been settled before distribution occurs.

-

8.Review all entered information for accuracy and completeness, making adjustments as needed.

-

9.Once satisfied, save the document and proceed to e-sign if required.

-

10.Download the completed deed of distribution and distribute copies to all relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.