Get the free Promissory Note - Horse Equine s template

Show details

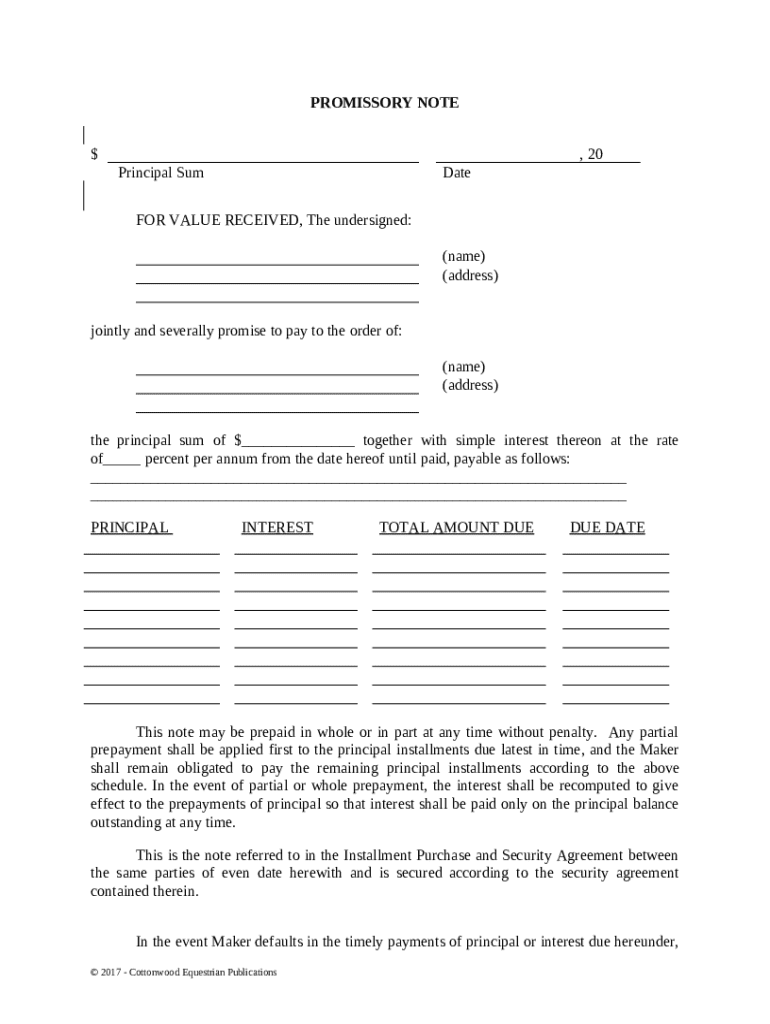

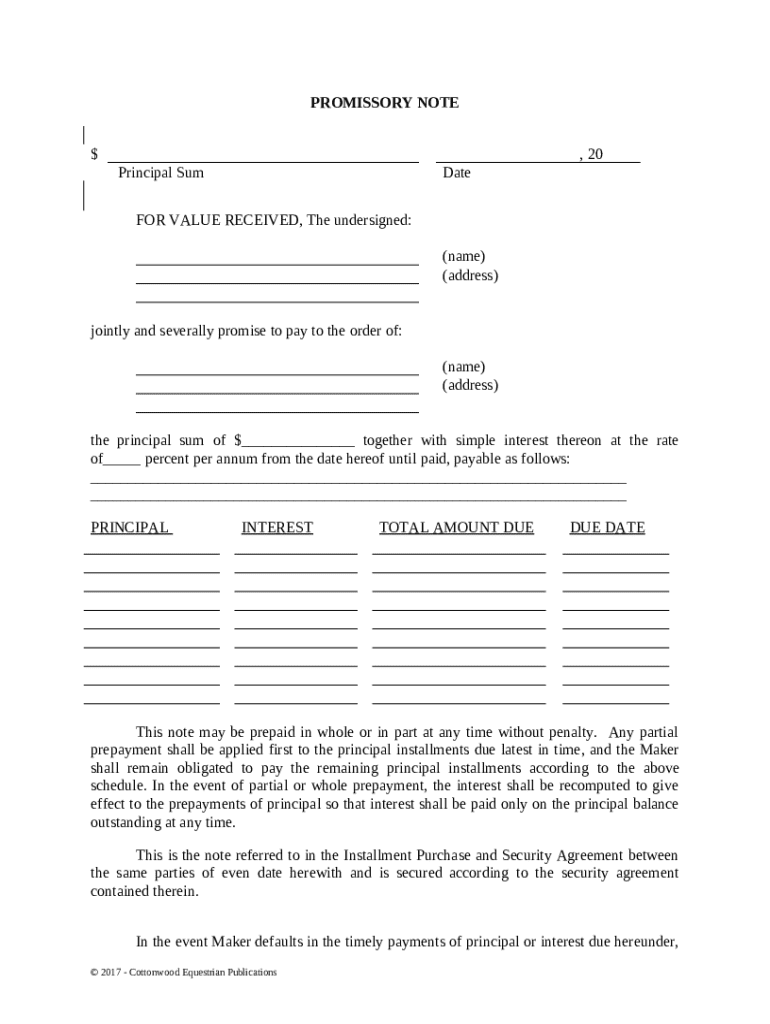

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is promissory note - horse

A promissory note - horse is a legal document in which one party promises to pay a specific amount for the purchase or lease of a horse.

pdfFiller scores top ratings on review platforms

super customer service and great product. LOVE IT!

it doesnt tell you in advance of all the options

Interface could be smoother, having instructions in documents is awkward

Helps me be efficient

Simple!

I love using this program, it has been SO helpful!!!!

Who needs promissory note - horse?

Explore how professionals across industries use pdfFiller.

How to create and manage a promissory note: A comprehensive guide

How to fill out a promissory note form

Filling out a promissory note involves clearly identifying the borrower, lender, loan amount, interest rate, and repayment schedule. It’s crucial to ensure all terms are well-defined to avoid misunderstandings. Using a structured form can simplify this process.

What is a promissory note?

A promissory note is a legally binding document that establishes a promise between a borrower and a lender to repay a specified amount under agreed conditions. It serves as a record of the transaction, safeguarding the interests of both parties.

-

To formalize the borrowing arrangement and provide a clear record.

-

Typically includes the principal sum, interest, repayment schedule, and signatures.

-

Essential for legal protection and clarity for both lenders and borrowers.

What essential components should be included?

A well-structured promissory note contains several key elements that protect all parties involved.

-

This is the total amount borrowed and is the basis of the note.

-

Specify the date the note is issued which helps in tracking payments.

-

Clearly outline the interest rate and any scheduled repayments.

-

Detail any rules regarding early repayment to avoid confusion.

How to fill out a promissory note on pdfFiller?

pdfFiller offers a user-friendly interface to create and manage promissory notes easily.

-

Select the promissory note template from pdfFiller.

-

Fill in the necessary fields like borrower and lender details.

-

Utilize interactive editing tools provided for form completion.

-

Sign and send or manage the document directly on the platform.

What common mistakes should you avoid?

When drafting a promissory note, several pitfalls could compromise the note’s validity.

-

Always follow state-specific laws to ensure enforceability.

-

Ensure clarity in payment schedules to prevent disputes.

-

If applicable, describe any collateral tied to the loan.

How to manage your promissory note post-agreement?

Effective management of your promissory note is crucial to maintain good relationships and ensure payments are made on time.

-

Establish a schedule for tracking due dates and payments.

-

Be prepared with a plan for addressing late payments or defaults.

-

Know when and how to update the promissory note if circumstances change.

What legal considerations should be taken into account?

Understanding the legal framework around promissory notes is essential for lenders and borrowers.

-

Clarify what each party is entitled to under the agreement.

-

Research local regulations as they can vary significantly.

-

Review any conditions specific to pdfFiller's platform to ensure compliance.

What alternatives to traditional promissory notes exist?

There are various forms of documentation that could serve as an alternative to traditional promissory notes.

-

Consider formal contracts that may provide broader protection.

-

Explore digital promissory notes that can streamline the process.

-

Weigh the pros and cons of different options, assessing your specific needs.

How can pdfFiller aid in document management?

pdfFiller offers a range of features that enhance the efficiency of managing your promissory note.

-

Facilitate quick electronic signatures to expedite processes.

-

Easily share documents for collaborative input without physical meetings.

-

Review successful examples of organizations effectively managing documents through pdfFiller.

How to fill out the promissory note - horse

-

1.Begin by obtaining a template for the promissory note - horse, either online or through a legal provider.

-

2.Open the document on pdfFiller to fill out the required fields electronically.

-

3.In the first section, write the date on which the promissory note is created.

-

4.Next, clearly state the name and address of the borrower (the party receiving the horse).

-

5.Then, provide the lender's name and address (the party providing financing for the horse).

-

6.Specify the amount of money being borrowed for the horse purchase or lease.

-

7.Include the details of the horse, such as breed, age, and registration number if applicable.

-

8.Outline the repayment terms, including the interest rate, payment schedule, and due dates.

-

9.Add a clause explaining what happens in case of default on the note, including penalties or repossession rights.

-

10.Finally, have both parties sign the document and date it. Ensure that each party retains a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.