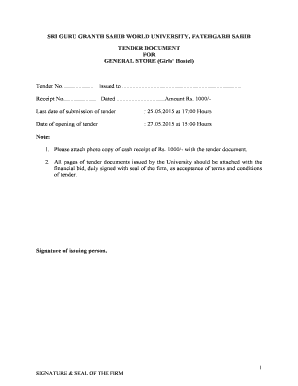

Get the free Borrower's Affidavit of Title Individual template

Show details

The affiant swears to the truth and accuracy of the statement contained in the affidavit. This sample is for property title.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is borrowers affidavit of title

A borrower's affidavit of title is a legal document in which a borrower certifies the ownership of property and the accuracy of the information provided in a loan application.

pdfFiller scores top ratings on review platforms

very pleasant

Fast and reliable

Great experience! Lots of helpful tools!

Everything i need in one place. I love it! I especially like that i can fill out these forms from my desktop.

Their customer service is great! And they didn't hesitate to refund my money and give me another option that would meet my needs!

Their customer service is great! And they didn't hesitate to refund my money and give me another option that would meet my needs!

Who needs borrowers affidavit of title?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Borrower's Affidavit of Title on pdfFiller

Filling out a borrower's affidavit of title form accurately is essential for ensuring smooth real estate transactions. This guide provides detailed instructions and tips to help you navigate the process effectively.

What is a borrower's affidavit of title?

A borrower's affidavit of title is a legal document used in real estate transactions to affirm the borrower's ownership of a property and to confirm that they are entitled to the title. This affidavit serves as a declaration that the individual holds legal title to the property and outlines their rights, the terms of any liens or mortgages, and any other relevant details.

The affidavit plays a critical role in real estate transactions by safeguarding buyer and lender interests. Failing to provide accurate information can lead to legal complications, affecting property rights and ownership.

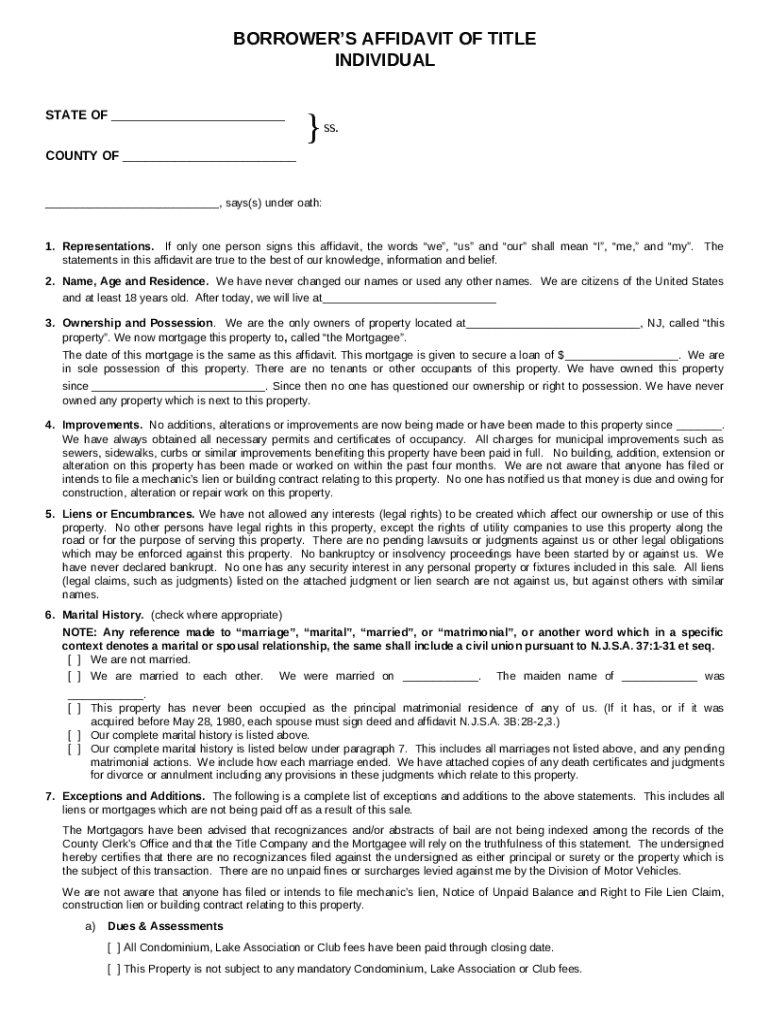

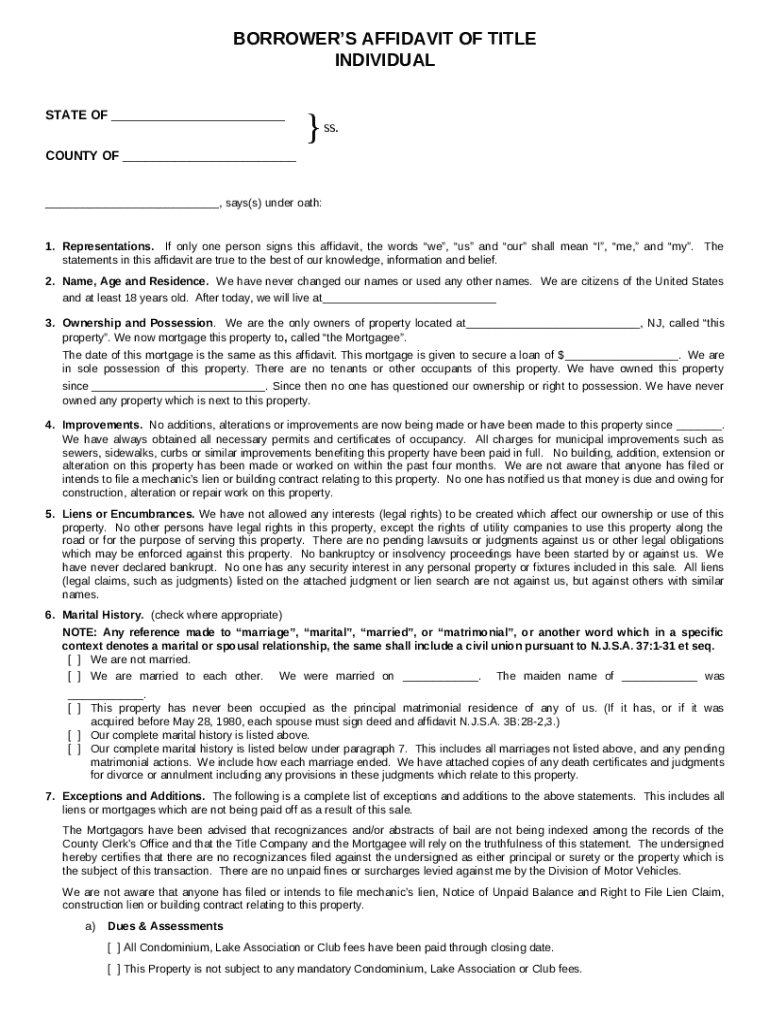

What are the key sections of the affidavit?

-

This section requires the borrower to provide their full name, age, and address, ensuring they meet citizenship and age requirements.

-

Here, you'll describe the property, including its location and details regarding the mortgage and occupancy status, confirming no other tenants are living there.

-

You must disclose any renovations or enhancements made to the property, backed by receipts and permits, and affirm that there are no mechanic's liens.

How do fill out the borrower's affidavit of title?

Filling out the borrower's affidavit of title form involves several important steps. Start by gathering all necessary documents, including your identification and property details.

-

Read the form carefully to understand the requirements and sections.

-

Ensure the information is accurate and matches supporting documents.

-

Avoid common errors such as typos or missing signatures, as these can delay the process.

How can use pdfFiller to manage my affidavit?

pdfFiller is an excellent platform for managing your borrower's affidavit of title. You can upload completed documents, edit them as needed, and electronically sign them.

-

Upload your completed affidavit to pdfFiller for easy access.

-

Utilize editing tools to modify your document seamlessly.

-

Store and organize all of your documents in one cloud-based location, ensuring you can access them from anywhere.

What are compliance considerations for your affidavit?

Compliance with state laws is crucial when completing your borrower's affidavit of title. In New Jersey, for example, notarization is often required to maintain the legal standing of the affidavit.

-

Familiarize yourself with the legal requirements specific to New Jersey and ensure your affidavit meets these.

-

Know the steps and fees involved in notarizing your affidavit.

-

Be aware that inaccuracies may lead to denying mortgage approvals or legal complications.

What strategic considerations should keep in mind?

When working with your team on the borrower's affidavit of title form, it's essential to balance document management effectively. Utilizing collaborative tools available on pdfFiller can streamline the process.

-

Implement collaborative features for real-time editing and signing.

-

Assign roles to team members to ensure that all compliance requirements are met.

How to fill out the borrowers affidavit of title

-

1.Open pdfFiller and upload the borrowers affidavit of title form.

-

2.Start by entering the borrower's full name at the designated field.

-

3.Provide the property address that is being mortgaged in the appropriate section.

-

4.Include details of any existing liens or encumbrances if applicable.

-

5.Review the section detailing the borrower's ownership of the property.

-

6.If required, state any stipulations or conditions regarding the title.

-

7.Sign the affidavit in the presence of a notary public, ensuring all signatures are completed.

-

8.Save the filled form to your account or export it in your desired format.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.