Get the free pdffiller

Show details

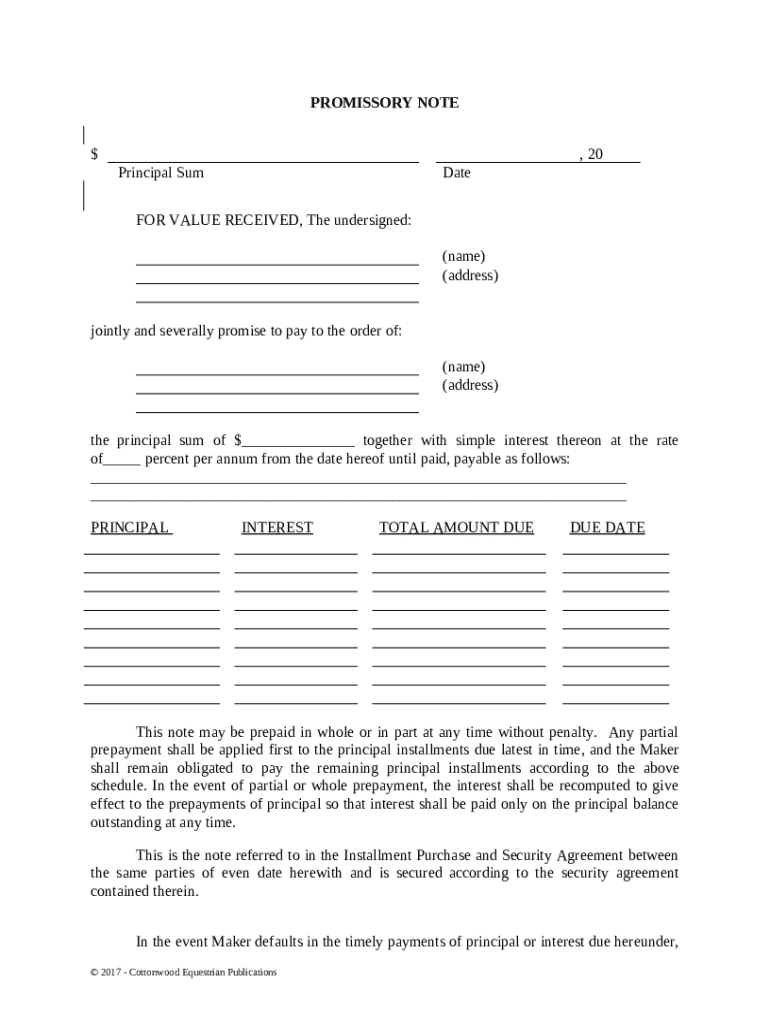

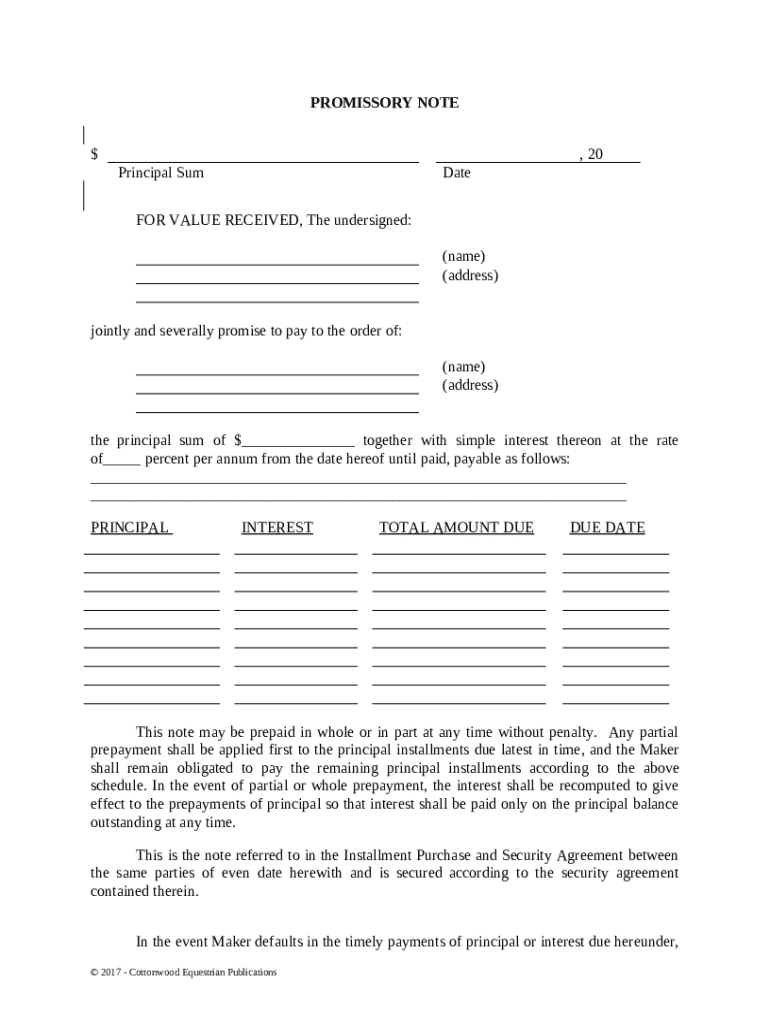

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note for a horse is a legal document in which one party agrees to pay another a specific amount of money for the purchase of a horse.

pdfFiller scores top ratings on review platforms

I've only used this a few days, but so far it has done everything I have asked it to do. Seems pretty easy to use.

loved it

good

Es justo lo que necesito. Es eficiente y rápido.

good online help. very user friendly

Great software. I love it !

Who needs pdffiller template?

Explore how professionals across industries use pdfFiller.

How to fill out a promissory note - horse form form

Understanding the Promissory Note

A promissory note is a legal document in which one party makes an unconditional promise to pay a specific sum to another party. This essential financial instrument plays a significant role in loan agreements, where the borrower acknowledges their obligation to repay borrowed funds. Understanding the components and implications of a promissory note is crucial for anyone engaged in financial transactions.

-

A promissory note is a written promise to pay a specified amount to bearer or to a named individual. It serves as a formal record of a loan or financial obligation.

-

Critical elements include the principal sum, interest rate, payment schedule, and signatures of the borrower and lender.

-

It protects the interests of both parties and serves as evidence in case of disputes, ensuring clarity and legal protection.

What essential fields are required in a promissory note?

Filling out a promissory note requires specific fields to ensure its effectiveness and legal standing. Each component plays a crucial role in defining the terms of the agreement.

-

The principal sum is the total amount borrowed, which forms the basis of repayment and interest calculations.

-

Including the date on the promissory note establishes when the obligation was created, affecting the timeline of repayments.

-

Both the borrower and lender's details must be clearly stated to avoid confusion in the documentation.

-

The stipulated interest rate can significantly impact the total amount repaid over the term of the note.

-

The payment schedule outlines the frequency and method of installments, providing clarity for financial planning.

How can fill out my promissory note using pdfFiller?

Utilizing pdfFiller transforms the process of creating a promissory note into a streamlined experience. Users can fill out and customize their forms through an intuitive interface.

-

Navigate through the pdfFiller platform to easily access the necessary forms, fill in your details, and ensure all critical fields are completed.

-

pdfFiller offers a variety of promissory note templates that can be tailored to meet your specific lending needs.

-

The platform provides interactive tools like auto-fill options and prompts that help prevent errors and ensure accuracy.

What are the steps for managing and editing your promissory note?

Once your promissory note is filled out, managing it effectively is paramount. pdfFiller's platform allows for seamless modifications and collaboration.

-

Use the editing function on pdfFiller to modify any part of your completed promissory note with ease. Changes are simple and intuitive.

-

Team members can collaborate on the document simultaneously, making it easy to incorporate inputs from multiple parties.

-

pdfFiller allows users to save their documents in the cloud, ensuring they are backed up and accessible whenever needed.

What should know about prepayment and default clauses?

Understanding the implications of prepayment and default is vital for both borrowers and lenders. These clauses can significantly influence the terms of the agreement.

-

Some promissory notes offer options to pay off the loan early without incurring penalties, which can be beneficial.

-

Defaulting on a loan can lead to severe repercussions including legal action and loss of collateral if specified.

-

Outstanding debts may accrue interest over time, increasing the total amount owed, which could lead to further legal complications.

Comparative insights on other document preparation services

Evaluating other document preparation services can provide insight into the best tools for your promissory note needs. Understanding the advantages can inform your choices.

-

Many services offer varying degrees of functionality, which can influence which platform to choose based on your requirements.

-

pdfFiller boasts user-friendly features and robust customer support, making it a preferred choice for many.

-

Studying successful implementations of promissory notes via different platforms showcases best practices and potential pitfalls.

How can get support with my promissory note needs?

Accessing support resources is important when dealing with potentially complex documents like promissory notes. pdfFiller provides various avenues for assistance.

-

Users can contact customer service for immediate assistance should issues arise during document preparation.

-

pdfFiller offers a wealth of tutorial videos and articles designed to aid users through the document filling and editing process.

-

Engaging with community forums provides valuable tips from fellow users and can resolve common issues swiftly.

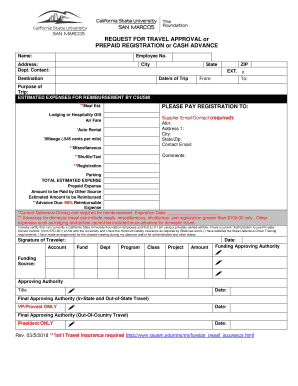

How to fill out the pdffiller template

-

1.Open pdfFiller and upload the promissory note template for a horse.

-

2.Fill in the date at the top of the document to specify when the agreement is made.

-

3.Enter your name and contact information as the borrower in the appropriate section.

-

4.Provide the seller's name and contact information in the lender section.

-

5.Specify the amount to be financed for the horse in the designated field.

-

6.Outline the interest rate applicable to the loan, if any, as per your agreement with the seller.

-

7.Clearly state the payment schedule, including the number of payments and due dates.

-

8.Include any terms regarding late payments or prepayment penalties, if applicable.

-

9.Sign and date the document, ensuring to print the names where necessary to confirm authenticity.

-

10.Download or print the completed promissory note for both parties to keep a copy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.