Get the free Lender's Certification template

Show details

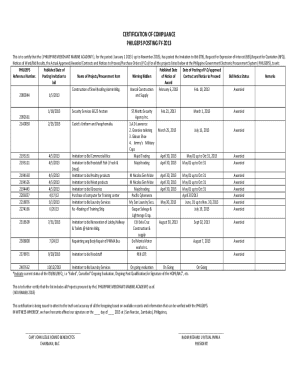

A lender certifies to the terms of a small business (SBA) loan and prior liens along with the terms of a permanent loan.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is lenders certification

A lenders certification is a document that verifies the details of a loan and the borrower's qualifications for mortgage lenders.

pdfFiller scores top ratings on review platforms

I am a Medical Billing and Coding student and have been using pdfFiller forms to do an assignment where we are using the CMS 1500 claim form, and pdfFiller has helped me a lot by allowing me to used the forms online. Thanks I appreciate that

I am a Medical Billing and Coding student and have...

I am a Medical Billing and Coding student and have been using pdfFiller forms to do an assignment where we are using the CMS 1500 claim form, and pdfFiller has helped me a lot by allowing me to used the forms online. Thanks I appreciate that

I was totally new to this program and I found a pretty complex but all of my questions were answered quickly and well.

What do you like best?

PDF Filler makes it easy to get documents filled and signed remotely.

What do you dislike?

I believe the mobile experience could be improved. It's sometimes confusing when a client is prompted to download the app.

Recommendations to others considering the product:

If you need to have forms filled and signed remotely, PDF Filler is a great resource!

What problems are you solving with the product? What benefits have you realized?

PDF FIller has played an essential role in helping us conduct contact-free business during the COVID pandemic.

Recommended for easy and trustworthy service

I was searching for a safe and efficient way to convert a few PDF file on the internet when I came across pdffiller.com and next thing i did was get a subscription since the tools I used was so helpful and seamless. The customer service is fast, reliable and helpful especially Mr. SAM who helped me with my subscription and account details. Kudos and keep up the great work pdffiller team.

I just simply love PDFfiller

I just simply love PDFfiller. Easy to use and quickly converts my pdf documents to word without any errors. Love it

Who needs lenders certification template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the lender's certification form

How to fill out a lenders certification form form effectively

Filling out a lender's certification form is crucial for securing SBA loans and ensuring compliance with lending regulations. This comprehensive guide will walk you through the key elements and processes involved in completing this form accurately.

What is the lender's certification form?

The lender's certification form is a vital document required by the SBA to corroborate the details and legitimacy of a loan application. It serves to perpetuate accountability and transparency between the lender and borrower, making it essential for verifying that the loan meets program criteria.

Why is the lender's certification important for SBA loans?

The certification underscores the lender's role in delivering funds responsibly, ensuring that the borrower is aware of their obligations. It not only facilitates the funding process but also mitigates risks associated with loan disbursement, ultimately protecting both parties.

How does accuracy and compliance matter?

Document accuracy and compliance are paramount in the lending process. Any discrepancies can lead to loan rejection or delays, thus reinforcing the necessity of meticulous entries throughout the lender's certification form.

What are the key elements of the lender's certification?

The lender's certification encompasses several essential components that must be filled out accurately.

-

This includes the lender’s name, address, and other identifying information necessary for regulatory compliance.

-

Clarifies the identity of the borrower, which may also include their marital status or joint ownership situation.

-

A legal description of the project for which the loan is requested must be clearly stated.

-

Documentation of any existing liens on the property is essential to assess risk appropriately.

What financial information is required?

For a thorough assessment, the lender needs detailed financial insights.

-

A clear list of all outstanding loans, including their terms, is critical for understanding the borrower's current financial obligations.

-

Details on the structure of promissory notes must be included, reflecting the terms of repayment.

-

Accurate information regarding interest rates and payment terms is necessary to gauge total borrower liability.

What collateral and security requirements are there?

Collateral requirements play a key role in the integrity of loan agreements and the security of funds.

-

Lenders must record information regarding both types of notes to secure the loan effectively.

-

Correct documentation of mortgages is crucial for legal accountability in the lender's certification process.

-

Well-documented collateral directly influences loan approval chances and disbursement timelines.

How to complete the lender's certification form using pdfFiller?

Using pdfFiller to complete your lender's certification form simplifies the entire process.

-

Initiate the process by accessing the lender's certification form directly through pdfFiller's interface.

-

Efficiently fill out necessary fields using pdfFiller’s intuitive interface.

-

Make use of pdfFiller's editing tools to enhance document accuracy before finalizing your certification.

-

Easily sign and share the completed form securely with all required parties.

What common mistakes should be avoided?

Recognizing potential errors can significantly affect the success of your lender's certification form submission.

-

Ensure that no required fields are left blank, as omissions can lead to delays.

-

Double-check all financial data for accuracy to prevent unnecessary complications.

-

Review collateral documentation meticulously to uphold transparency and compliance.

How can pdfFiller enhance document management?

Utilizing pdfFiller not only aids in document creation but also enhances overall document management.

-

pdfFiller allows for seamless collaboration among teams working on loan documents, facilitating better communication.

-

With its cloud features, pdfFiller provides unparalleled access to documents from any location.

-

Ensuring the secure management of certifications helps maintain the integrity of sensitive data and documents.

How to fill out the lenders certification template

-

1.Open the PDF filler application and choose the lenders certification template.

-

2.Review the fields required, such as borrower information, loan amount, and property details.

-

3.Fill in the borrower's personal details including name, address, and contact information.

-

4.Input the loan amount and terms, ensuring accuracy to avoid errors later.

-

5.Provide accurate property information including the address and type of property being financed.

-

6.If applicable, include information regarding the borrower's employment and income to support the loan application.

-

7.Double-check all entries for completeness and correctness before submitting the form.

-

8.Save the completed document to your device or directly send it to the lender through the platform.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.