Get the free Long Term Educational Loan Promissory Note template

Show details

This promissory note is associated with a loan given to a student of a high education institution. The loan is made by the university or college directly. The note becomes due at the time of graduation

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is long term educational loan

A long term educational loan is a financial product designed to cover the costs of education over an extended repayment period.

pdfFiller scores top ratings on review platforms

Easy to edit and recreate a more professional invoice

love it

simple to use

awesome

No problems over here. Thanks

easy to use and I love it!

Who needs long term educational loan?

Explore how professionals across industries use pdfFiller.

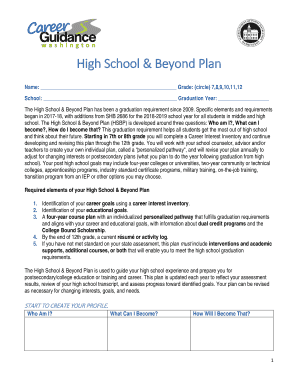

Long Term Educational Loan Form Guide

How to fill out a long term educational loan form

Filling out a long term educational loan form requires careful attention to detail. Start by gathering necessary financial documents and personal identification. Make sure to accurately enter all required information to avoid delays in processing.

Understanding the long term educational loan promissory note

The long term educational loan promissory note is a critical document in the borrowing process. It serves as a legally binding contract that outlines the borrower's commitment to repay the loan. This note not only formalizes the terms of the loan but also clarifies the financing of educational expenses.

-

A promissory note is a written agreement in which the borrower promises to pay back the amount borrowed, along with any applicable interest.

-

The note details the total loan amount, repayment conditions, and interest rates—essential for managing your educational financing.

-

The borrower is typically the student, while the university or lending institution provides the funds, making both parties crucial to the agreement.

What are the key components of the loan agreement?

An educational loan agreement includes several critical components that establish the borrowing terms. Understanding these components can help you manage your obligations effectively throughout the loan period.

-

Identifying the parties involved in the loan ensures clarity about who is responsible for repayment.

-

This clearly outlines the total amount available for borrowing and what can be expected to pay back.

-

Loan agreements specify how interest is calculated, often as a percentage of the principal amount.

-

Understanding additional fees like origination and late fees is essential for effective financial planning.

What are the repayment terms and conditions?

Repayment terms define when and how borrowers must start to repay their loans. Knowing these conditions in advance will help prepare financially for the journey ahead.

-

Most loans require repayment to start shortly after graduation, reinforcing the importance of understanding your graduation timeline.

-

Repayment is often structured into monthly payments, making it essential to know your loan's schedule for budgeting purposes.

-

A well-defined repayment schedule helps borrowers remain organized and avoid missed payments, which can affect their credit score.

How do interest rates and charges apply?

Interest rates significantly impact the total amount repaid over the life of a loan. Different types of interest rates may apply depending on the loan specifics.

-

A variable interest rate may fluctuate over time, while a fixed rate remains constant, affecting your payment amounts.

-

Interest typically begins accumulating after graduation, and understanding how to calculate this can help borrowers gauge their total financial obligation.

-

Interest rates can change based on economic conditions, influencing repayment amounts during the loan’s life.

What are the late payment penalties and charges?

Failure to make timely payments can lead to penalties. Knowing these potential charges helps borrowers avoid unexpected financial burdens.

-

Late payments often result in additional fees and can negatively impact credit ratings.

-

Lenders typically have clear policies on how late fees are calculated, often based on a percentage of the overdue amount.

-

Understanding how payments are applied helps borrowers strategize payment approaches to minimize their financial impact.

What are forbearance and deferment options?

Forbearance and deferment are options available for borrowers who may temporarily struggle to make payments. These options can provide relief during financial hardships.

-

Forbearance allows borrowers to temporarily stop making payments, provided they meet specific lender requirements.

-

Deferment is often available during qualifying life events, such as returning to school or unemployment.

-

These options can extend the repayment timeline or increase overall interest paid; thus, manage them carefully.

How can use pdfFiller to manage my loan documents?

Utilizing pdfFiller can simplify the management of your educational loan documents. The platform offers tools that streamline the form-filling process and enhance document management.

-

Accessing your loan form through pdfFiller allows for easy edits and the ability to save your progress.

-

There are interactive calculators available to assess potential payments and total interest, aiding in budget planning.

-

The platform allows for seamless collaboration with universities or financial aid representatives, ensuring smooth communication.

How to navigate educational loan templates on pdfFiller?

Navigating pdfFiller's array of educational loan templates can make the application process smoother. Finding the right template is crucial to ensure accuracy and compliance.

-

The platform’s search functionality allows users to easily locate specific loan templates tailored to their requirements.

-

pdfFiller provides step-by-step guidelines, minimizing confusion during the filling process.

-

If issues arise, resources on pdfFiller assist users in resolving form submission problems efficiently.

How can maximize my loan benefits and options?

Maximizing the benefits of your loan can be achieved through understanding all available resources. Many universities and institutions provide additional options that can ease the financial burden.

-

Resources like financial aid advisors or scholarship opportunities can supplement your loan.

-

Grants and work-study programs can often be more favorable alternatives to loans, easing repayment burdens.

-

Establishing a budget tailored to your educational finances can help control spending and maximize loan utility.

How to fill out the long term educational loan

-

1.Visit the pdfFiller website and log in to your account or create a new one.

-

2.Search for the long term educational loan form in the document library.

-

3.Open the document in the editor by clicking on it.

-

4.Start filling out personal details such as your name, contact information, and Social Security number.

-

5.Provide information about the educational institution you plan to attend, including its name and location.

-

6.Indicate the type of program and degree you are applying for.

-

7.Complete the financial details section, including estimated costs and any scholarships or grants received.

-

8.Review all entered information for accuracy and completeness.

-

9.Save the document periodically to avoid losing progress.

-

10.Once finished, download the completed form or submit it directly through pdfFiller.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.