Get the free Sample Mortgage

Show details

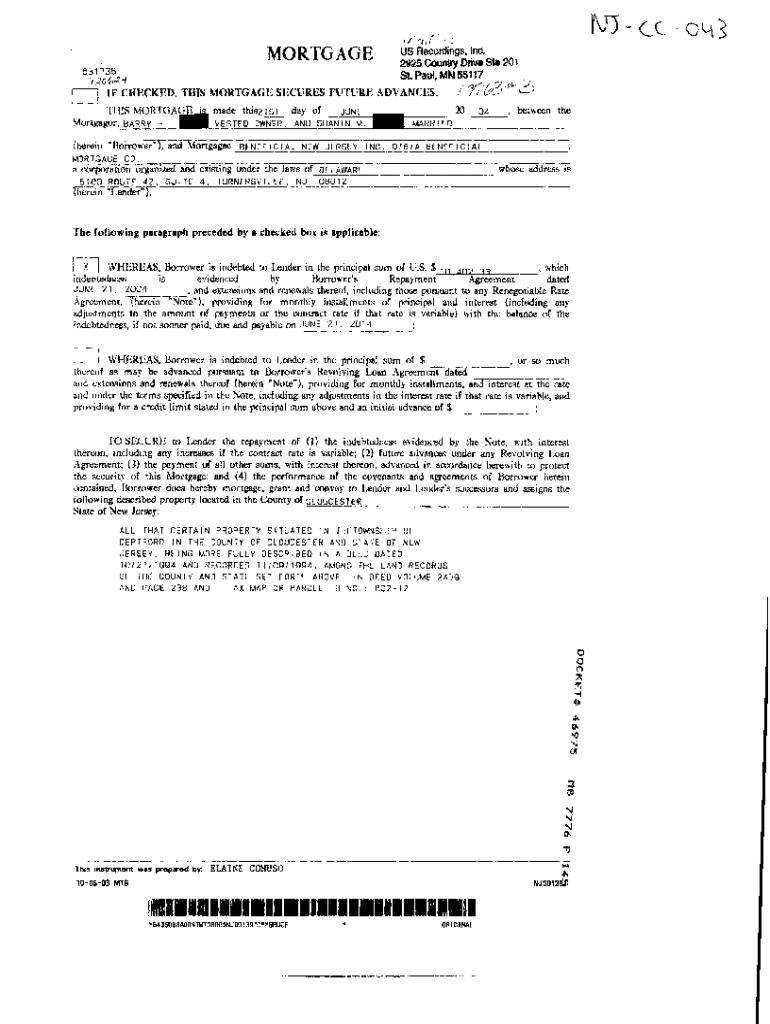

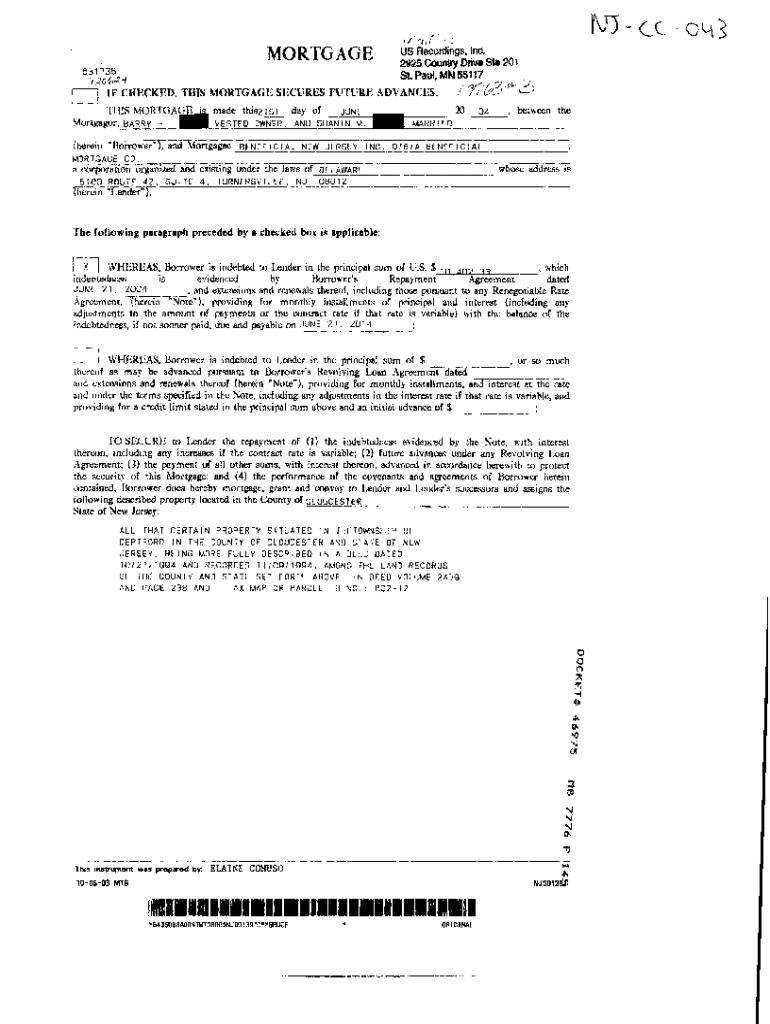

Sample Mortgage

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is sample mortgage

A sample mortgage is a template illustrating the structure and terms of a mortgage loan agreement.

pdfFiller scores top ratings on review platforms

AWESOME AND GREAT TOOL

The best app ever

The best app ever, it is so easy to use and hassle free. 100% recommend

Nice Tool

Efficient. Easy to handle. Good value for money.

great

great, better then the comp.

good & Helpful

Top Tier PDF Editor with Great Tools

Very friendly, easy-to-use user interface, and it allows you to do many useful things by having various tools. Great site!

Who needs sample mortgage?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Sample Mortgage Forms on pdfFiller

What are mortgage forms?

A mortgage form is a critical document in the loan process that details the terms and conditions of a mortgage. It is significant because it not only lays out the specifics of the loan but also serves as a legally binding agreement between lender and borrower. Properly understanding and filling out these forms is essential for a smooth mortgage application process.

-

A form that provides a summary of the loan's terms, costs, and potential monthly payments.

-

This document outlines the final terms of the loan, including all closing costs.

How does a Loan Estimate blank model form work?

The Loan Estimate blank model form is structured to present crucial loan-related information in a standardized format. It includes sections detailing the estimated loan amount, interest rate, and monthly payments. Grasping the importance of accurate information is vital here, as any discrepancies can lead to issues later in the mortgage process.

-

This section indicates how much the borrower intends to borrow.

-

The rate at which interest will accrue on the loan.

-

An estimate of the monthly payment will be required from the borrower.

Can see a completed sample Loan Estimate form?

Having a filled-out example of a Loan Estimate can be extremely beneficial. By understanding how to read and interpret each section of the filled form, borrowers can better prepare for discussions with their lenders. pdfFiller also offers tools that allow users to easily edit and manage digital forms.

-

A filled form will show the actual loan details, helping in comparison shopping.

-

Decode various charges and fees outlined in the estimate.

How is the Closing Disclosure blank model form structured?

The Closing Disclosure blank model form contains essential information for the closing phase of a mortgage. It highlights the final terms of the loan, including all closing costs and payment information. Knowing these details ensures that borrowers are well-prepared for what is essentially the final step in securing a mortgage.

-

Specifications on the loan terms finalized at closing.

-

An outline of all fees associated with the closing of a mortgage.

-

Details related to monthly payments after the loan closes.

What insights can a completed Closing Disclosure provide?

A completed Closing Disclosure is a critical document that offers transparency into the final terms of a mortgage. It is important to clarify the interpretation of various data points within the form to avoid surprises at closing. Users can leverage pdfFiller for eSigning and storing this necessary document efficiently.

-

Understand each cost in relation to the mortgage agreement.

-

Utilize pdfFiller to eSign your Closing Disclosure remotely.

What other editable forms are relevant to mortgages?

When dealing with mortgages, several other blank model forms are also essential. These documents, such as Loan Agreements and Borrower Information Sheets, are not only fundamental but also assist in the comprehensive understanding of the mortgage process. pdfFiller provides a platform where you can access a wide range of editable forms, enhancing your mortgage application experience.

-

A formal document outlining the terms of the loan between borrower and lender.

-

A form that collects the necessary information of the borrower for loan processing.

How can pdfFiller enhance document management?

pdfFiller offers various functionalities that streamline the management of mortgage forms. With features such as PDF editing, electronic signatures, and document sharing capabilities, pdfFiller supports collaboration among individuals and teams. These tools are essential for efficient workflow in document management, especially in the fast-paced mortgage industry.

-

Edit PDF mortgage forms easily to reflect accurate information.

-

Sign documents digitally to expedite the process.

What compliance considerations apply to mortgage forms?

Navigating compliance for mortgage forms is crucial due to varying regional regulations. Each area may have specific laws affecting the filling out and submission of these forms. It's vital to adhere to local laws to avoid legal issues in the mortgage process.

-

Stay updated on laws governing mortgage documents in your area.

-

Familiarize yourself with regulations that affect mortgage transactions.

How to fill out the sample mortgage

-

1.Download the sample mortgage template from pdfFiller.

-

2.Open the PDF in pdfFiller's editor.

-

3.Begin by entering your personal information in the designated fields, including your name, address, and contact details.

-

4.Input the property information for the home you wish to purchase or refinance, including the property's address, type, and value.

-

5.Fill in the mortgage amount you are seeking, the interest rate, and the term of the loan.

-

6.Review the disclosure and terms sections carefully, making sure to understand any fees and conditions outlined in the contract.

-

7.Add any co-borrowers' information if applicable, and ensure that all personal data is accurate.

-

8.Once all fields are completed, proofread the document for errors or omissions.

-

9.Save your document and either print it for physical signature or send it electronically, as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.