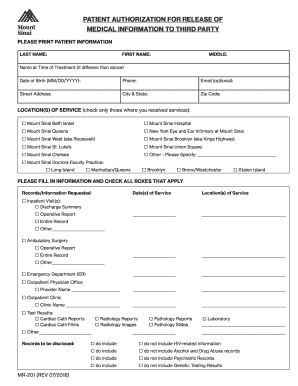

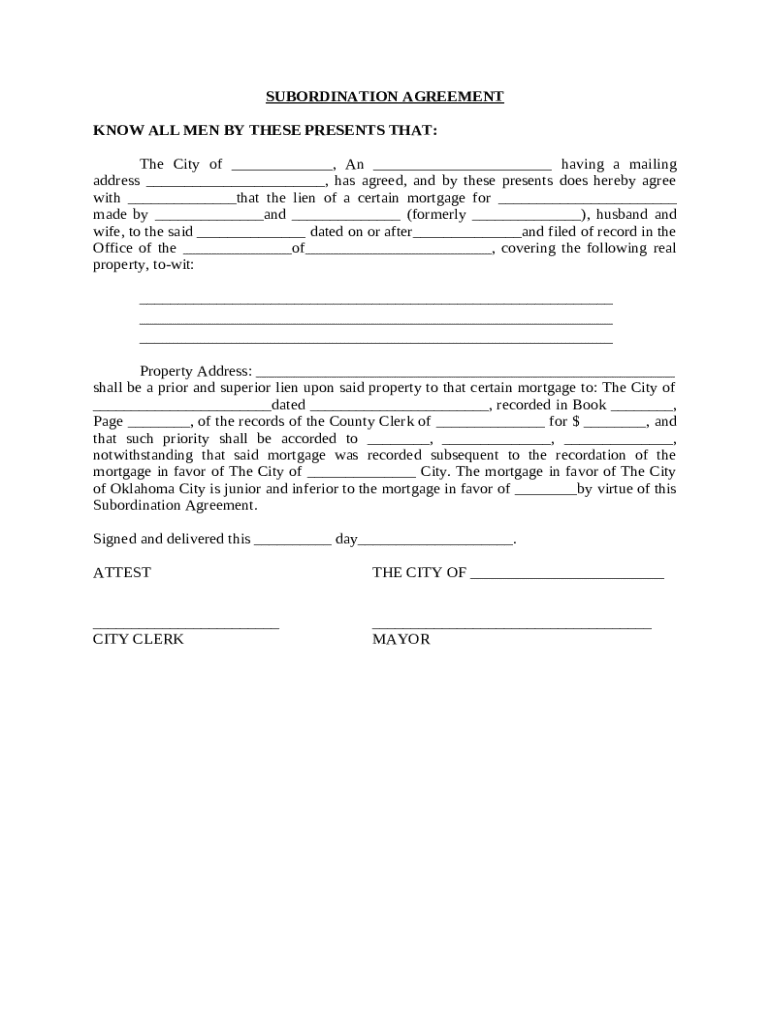

Get the free Subordination Agreement template

Show details

It is a contract in which a junior creditor agrees that its claims against a debtor will not be paid until all senior indebtedness of the debtor

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is subordination agreement

A subordination agreement is a legal document that establishes the priority of debts in relation to one another, typically involving a second mortgage or loan that is subordinate to a first mortgage.

pdfFiller scores top ratings on review platforms

first time using the app and i love it

first time using the app and i love it

very easy but not free but worth it

very easy but not free but worth it

Great application

Great application. Very helpful.

it is very friedly to use.

it is very friedly to use.

Super helpful software!

Super helpful software!

Kara was so nice to me

Kara was so nice to me! She did everything she could to help me.

Who needs subordination agreement template?

Explore how professionals across industries use pdfFiller.

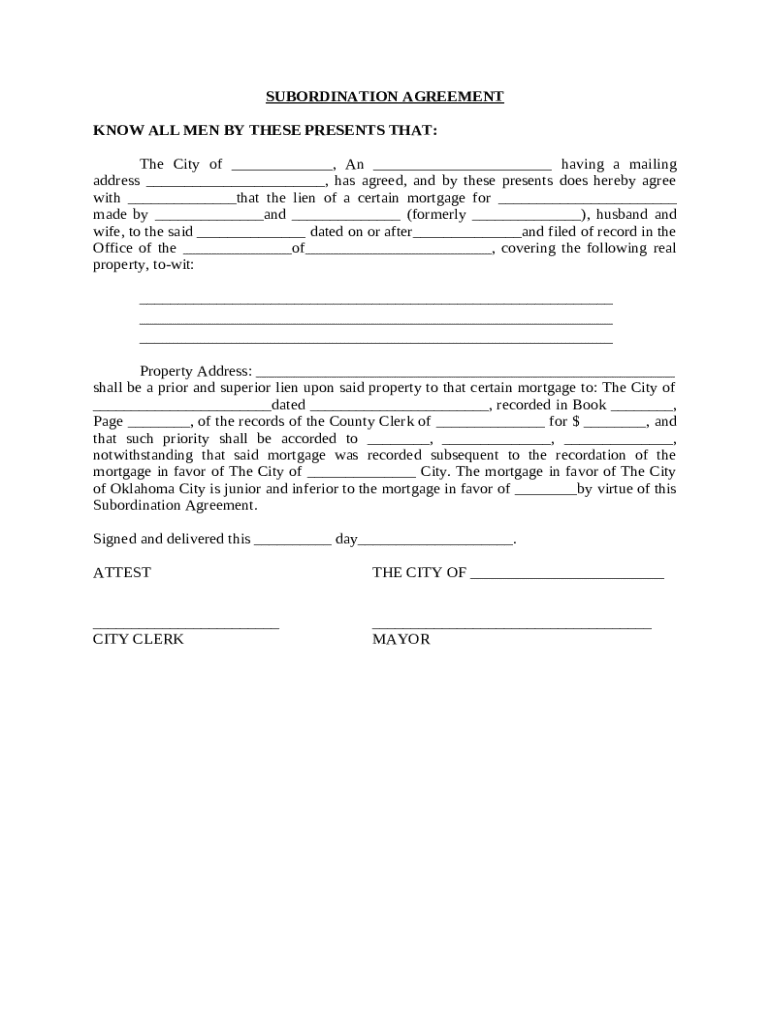

Subordination agreement form form

A subordination agreement form is a critical document in real estate transactions, outlining the terms under which one debt is prioritized over another. Understanding its components is essential for both individuals and teams looking to navigate complex financial dealings.

This guide will explore everything you need to know about the subordination agreement form—from its definition to its submission process and interactive tools that facilitate the preparation and signing of this document.

What is a subordination agreement?

A subordination agreement is a legal document that changes the priority of debts secured by real property. The primary purpose is to allow a borrower to secure additional financing while ensuring that existing lenders are made aware of their position in relation to new loans.

-

It allows homeowners to refinance or take out additional loans.

-

Essential for lenders to understand the risk level attached to their financing.

-

Informs how subsequent mortgages will impact existing debts.

What are the key components of a subordination agreement form?

The primary components of a subordination agreement form are pivotal in outlining the responsibilities and details of involved parties and properties.

-

Names and contact information of all parties involved.

-

Specifics about the mortgage being subordinated.

-

Exact location and information about the property in question.

-

Documentation that parties acknowledge their understanding and agreement.

-

All necessary signatures and notarization must be provided.

How can fill out the subordination agreement form?

Filing out the subordination agreement form requires careful attention to each section and detail. This comprehensive process ensures that your information is accurate and correctly formatted.

-

Follow each step meticulously to avoid errors.

-

Leverage tips for accuracy like double-checking entries and seeking clarification when needed.

-

Avoid incomplete sections which may delay the processing of your agreement.

What are the methods for submitting the subordination agreement?

Once the form is filled out, submission can occur through various methods suitable to your needs and circumstances.

-

Delivering the document to the appropriate office.

-

Sending the completed document via postal mail.

-

Using online platforms that allow electronic submission.

Where can get assistance with my subordination agreement?

If you find the process daunting, there are multiple resources available to assist you.

-

Reach out to professionals specializing in real estate law.

-

Utilize platforms like pdfFiller for easy editing and eSigning.

-

Investigate resources that address frequent queries around the use of subordination agreements.

What compliance issues should be aware of regarding subordination agreements?

Compliance with state regulations is crucial when crafting a subordination agreement.

-

Different states may have varying rules governing subordination agreements.

-

Being aware of these helps in avoiding legal complications.

-

The platform ensures compliance during document creation via expert guidelines.

What interactive tools does pdfFiller offer for subordination agreements?

pdfFiller provides a range of interactive tools that can significantly enhance the document management experience.

-

Tools to customize document templates.

-

Easily send documents for quick approvals.

-

Features that facilitate teamwork in drafting and finalizing subordination agreements.

What are real-life use cases of subordination agreements?

Many real estate transactions necessitate the use of subordination agreements, showcasing their practicality and benefits.

-

Common in mortgage refinancing to prioritize new loans.

-

Obtain financing where existing mortgages need modification.

-

Streamline processes can lead to better financial management.

By understanding how to correctly manage a subordination agreement form, whether filling it out or submitting it for processing, you can participate effectively in real estate transactions. Utilizing pdfFiller's tools ensures a smoother experience, allowing for a seamless process from start to finish.

How to fill out the subordination agreement template

-

1.Open pdfFiller and upload the subordination agreement template.

-

2.Fill in the borrower's information at the top of the document, including name and address.

-

3.Enter the lender's details, such as name, address, and contact information.

-

4.Specify the original loan amount and the property involved in the subordination agreement.

-

5.Indicate the terms of the subordinate loan, including interest rate and maturity date.

-

6.Clearly state the priority order of loan repayment within the agreement.

-

7.Review the filled information for accuracy and completeness.

-

8.Sign the document as required by all parties involved.

-

9.Download or electronically send the completed agreement for further processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.