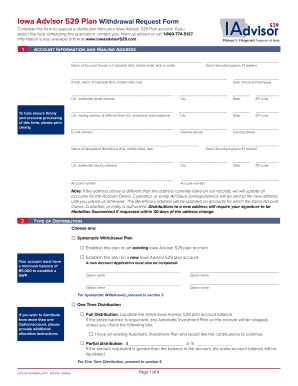

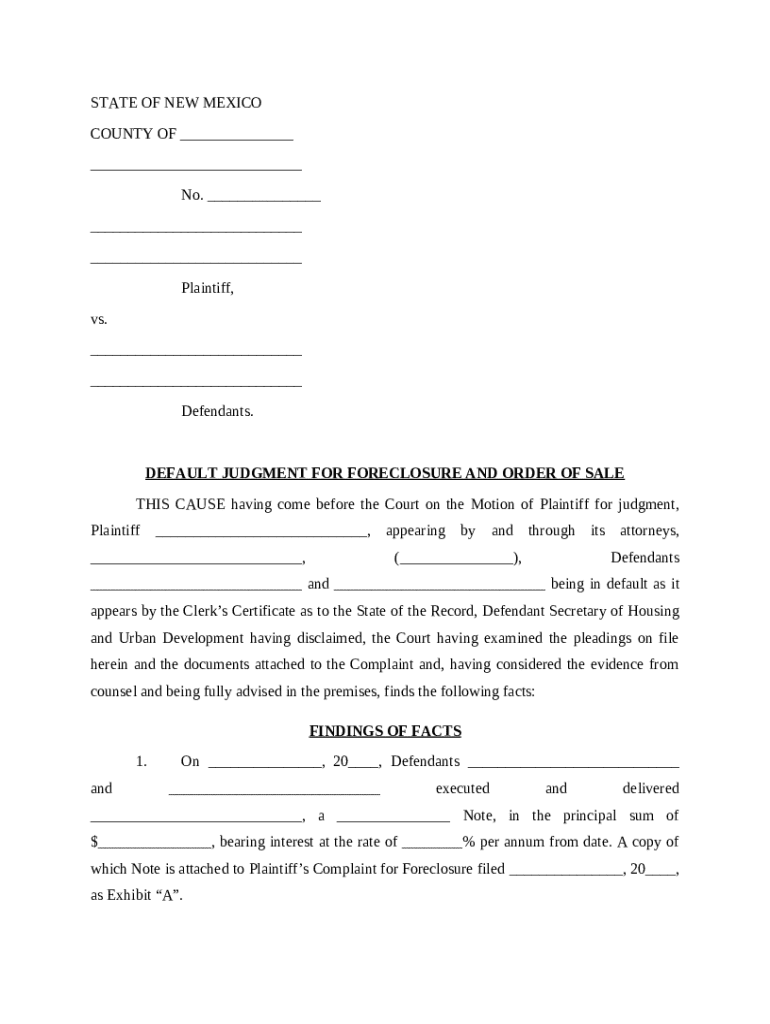

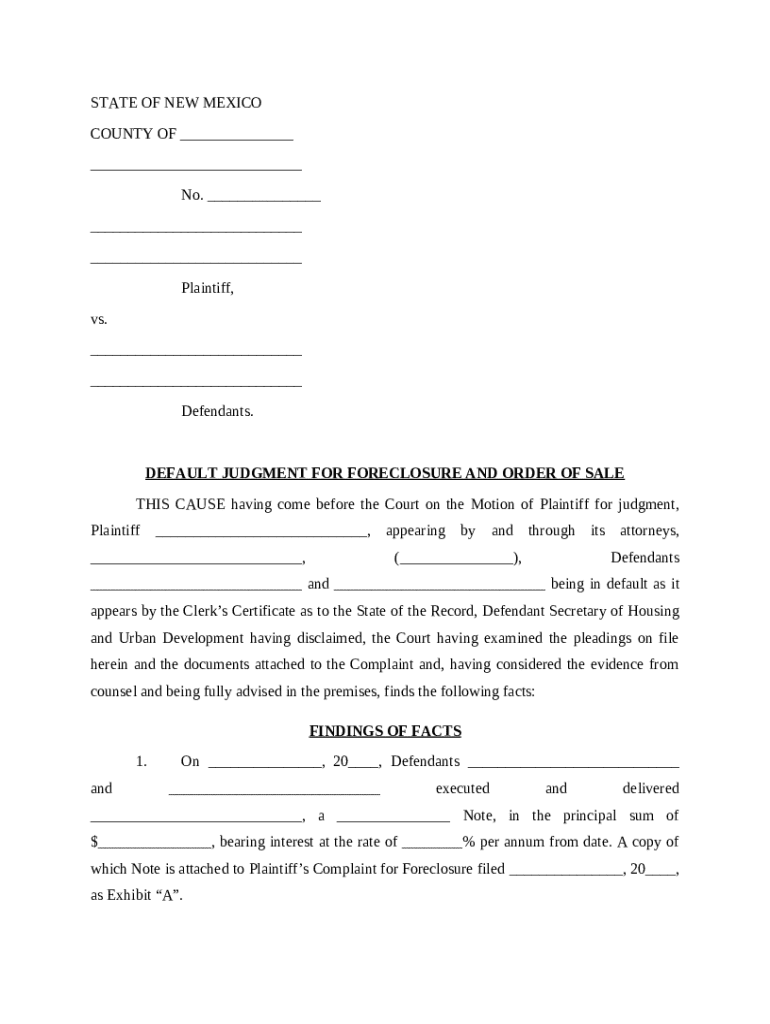

Get the free Default Judgment for Foreclosure and Order of Sale template

Show details

This order grants a default judgment in favor of a Mortgagee Plaintiff, following failure of the Defendant failed to timely please or otherwise defend the foreclosure action where the Department of

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is default judgment for foreclosure

A default judgment for foreclosure is a court ruling that allows a lender to proceed with foreclosure after the borrower fails to respond to a foreclosure lawsuit.

pdfFiller scores top ratings on review platforms

Love pdfFiller! Just need to learn more features that would benefit me.

Its doing the job for what I need but I would love to know how to send secure files to be signed (editable) and retuned back securely.

Very easy to navigate and the files (png images) actually convert to a PDF with the correct size, unlike other sites I paid for and was unsatisfied with the resulting PDF. Thanks!

I find this very user friendly. Does the job perfectly!

Perfect

great

Who needs default judgment for foreclosure?

Explore how professionals across industries use pdfFiller.

How to effectively fill out a default judgment for foreclosure form

Filling out a default judgment for foreclosure form is a critical step in the foreclosure process. It involves documenting specific information needed for your court case. Understanding the intricacies of this form can greatly influence the outcome of foreclosure proceedings.

Evaluating your foreclosure situation

Before filling out any forms, it's essential to evaluate your situation carefully. A default judgment is a legal decision made by a court when one party fails to respond to a legal action, such as foreclosure.

-

A default judgment is a court ruling in favor of one party when the other fails to appear or respond.

-

Foreclosure can significantly affect your credit score and financial stability.

-

Determining whether you are the party initiating the foreclosure or the one defending against it is crucial.

-

Legal counsel can guide you through the nuances of foreclosure laws specific to New Mexico.

Key components of the default judgment for foreclosure form

Understanding the essential elements of the form is vital for its successful completion. Each section of the form requires specific information that must be accurate.

-

You must specify your location accurately to comply with local jurisdiction requirements.

-

Clearly identifying all involved parties helps prevent delays in processing your case.

-

This section indicates who is legally representing the plaintiff and the specifics of the motion being submitted.

-

The Clerk's Certificate confirms the legitimacy of the process, ensuring the court recognizes the filing.

-

This helps establish the basis of your case and the evidence supporting your position.

Filling out the default judgment form

Completing the form correctly is essential for your case's success. Be meticulous about the information you provide.

-

Ensure all required details are completed accurately to avoid complications.

-

These attachments substantiate your claims and should always accompany the form.

-

Understanding the timeline helps to prevent missing critical deadlines.

-

Be precise in describing the property in question to avoid legal challenges.

-

Be prepared with potential defenses to present if your case is contested.

Utilizing pdfFiller for your form needs

pdfFiller can streamline the process of filling out your default judgment for foreclosure form. With its cloud-based platform, you can edit, sign, and manage documents seamlessly.

-

Simply log in to your account, locate the form, and start editing it online.

-

Utilize the eSignature feature to sign your documents quickly, without the need for printing.

-

Share your documents securely with your legal counsel for insights and revisions.

-

Store all relevant documents in one place, making it easy to track changes or updates.

Court process after form submission

Once you submit your default judgment form, it's essential to understand the subsequent steps in the court process.

-

You will receive notifications regarding the court's decision and any required actions.

-

The judge will review the form and may schedule a hearing, where you may present further evidence.

-

The outcome will significantly impact your financial health, possibly resulting in the sale of your property.

-

If successful, understand the follow-up actions required to enforce or appeal the decision.

Common questions and misconceptions

Navigating foreclosure can be daunting. Understanding common questions can assist in clarifying your path.

-

If a defendant responds, the case may shift back to litigation, requiring further hearings.

-

Yes, negotiations can still take place to reach a settlement even after a judgment has been made.

-

A judgment can significantly affect your credit score, impacting future loans and mortgages.

-

New Mexico has particular laws that govern foreclosure, necessitating awareness of local regulations.

How to fill out the default judgment for foreclosure

-

1.Obtain the necessary default judgment form for foreclosure from your state’s court website or legal sources.

-

2.Open the form using pdfFiller or upload it if you have a physical copy.

-

3.Begin filling out the borrower’s information, including the name, address, and loan details.

-

4.Input the lender's information, such as name and contact details.

-

5.Provide specific case details, including the court name and case number if applicable.

-

6.Indicate the reasons for seeking a default judgment, specifying the lack of response from the borrower.

-

7.Attach any required documents, such as proof of service or the original loan agreement, as necessary.

-

8.Review all entered information for accuracy before submission.

-

9.Submit the completed form via pdfFiller’s platform or print it out for mailing to the court.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.