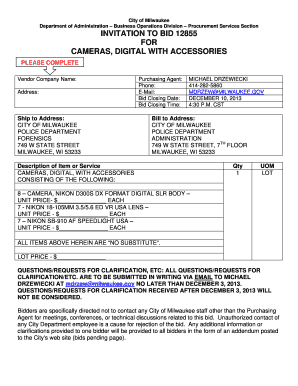

Get the free Amendment to Building Loan Agreement template

Show details

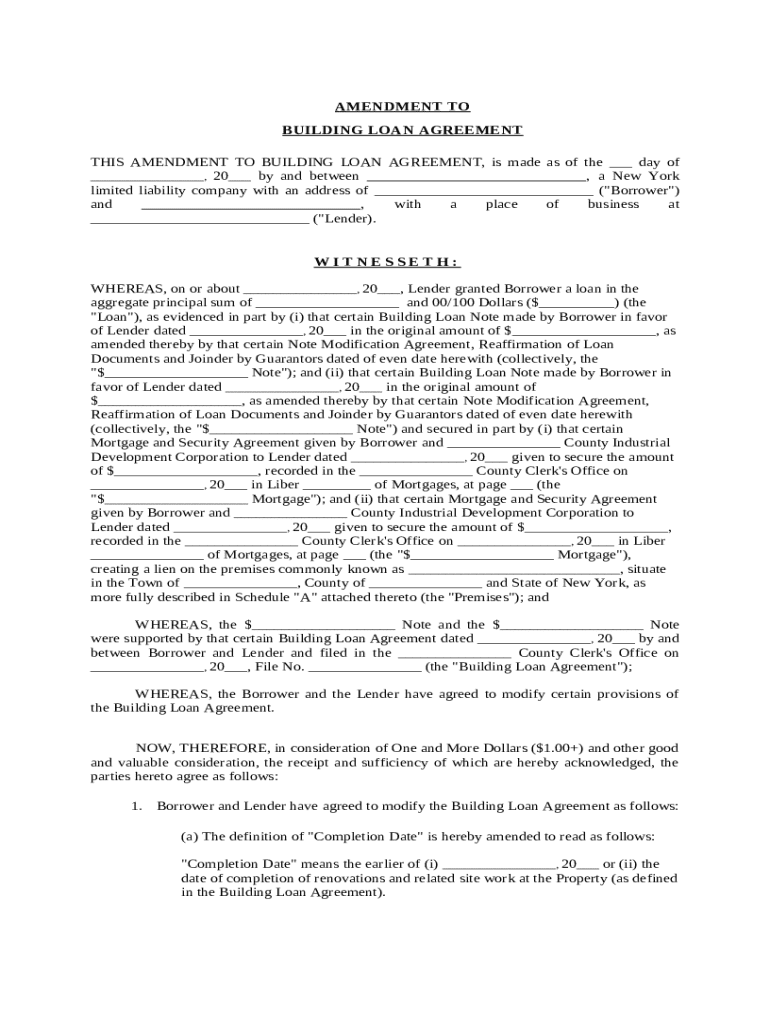

The parties to an existing building loan agreement agree to amend the agreement to change the completion date of the construction project.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is amendment to building loan

An amendment to a building loan is a formal modification to the terms of an existing loan agreement for construction or renovation projects.

pdfFiller scores top ratings on review platforms

Do not use it a lot but it is well worth money.

Easy to grasp interface, just slightly a bit pricey for an intermittent user...

I love it. I would love to learn how to use ALL the features to better use this service.

it was immediately available. it seems fairly straight ahead, but I've not had time to really check it out. each time I use it , it gives me a litle anxiety

Took forever to figure out it wasn't free. Here I thought I was filling out a form to print and filled it all out then said I need to pay. Very frustrating

need a little more instructions on how to do some things

Who needs amendment to building loan?

Explore how professionals across industries use pdfFiller.

How to Effectively Amend a Building Loan Agreement: A Comprehensive Guide

How can you swiftly fill out an amendment to a building loan form?

To fill out an amendment to a building loan form effectively, start by gathering all relevant information regarding the original loan agreement. Then, clearly define the changes needed and include all necessary legal language to ensure clarity. Finally, utilize interactive tools like those provided by pdfFiller for easy editing and electronic signing.

Understanding the building loan agreement

A building loan agreement is a contract between a borrower and a lender that outlines the terms under which the lender provides funds for construction. This agreement includes critical terms such as the borrower's responsibilities, the lender's obligations, and the conditions for repayment, ensuring both parties are protected.

-

Understanding what a building loan agreement is and its key role in financing construction projects.

-

Who the parties involved are and how guarantees protect the lender’s investment.

-

Essential components like interest rates, payment schedules, and covenants.

Why are amendments often necessary in building loan agreements?

Amendments may be required due to changes in project scope, budget adjustments, or unforeseen construction delays. Failing to amend a building loan agreement may lead to legal complications and financial losses for both the borrower and lender.

-

Examples include budget overruns, changes in the project timeline, or modifications in the loan terms.

-

Potential legal issues, financial penalties, and strained borrower-lender relationships.

-

Overview of state-specific regulations that impact amendments.

What steps should you take to prepare an amendment?

Preparing an amendment involves thorough documentation and careful drafting. Start with collecting all necessary documents and then identify the specific changes that need to be made to ensure the amendment reflects accurate agreements.

-

Compile original agreements, correspondence, and any relevant amendments that have taken place.

-

Clearly outline each change that needs to be made to the agreement.

-

Ensure that the amendment includes parties' names, effects of changes, and a statement of consent.

-

Use precise legal language to avoid ambiguities in the agreement.

What are the essential components of the amendment document?

A well-structured amendment document ensures that all changes are clear and legally binding. It should include identifiable parties, details about the original agreement, and any new terms that affect compliance.

-

It is crucial to specify who the borrower and lender are in the document.

-

Outline what the original terms were and what modifications are now being proposed.

-

Ensure that all modifications meet state regulatory requirements.

How do you fill out the amendment to the building loan agreement?

Filling out the amendment requires careful attention to detail. Use pdfFiller's interactive tools to navigate through the document, ensuring each section is populated correctly with updated information.

-

Leverage technology that allows for easy editing and formatting of the amendment document.

-

Follow guidance on which sections to fill out to avoid errors.

-

Pay close attention to these key areas to ensure all details are up to date.

What is the review and finalization process for the amendment?

Reviewing an amendment is crucial to ensure accuracy and legal compliance. After finalizing the document, it's essential to obtain all necessary signatures to guarantee its enforceability.

-

Consult both parties to clarify any uncertainties and confirm mutual agreement on changes.

-

Utilize electronic signing to streamline the finalization process.

-

Employ secure cloud storage solutions to prevent loss and guarantee accessibility.

What post-amendment actions should be taken?

After completing the amendment process, it is vital to file the document properly and communicate changes to relevant parties. Proper record-keeping prevents future misunderstandings and maintains compliance.

-

Ensure that all official changes are recorded for public reference.

-

Revise other related documents to reflect the latest changes.

-

Notify all relevant stakeholders to maintain transparency.

How to fill out the amendment to building loan

-

1.Open the amendment to building loan document on pdfFiller.

-

2.Begin with entering the date at the top of the document.

-

3.Fill in the name and contact information of the borrower.

-

4.Next, provide the lender's details, including name and address.

-

5.Indicate the original loan amount and the principal balance remaining.

-

6.Specify the changes being proposed, such as new interest rates or repayment terms.

-

7.Review all entered information for accuracy and completeness.

-

8.Use the electronic signature option to sign the document.

-

9.Finally, save the amended document and download or share it as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.