Get the free Memorandum of Trust

Show details

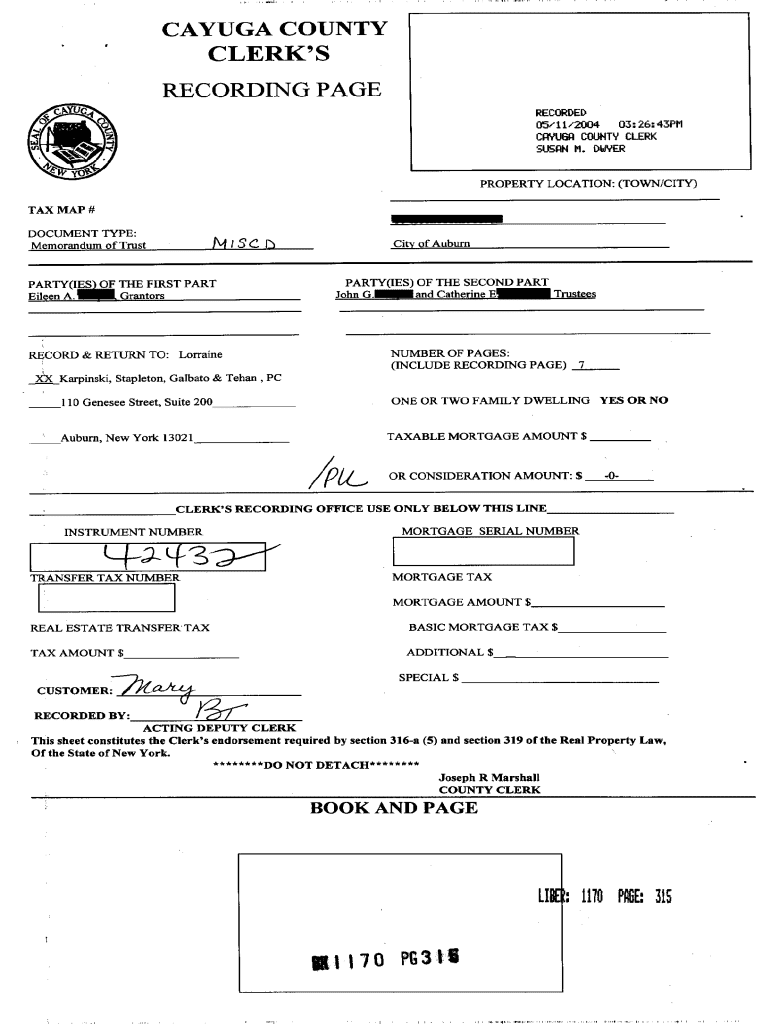

Memorandum of Trust

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is memorandum of trust

A memorandum of trust is a legal document that summarizes the terms of a trust agreement and serves as evidence of the trust's existence and validity.

pdfFiller scores top ratings on review platforms

gresat

I only needed it for one purpose, to make my client's insurance claim sheets a fillable form so I wouldn't have to freehand it. After the initial struggle to get it structured right it works wonderfully

Great!

Easy to use and was able to add signature to documents. Was perfect for what I needed

So far so good! I am very pleased with this option to write on existing document. Saved from recreating document for each client!

Very user friendly, very helpful

Who needs memorandum of trust?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Memorandum of Trust Form

What is a memorandum of trust?

A memorandum of trust is a legal document that outlines the key details of a trust agreement. It serves as a summary that can be shared with third parties to provide essential information regarding the trust without disclosing the entire trust document. This form is important for ensuring clarity and transparency among trustees and beneficiaries.

Understanding its significance

-

The memorandum helps in clarifying the roles and responsibilities of trustees.

-

You might utilize a memorandum of trust during estate planning processes, particularly for managing inheritances.

-

Understanding terms like 'Trust' (an arrangement where one party holds property for the benefit of another), 'Trustee' (a person who manages the trust), and 'Beneficiary' (a person entitled to receive benefits from the trust) is crucial.

What does the memorandum of trust form include?

-

You will need to fill out details such as the name of the trust, trustee’s name, and beneficiaries.

-

Ensure you gather proper documentation, such as the full trust agreement or identification of the parties involved.

-

It's essential that all personal information is accurately presented to avoid legal issues or disputes later.

How to complete the memorandum of trust form

Filling out a memorandum of trust form requires careful attention to detail. Start by gathering all the necessary information to make the process smoother.

-

Gather all the required information before you start filling out the form.

-

Accurately fill in details like your name, address, and contact information.

-

Provide comprehensive details about the trust, including its name and the date it was established.

-

Clear identification of trustee(s), specifying their roles is crucial for transparency.

-

Thoroughly list all beneficiaries and clearly define their interests in the trust.

-

Review all the information you provided to ensure there are no errors before submission.

How to manage your document with pdfFiller

pdfFiller offers a variety of tools to streamline the process of editing and managing your memorandum of trust form.

-

Use pdfFiller’s editing tools to make any necessary modifications to your form.

-

Utilize eSignature capabilities, which provide legal validity once completed.

-

Collaborate with other stakeholders using cloud document features to keep everyone informed.

-

Maintain secure storage and management of your documents in the cloud to prevent loss.

What legal considerations should you keep in mind?

When dealing with a memorandum of trust, it is vital to understand the legal landscape that governs trusts in your area.

-

Every state has its own regulations regarding trusts; ensure you are aware of Florida's specific laws if that's your region.

-

Having a checklist can guide you through necessary steps to ensure legal compliance while creating your memorandum.

-

For complex trust scenarios, consulting legal professionals such as estate planning attorneys can provide additional assurance of compliance.

What mistakes should you avoid?

-

Not including critical information or signatures can delay the processing of your form.

-

It's essential to understand trustee rights and responsibilities to avoid conflicts.

-

Failing to inform beneficiaries of the trust's existence can lead to disputes and confusion.

What interactive tools does pdfFiller provide?

pdfFiller features numerous interactive tools to assist users with form management and customization.

-

Explore various tools designed for efficient form management, enhancing user experience.

-

Utilizing version control features allows you to track modifications made to your document.

-

Access templates that are specifically tailored for trust documentation to streamline your processes.

How to fill out the memorandum of trust

-

1.Start by opening the memorandum of trust template on pdfFiller.

-

2.Enter the name of the trust at the top of the document.

-

3.Input the date when the trust was established.

-

4.List the trustees responsible for managing the trust, including their contact information.

-

5.Detail the beneficiaries of the trust, specifying their relationship to the grantor.

-

6.Outline the terms and conditions of the trust, including any limitations or special provisions.

-

7.If applicable, include information about the assets held in the trust.

-

8.Review all the filled information for accuracy and completeness.

-

9.Once confirmed, save the document to your device or choose the option to print it directly.

-

10.Consider having the document notarized to ensure its legal validity.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.