Get the free Order Reing Loan Modification Agreement and Subordinating and Divesting Ownership In...

Show details

The court orders a reformation of a loan modification and setting priority to ownership interests and subordinating the interest of the Plaintiff. The matter is referred back to the foreclosure unit

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

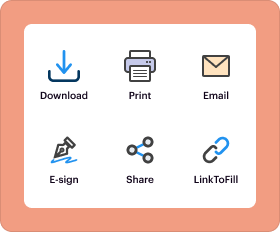

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is order reforming loan modification

Order reforming loan modification is a legal process that alters the terms of a loan agreement, often to make repayment more affordable for the borrower.

pdfFiller scores top ratings on review platforms

I have a 30 day free trial

Easy to complete my document

So far, so good - application is doing all I need it to do

good and efficient

It has been a support system

Overall im quite happy with it!!! I like that I can fill out pdfs

Who needs order reing loan modification?

Explore how professionals across industries use pdfFiller.

Ultimate Guide to Order Reforming Loan Modification Form

How does the order reforming loan modification form work?

The order reforming loan modification form is a key document employed in foreclosure proceedings, allowing for the modification of loan terms. This form plays a critical role in ensuring that homeowners facing financial difficulties can restructure their loans to avoid or mitigate foreclosure. Understanding how to fill out this form correctly is essential for anyone navigating the complex landscape of loan modifications, especially in jurisdictions like New Jersey.

-

The order reforming loan modification form is a legal document filed in court to amend the terms of a mortgage.

-

This form is crucial in foreclosure proceedings as it can provide relief to distressed homeowners by modifying unfavorable loan terms.

-

Common terms associated with loan modifications include 'principal reduction,' 'interest rate adjustment,' and 'payment forbearance.'

What is the legal context of loan modifications?

Loan modifications are grounded in legal statutes and procedures, particularly regarding foreclosure processes. In states like New Jersey, the Superior Court plays a pivotal role in adjudicating reform cases involving mortgage loans. Understanding the legal implications of modifying loan agreements is essential for anyone considering this process.

-

New Jersey has specific laws governing foreclosure, including the need for judicial proceedings rather than non-judicial foreclosures.

-

The Superior Court evaluates petitions for loan modifications, ensuring all legal criteria are satisfied before approving changes.

-

Modifying loan agreements can affect credit scores, loan terms, and future financial obligations, making understanding this process crucial.

How can you fill out the order reforming loan modification form?

Filling out the order reforming loan modification form requires attention to detail and an understanding of the document's components. Each section must be completed accurately to avoid delays or rejection by the court. Below are some tips to assist in this important process.

-

Follow a step-by-step manual to ensure each line is filled in correctly, starting with personal and property identification.

-

Avoid errors such as mismatching names, incorrect numbers, or missing signatures, which can lead to form rejection.

-

Double-check all entries and consider consulting an attorney for legal advice to ensure compliance with state regulations.

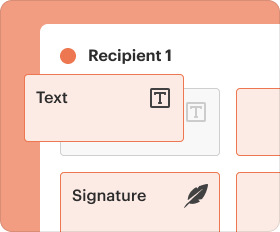

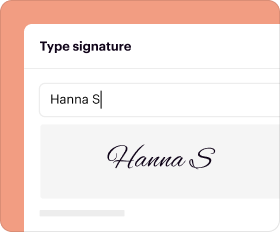

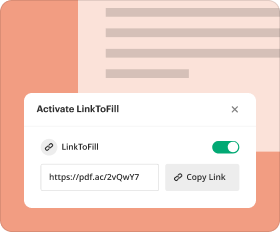

How can pdfFiller assist in document management?

Utilizing pdfFiller’s features can significantly streamline the process of editing and managing the order reforming loan modification form. With its cloud-based platform, users can collaborate effectively, ensuring all necessary revisions are made and stored securely. This capability enhances the overall efficiency of document management.

-

pdfFiller allows users to edit and electronically sign documents quickly, saving time in the submission process.

-

Teams can work together in real time on the loan modification form, making it easier to finalize documents before submission.

-

Cloud storage options ensure that all versions of the document are retained, allowing easy access and review when needed.

What is the submission process for the completed form?

Once the order reforming loan modification form is filled out, knowing where and how to submit it is vital. In New Jersey, filing procedures must be adhered to strictly to ensure timely processing. Understanding associated costs and processing timelines will also help avoid potential delays.

-

Completed forms should be filed at the appropriate Superior Court in the jurisdiction where the property is located.

-

There may be fees attached to the submission of the form, which can vary by court, so checking local guidance is necessary.

-

Typically, courts may take several weeks to process these forms, so it's essential to submit early and track the progress closely.

What should you expect after submission?

After submitting the order reforming loan modification form, it’s important to understand the court’s adjudication process. There are various potential outcomes, and knowing the steps to take if the form is contested can be crucial for maintaining a favorable position in negotiations.

-

The court will evaluate the submitted form, including all supporting documentation, before reaching a decision.

-

The court may approve the modification, request additional information, or deny the request based on legal standards.

-

If the order is contested, the parties involved may need to prepare for hearings or negotiate further, potentially with legal representation.

How to fill out the order reing loan modification

-

1.Obtain the form for the order reforming loan modification from your local court or download it from a reliable source.

-

2.Carefully read the instructions provided with the form to understand all requirements and necessary documentation. Make sure you have all personal and financial information ready.

-

3.Begin filling in your personal details at the top of the form, including your name, address, and contact information. Ensure accuracy to prevent any delays in processing.

-

4.Next, enter the details regarding the loan you want to modify. Include the loan number, lender's information, and the current terms of the loan such as interest rate and length.

-

5.Clearly state the reasons for requesting the modification and the proposed new terms you are seeking. Be thorough and honest to support your case.

-

6.Review your completed form for any errors or omissions to ensure all required fields are filled in correctly.

-

7.Once you're satisfied with the form, print it out if filled out electronically or sign it if filled out by hand.

-

8.Finally, submit the completed form to the appropriate court or lender according to the instructions. Keep a copy for your records and monitor the follow-up process.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.